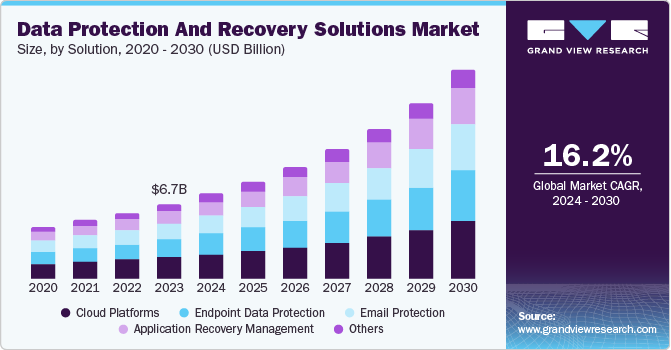

Data Protection And Recovery Solutions Market growing at a CAGR of 16.2% from 2024 to 2030

The global data protection and recovery solutions market size was valued at USD 6.73 billion in 2023 and is projected to reach USD 18.78 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030. Increasing dependency of businesses and industries on data sets and data availability, growing adoption of advanced technologies such as cloud computing, Internet of Things (IoT), Artificial Intelligence (AI), and machine learning, rising incidents of cyberattacks and increasing potential cyber threats have developed alarming need for effective data protection and recovery solutions in recent years.

Key Market Trends & Insights

- North America dominated the global data protection and recovery solutions market and accounted for a revenue share of 39.0% in 2023.

- The U.S. data protection and recovery solutions market held a significant revenue share of the regional market in 2023.

- Based on solution, the cloud platforms segment captured the largest market share of 29.0 % in 2023.

- Based on deployment, the on-premise deployment segment held the largest revenue share in 2023.

- Based on enterprise size, the large enterprise segment dominated the global market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.73 Billion

- 2030 Projected Market Size: USD 18.78 Billion

- CAGR (2024-2030): 16.2%

- North America: Largest Market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/data-protection-recovery-solutions-market/request/rs1

As businesses increasingly rely on data for multiple functions such as operations, decision-making, customer experiences, strategy development, strategy implementation, and more, the accessibility and availability of large datasets have become vital for growth. Unprecedented growth in cybercrime, data theft activities, data breach incidences, and targeted ransomware cyberattacks have driven the demand for data protection and recovery market. The U.S. Federal Investigation Bureau’s Internet Crime Complaint Center (IC3) received nearly 21.489 complaints of Business Email Compromise (BEC) cases, 2,825 complaints categorized as ransomware, and nearly 14,190 incident complaints of government impersonation.

The generation of personalized data through smartphones, connected devices, internet usage, and more has become one of the finest tools for businesses to identify customer behavior and changes. However, due to increased dependency on such data for daily operations, storage of key data sets related to areas such as financial services and banking has developed a requirement for robust data protection infrastructure. In addition, the reliability of critical infrastructure on technologies and data-driven systems has also generated demand for strong protection and recovery solutions.

Increasing digital transformations, a large number of data-driven online transactions, growing social media dialogue, and dependency on multiple critical infrastructure elements such as energy, water utilities, disaster management, transport, electricity grids, and others have developed growing demand for the innovative data protection solutions, as traditional data protection methods have become prone to attack and threats. For instance, from November 2023 to 2024, the U.S. infrastructure experienced cyber-attacks and unauthorized access incidents related to industrial control systems (ICS) operating in multiple industries, such as food and agriculture, healthcare, and water and wastewater management.

Solution Insights

The cloud platforms segment captured the largest market share of 29.0 % in 2023. Cloud platforms offer scalability and flexibility, enabling organizations to seamlessly adjust their data protection and recovery needs in response to fluctuating data volumes and evolving business requirements. This dynamic capability is particularly advantageous for businesses experiencing rapid growth or seasonal data spikes, as it allows them to scale their resources up or down quickly without substantial investments in physical infrastructure. By leveraging cloud platforms, organizations can accommodate sudden increases in data without facing the limitations and costs associated with traditional on-premises solutions. This scalability ensures that businesses can maintain optimal performance and reliability of their data protection and recovery systems, adapting swiftly to changes in demand and maintaining continuous protection.

The application recovery management segment is projected to expand at the fastest CAGR of 17.6 % over the forecast period. The increasing frequency of cyberattacks necessitates robust application recovery plans for businesses to safeguard their operations. These attacks can severely disrupt business processes and result in significant data loss if not adequately addressed. In this context, application recovery management solutions are essential, providing the tools and methods to restore critical applications and minimize downtime swiftly. These solutions help mitigate cyber incidents’ financial and operational impacts by ensuring rapid recovery, maintaining business continuity, and protecting sensitive data.

Data Protection And Recovery Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 6.73 billion |

|

Revenue forecast in 2030 |

USD 18.78 billion |

|

Growth rate |

CAGR of 16.2 % from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2024 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, enterprise size,end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico , Germany, UK, Germany, France, Japan, China, , India, Australia, South Korea, Brazil, Argentina, South Africa, And UAE, |

|

Key companies profiled |

Acronis International GmbH; Actifio Inc.; Arcserve, LLC; Axcient; Cohesity, Inc.; Commvault; Dell Inc.; Hewlett Packard Enterprise Development LP; IBM; Microsoft; NinjaOne; Rubrik; Unitrends; Veeam Software |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |