Dental Membrane Market growing at a CAGR of 7.27% from 2026 to 2033

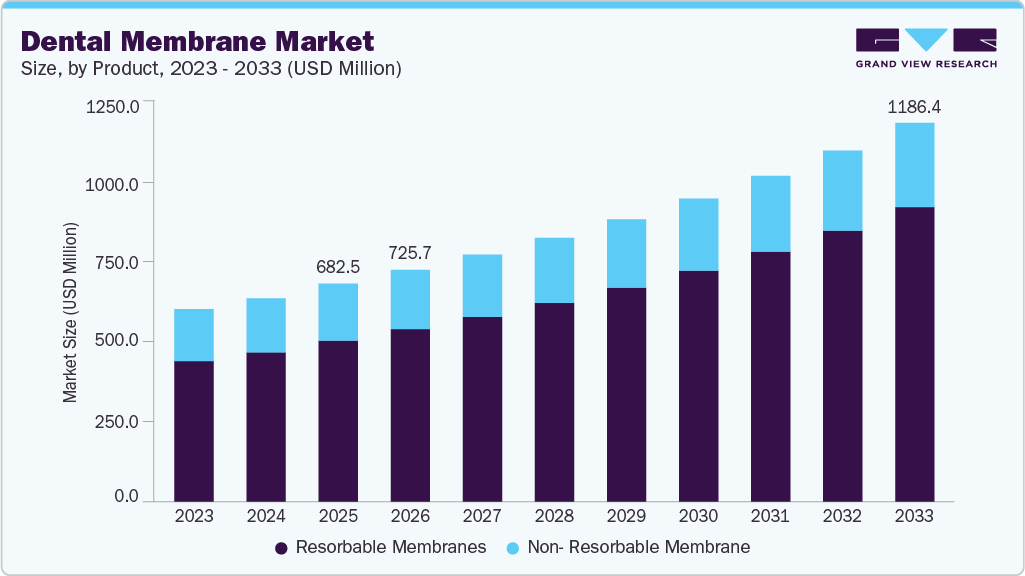

The global dental membrane market size was valued at USD 682.46 million in 2025 and is projected to reach USD 1,186.38 million by 2033, growing at a CAGR of 7.27% from 2026 to 2033. The rising global prevalence of periodontal disease and tooth loss is a key driver of demand in the dental membrane market.

Key Market Trends & Insights

- North America dominated the dental membrane market with the largest revenue share of 37.90% in 2025.

- By product, the resorbable membranes segment led the market with the largest revenue share of 73.92% in 2025.

- By application, the socket preservation segment led the market with the largest revenue share of 27.80% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 682.46 Million

- 2033 Projected Market Size: USD 1,186.38 Million

- CAGR (2025-2033): 7.27%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing markets

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/dental-membrane-market-report/request/rs1

According to the World Health Organization (March 2025), more than 1 billion people worldwide suffer from severe periodontal disease, a leading cause of alveolar bone loss that often requires guided tissue regeneration (GTR) and guided bone regeneration (GBR) procedures using dental membranes. Additionally, a significant proportion of older adults experience partial or complete tooth loss, thereby increasing the need for dental implants and bone regeneration therapies. As tooth loss is frequently accompanied by jawbone resorption, the use of bone grafts and barrier membranes is critical to support successful implant placement and long-term clinical outcomes, thereby sustaining market growth.

The global rise in periodontal disease and tooth loss is directly increasing the clinical use of dental membranes in guided tissue regeneration (GTR) and guided bone regeneration (GBR) procedures. According to World Health Organization data published in March 2025, over 1 billion people worldwide suffer from severe periodontal disease, a condition that routinely requires barrier membranes to prevent epithelial migration and enable controlled tissue regeneration.

Tooth loss further accelerates membrane utilization. Nearly 7% of adults aged 20 years and above and approximately 23% of individuals over 60 years experience complete tooth loss, creating a large patient pool requiring regenerative interventions where dental membranes are a standard of care. A February 2025 report by Humble Memorial Dental estimates that 3.5 billion people globally are affected by oral diseases, with nearly 50% of adults aged 30 and above experiencing gum disease, underscoring sustained procedural demand.

Growth in dental implant placement is further strengthening the dental membrane market. Dental membranes are routinely used during implant site preparation to stabilize healing sites, isolate soft tissue, and improve regenerative predictability. According to Twin Dental New York, approximately 5 million dental implants are placed annually in the U.S., supporting consistent and repeat demand for dental membranes across clinical settings.

Ongoing clinical studies evaluating membrane material performance, resorption behavior, and handling characteristics are reinforcing clinician confidence and accelerating adoption, positioning dental membranes as indispensable consumables in modern periodontal and implant dentistry.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The dental membrane market is characterized by high growth owing to the rising demand for aesthetic and restorative dentistry, growing launches of novel products, and increasing burden of dental disorders.

The rising number of clinical trials focused on dental membranes reflects the market’s strong emphasis on material innovation, biocompatibility, and predictable regeneration outcomes. Manufacturers are increasingly investing in next-generation resorbable membranes, including products that are entirely free from animal-derived components to address ethical, safety, and regulatory concerns. For instance, in August 2025, VIVOLTA partnered with Fibrothelium to manufacture SimplySilk, a CE-marked resorbable dental membrane engineered using proprietary silk fibroin technology. SimplySilk features a multi-layered electrospun structure designed to deliver extended barrier function and support controlled tissue regeneration in dental surgical procedures. This development highlights the industry’s shift toward synthetic, high-performance membranes that align with clinician expectations for handling performance and patient demand for non-animal-derived materials.

Dental membranes are subject to stringent regulatory oversight by agencies such as the U.S. Food and Drug Administration, Health Canada, and the European Medicines Agency. Regulatory classification is primarily determined by material composition, resorption profile, and intended use. In the U.S., most standard resorbable dental membranes are regulated as Class II medical devices, requiring compliance with special controls and premarket notification pathways.

Dental Membrane Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 725.71 million |

|

Revenue forecast in 2033 |

USD 1,186.38 million |

|

Growth rate |

CAGR of 7.27% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2026- 2033 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Institut Straumann AG; Dentsply Sirona; Nobel Biocare Services AG (Envista); Geistlich Holding; ZimVie Inc.; Osteogenics Biomedical (Envista); Regenity; BioHorizons; REGEDENT AG; Bioteck S.p.A.; EUCARE Pharmaceuticals (P) Ltd; Curasan, Inc.; TBR Dental; DentiumUSA; Tecnoss Dental Srl; Unicare Biomedical, Inc.; Neoss; Advanced Medical Solutions Group plc; Maxigen Biotech Inc.; B&B Dental Implant Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |