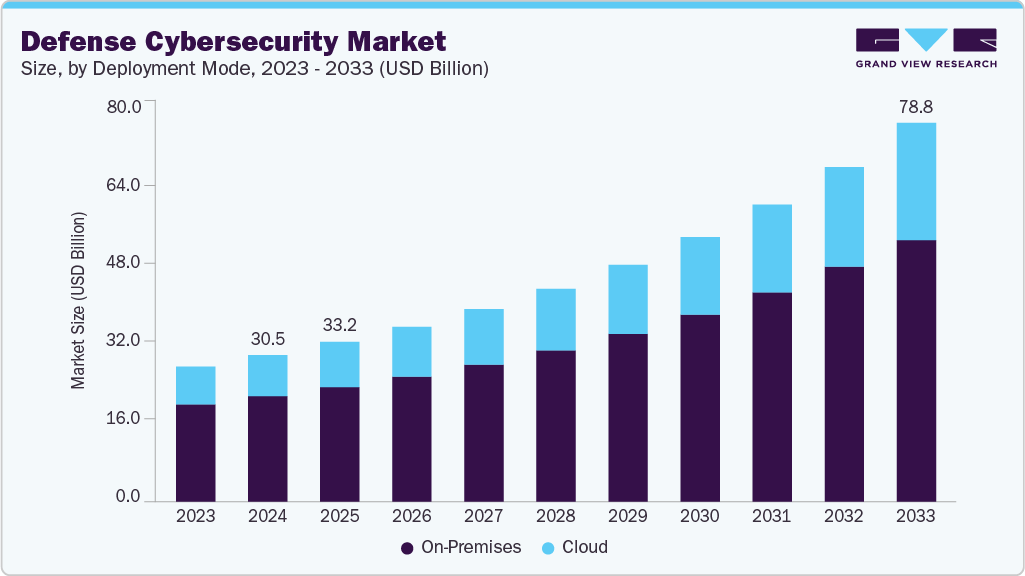

Defense Cybersecurity Market Size, Share & Trends Analysis growing at a CAGR of 11.4% from 2025 to 2033

The global defense cybersecurity market size was estimated at USD 30.49 billion in 2024 and is projected to reach USD 78.85 billion by 2033, growing at a CAGR of 11.4% from 2025 to 2033. The growth is attributed to the increasingly investing in cybersecurity by nation-states, defense agencies, and militaryto counter a growing wave of nation-sponsored cyberattacks, zero-day exploits, and advanced persistent threats (APTs).

Key Market Trends & Insights

- North America held a 42.17% revenue share of the global defense cybersecurity market in 2024.

- In the U.S., the market is driven by federal investments, AI integration, and evolving zero-trust mandates.

- By deployment mode, the on-premises segment held the largest revenue share of 71.87% in 2024.

- By solution, the cyber threat protection segment accounted for the largest revenue share of 37.54% in 2024.

- By component, the services segment accounted for the largest revenue share of 41.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.49 Billion

- 2033 Projected Market Size: USD 78.85 Billion

- CAGR (2025-2033): 11.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/defence-cyber-security-market/request/rs1

Modern defense cybersecurity strategies are shifting from perimeter-based security to layered architectures that emphasize network segmentation, threat intelligence sharing, and resilient systems architecture. For instance, agencies are integrating multi-domain security frameworks that protect traditional IT infrastructure along with operational technologies (OT), military-grade communications, and weapon systems from cyber infiltration. Consequently, as hybrid warfare and cyber espionage become standard tactics, governments are prioritizing military-specific cybersecurity standards, red-teaming exercises, and scenario-based threat modeling to enhance national cyber defense readiness.

Additionally, governments across regions are significantly increasing defense cybersecurity budgets in response to escalating cyber conflicts and digital warfare risks. A growing trend is the formalization of cyber resilience frameworks that embed security across the entire weapon system lifecycle. Moreover, defense agencies are also aligning cybersecurity with mission assurance by mandating modular, standards-driven approaches that support continuous assessment, secure-by-design architectures, and adaptable threat mitigation. These efforts reflect a shift toward collating cybersecurity not as a compliance checkbox, but as a critical performance attribute.

For instance, in December 2024, the U.S. Department of Defense released Version 4.3 of its Cyber Resilient Weapon Systems (CRWS) Body of Practice, an updated online reference guide that helps defense programs implement cyber resilience measures across complex weapon systems. This provides revised practices, DoD-specific guidance, and improved navigation features, reinforcing the growing emphasis on scalable, threat-informed defense cybersecurity integration. In conclusion, as the threat landscape becomes more complex, the market is rapidly evolving to incorporate predictive, automated, and resilience-driven defense capabilities.

Component Insights

The services segment accounted for the largest revenue share of 41.92% in 2024, due to the increasing dependence of military agencies on outsourced expertise to safeguard critical digital infrastructure against advanced cyber threats. Additionally, as the complexity of cyber warfare increases defense organizations are relying on managed services for continuous monitoring, threat intelligence integration, system hardening, and rapid incident response. These services not only provide flexibility and scalability but also alleviate the burden on internal cyber units by offering support across diverse threat environments. For instance, in August 2024, Science Applications International Corp. (SAIC) was awarded a contract by the U.S. Navy to provide Command, Control, Communications, Computers, and Intelligence (C4I) integrated cyber support services for Naval Information Warfare Center Pacific. This includes cybersecurity engineering, vulnerability assessments, and red-teaming exercises to fortify maritime defense assets. Consequently, the surge in mission-specific, full-spectrum service engagements is propelling the growth of the services segment in the global market.

![Concrete Repair Mortars Market Analysis: Opportunities, Innovations, and Growth Potential Through [2025-2034]](https://beeswire.com/wp-content/uploads/2025/07/polaris-70-768x768.png)