Dental Impression System Market growing at a CAGR of 9.9% from 2025 to 2033

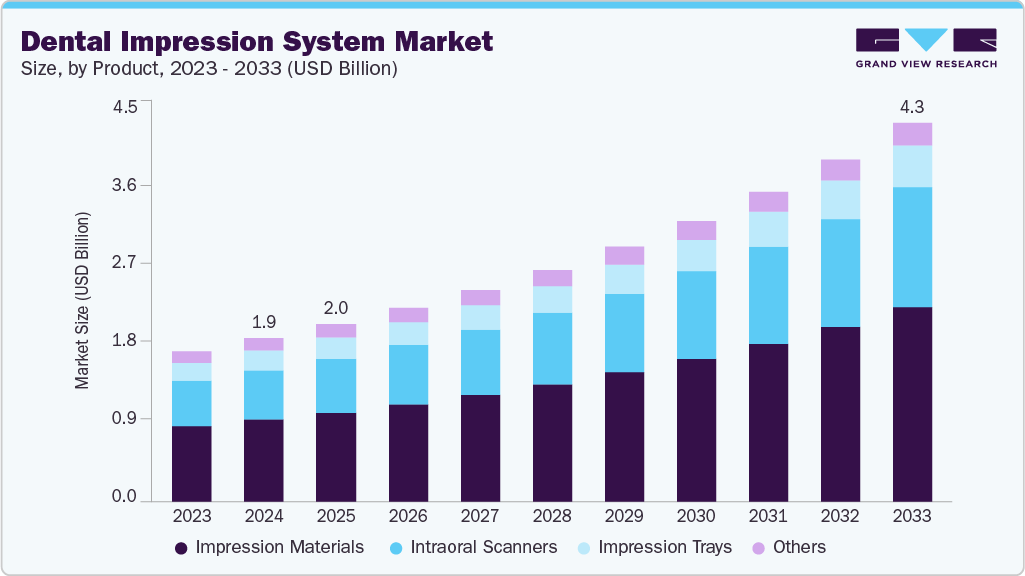

The global dental impression system market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 4.31 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. The dental impression system market is primarily driven by increasing demand for precise, digital, and CAD (Computer-Aided Design)/CAM (Computer-Aided Manufacturing) solutions, rising dental disorders, and advancements in impression materials.

Key Market Trends & Insights

- Europe dominated the dental impression system market with the largest revenue share of 39.81% in 2024.

- The dental impression system market in the U.S. accounted for the largest market revenue share of 84.46% in North America in 2024.

- Based on product, the impression materials segment led the market with the largest revenue share of 50.18% in 2024.

- Based on application, the restorative & prosthodontics dentistry segment led the market with the largest revenue share of 49.86% in 2024.

- By end use, the dental clinics segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2033 Projected Market Size: USD 4.31 Billion

- CAGR (2025-2033): 9.9%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/dental-impression-system-market-report/request/rs1

Growing dental tourism and technological innovations enhance accuracy and patient comfort, fueling market growth. In addition, the adoption of digital impression systems boosts efficiency and reduces turnaround time. The growing prevalence of dental disorders-including tooth decay, periodontal disease, tooth loss, dental caries, and plaque-is a key driver of the dental impression systems market. According to the World Health Organization, published in March 2025, over 1 billion people globally suffer from severe periodontal disease and overall oral diseases affect nearly 3.7 billion people globally. In addition, nearly 7% of adults aged 20+ and around 23% of those aged 60+ experience complete tooth loss, increasing the need for dentures and implants that require precise dental impressions. A report by Humble Memorial Dental published in February 2025 states that 3.5 billion people suffer from oral diseases globally, with cavities affecting over 90% of adults and gum disease impacting nearly half of those aged 30 and above. This rising disease burden significantly boosts demand for dental impression materials, scanners, and trays used in restorative and prosthetic procedures.

Furthermore, dental disorders affec both children and adults across various age groups, highlighting a widespread oral health challenge that underscores the growing need for effective dental impression materials and systems.

In addition, the growing demand for cosmetic dentistry is expected to drive the dental impression systems market significantly. As patients increasingly prioritize appearance and smile enhancement, there is a notable rise in procedures such as dental implants, veneers, crowns, and dentures. According to a study published by Twin Dental New York in June 2025, approximately 5 million new dental implants are placed annually in the U.S. alone.

Dental Impression System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.02 billion |

|

Revenue forecast in 2033 |

USD 4.31 billion |

|

Growth rate |

CAGR of 9.9% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait, UAE |

|

Key companies profiled |

Dentsply Sirona; Solventum; Henry Schein, Inc.; GC Corporation; Kulzer GmbH (Mitsui Chemicals, Inc.); Kerr Corporation (Envista); 3Shape A/S; Ivoclar Vivadent; Planmeca Oy; COLTENE Group; Ultradent Products Inc.; Septodont Holding; Zest Dental Solutions; Parkell, Inc.; Kettenbach GmbH & Co. KG; Keystone Industries; DMG; Align Technology, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |