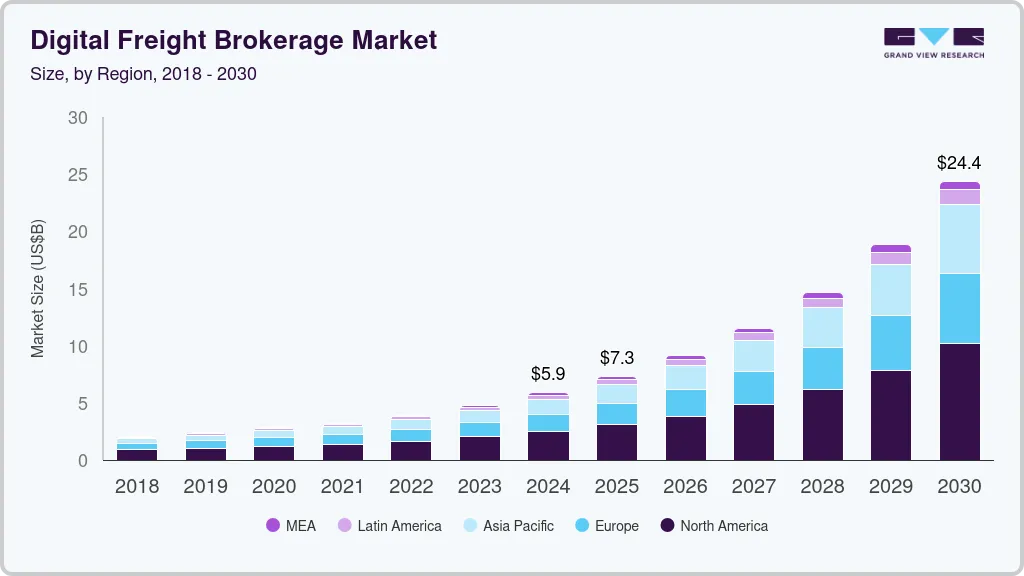

Digital Freight Brokerage Market Size, Share & Trends Analysis growing at a CAGR of 27.3% from 2025 to 2030

The global digital freight brokerage market size was estimated at USD 5.87 billion in 2024 and is projected to reach USD 24.36 billion by 2030, growing at a CAGR of 27.3% from 2025 to 2030. Today, traditional freight brokerage faces several challenges, such as a lack of real-time tracking, unpredictable pricing fluctuations, inefficiencies due to manual processes, and capacity constraints.

Key Market Trends & Insights

- North America dominated the digital freight brokerage market with the largest market revenue share of 42.4% in 2024.

- Based on transportation mode, the road freight segment led the market with the largest revenue share of 74.7% in 2024.

- Based on service type, the full-truckload (FTL) brokerage segment accounted for the market with the largest revenue share in 2024.

- Based on customer type, the business-to-business (B2B) segment accounted for the largest market share in 2024.

- Based on end user industry, the retail & e-commerce segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.87 Billion

- 2030 Projected Market Size: USD 24.36 Billion

- CAGR (2025-2030): 27.3%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/digital-freight-brokerage-market-report/request/rs1

To overcome such challenges, companies are focusing on digital freight brokerage solutions by leveraging automation, AI, and real-time data analytics. Digital freight brokerage is a freight brokerage model that uses technology, often online platforms or apps, to connect shippers with carriers, automating processes such as tendering, booking, and shipment execution, and aiming for more efficient and real-time freight matching. This modern approach is widely used across industries such as retail, manufacturing, and e-commerce, where fast and efficient logistics are crucial.

Growth in cross-border & intermodal freight transport is a key driver of the digital freight brokerage industry. As global trade expands, businesses face challenges such as customs delays, inefficient coordination between transport modes, and high costs associated with cross-border freight. Digital freight brokerage platforms offer real-time tracking, automated customs documentation, and AI-powered route optimization, enabling seamless transitions between different modes of transport. Major companies are increasingly focusing on expanding intermodal and cross-border capabilities to enhance supply chain resilience. For instance, in November 2024, Schneider National, Inc. (U.S.) launched a new intermodal service between the Southeast U.S. and Mexico in collaboration with CSX (U.S.) and CPKC (Canada). This service eliminates border delays common in trucking, ensuring faster, more secure freight movement, which aligns with the benefits provided by digital freight brokerage solutions.

The rise of e-commerce and on-demand deliveries is a significant driver of the digital freight brokerage industry. The rapid growth of e-commerce is driving demand for faster, more flexible, and cost-effective shipping solutions. Digital freight brokerage platforms enable instant carrier sourcing, reduce transit times, and improve delivery efficiency. According to The Census Bureau of the Department of Commerce, total e-commerce sales for 2024 were estimated at USD 1,192.6 billion, reflecting an 8.1% increase from 2023, while total retail sales grew by only 2.8%. This rapid e-commerce expansion has heightened the increasing reliance on advanced freight solutions to handle growing shipment volumes efficiently.

Regulatory complexities and trade policies are essential for security and trade standardization. However, it creates operational hurdles for freight companies, requiring them to invest in compliance management and digital solutions to streamline processes and minimize disruptions. Compliance with different countries’ transportation laws, customs regulations, and environmental mandates can lead to delays, fines, and increased operational costs. For instance, United States-Mexico-Canada Agreement (USMCA) regulations impose stricter labor laws, regional content requirements, and customs enforcement, directly affecting cross-border freight operations. In addition, The FMCSA (Federal Motor Carrier Safety Administration) mandates the use of Electronic Logging Devices (ELDs), which limits driving hours, requiring carriers to adhere to strict compliance measures, which increases operational costs and reduces driver flexibility.

Digital Freight Brokerage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.29 billion |

|

Revenue forecast in 2030 |

USD 24.36 billion |

|

Growth rate |

CAGR of 27.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Transportation mode, service type, customer type, end-user industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Italy; Poland; China; India; Japan; Australia; South Korea; Brazil; UAE.; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

C.H. Robinson Worldwide, Inc.; Total Quality Logistics, LLC; Coyote Logistics, LLC (a subsidiary of RXO, Inc.); WWEX Group; Landstar System Holdings, Inc.; Mode Global; Echo Global Logistics, Inc.; Schneider National, Inc.; Uber Freight (a subsidiary of Uber Technologies, Inc.); J.B. Hunt Transport Services, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |