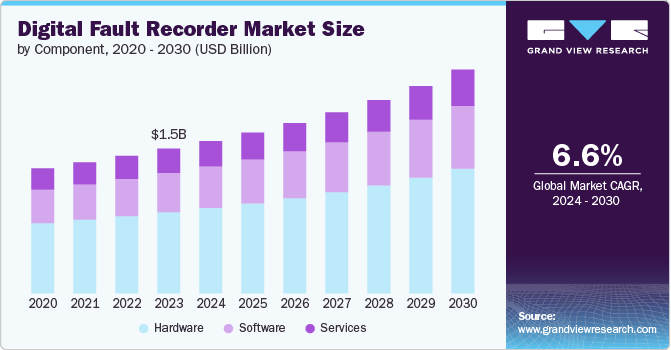

Digital Fault Recorder Market Size, Share & Trends Analysis grow at a CAGR of 6.6% from 2024 to 2030

The global digital fault recorder market size was estimated at USD 1.47 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. Several factors are driving the growth of the market, including the growing demand for reliable power supply, growing grid modernization initiatives, and rising focus on preventive maintenance. Digital Fault Recorders (DFRs) are specialized devices used in electrical power systems to capture and record data related to electrical faults and disturbances.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/digital-fault-recorder-market-report/request/rs1

DFRs are designed to monitor and store high-resolution data of events such as short circuits, voltage sags or swells, transient disturbances, and other anomalies that occur within the power grid. They play a critical role in maintaining the reliability and stability of electrical power systems by providing detailed insights into transient events and disturbances, and facilitating prompt corrective actions and improvements in system design and operation.

The increasing deployment of renewable energy sources such as solar and wind power introduces new challenges to grid stability due to their intermittent nature. According to the International Energy Agency (IEA), in 2023, the global addition of renewable energy capacity to energy systems surged by 50%, reaching nearly 510 gigawatts (GW). DFRs are essential for monitoring the impact of renewable energy integration on grid performance and for ensuring smooth operation during transient events.

Utilities are increasingly focused on optimizing asset management strategies to extend the lifespan of equipment and reduce maintenance costs. DFRs provide valuable data for predictive maintenance and condition monitoring of critical grid assets, helping utilities prioritize maintenance activities and minimize downtime. Many countries are investing in the modernization of aging power infrastructure to enhance grid resilience, accommodate renewable energy integration, and improve overall efficiency. DFRs play a crucial role in modern grid systems by providing real-time data for monitoring and optimizing grid operations.

Component Insights

Based on components, the hardware segment dominated the market in 2023 and accounted for more than 56.0% share of global revenue. The segment’s growth is attributed to the continuous advancements in the DFR hardware. Manufacturers are investing in Research & Development (R&D) to develop more advanced and robust hardware solutions that meet the evolving needs of utilities and industries. For instance, in 2023, AMETEK.Inc. spent USD 220.8 million on R&D, growing from USD 198.8 million in 2022. Moreover, increasing investments in energy infrastructure are driving the demand for DFRs. According to the IRENA – International Renewable Energy Agency, in 2022, global investment in energy transition technologies hit a record high of USD 1.3 trillion. Utilities and power generation companies are investing in advanced monitoring and control technologies to optimize asset performance and reduce operational costs.

The software segment is projected to witness the fastest CAGR of 7.2% from 2024 to 2030. The need for sophisticated data analytics to interpret the vast amounts of data collected by DFRs is driving the segment’s growth. Advanced software solutions provide powerful tools for analyzing fault data, identifying patterns, and predicting potential issues, enabling proactive maintenance and improved decision-making. Moreover, improved user interfaces and visualization contribute to the segment’s growth. Modern software solutions offer intuitive user interfaces and advanced visualization tools that make it easier for operators and engineers to interpret complex data. These tools help in quickly diagnosing faults and understanding the impact on the grid, leading to faster and more effective responses.