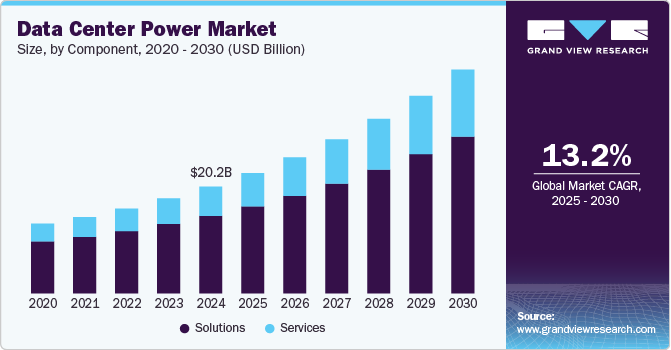

Data Center Power Market Size, Share & Trends Analysis growing at a CAGR of 13.2% from 2025 to 2030

The global data center power market size was estimated at USD 20.21 billion in 2024 and is projected to reach USD 42.35 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030, driven by the rising demand for data storage, cloud computing, and digital transformation across industries. With the expansion of hyper scale and colocation data centers, there is an increasing need for efficient and reliable power solutions to support continuous operations.

Key Market Trends & Insights

- North America data center power market held a significant share of over 37.0% in 2024.

- The data center power market in the U.S. is expected to grow significantly at a CAGR of 13.3% from 2025 to 2030.

- By component, the solutions segment dominated the market and accounted for a revenue share of over 72.0% in 2024.

- By solutions, the uninterruptible power supply (UPS) segment dominated the market in 2024.

- By services, the integration & deployment segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.21 Billion

- 2030 Projected Market Size: USD 42.35 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/data-center-power-market/request/rs1

Businesses are shifting towards scalable and high-performance computing environments, which require robust power infrastructure, including uninterruptible power supplies (UPS), generators, and power distribution units (PDU).

Energy efficiency and sustainability concerns are also playing a crucial role in shaping the data center power market. Companies are prioritizing green energy solutions such as renewable energy sources, advanced cooling technologies, and energy-efficient power management systems. Governments and regulatory bodies worldwide are enforcing stricter guidelines to reduce carbon footprints, pushing data center operators to invest in eco-friendly power infrastructure. Innovations such as liquid cooling, AI-driven power management, and modular power solutions are becoming essential to meet both performance and environmental goals. A survey conducted by The Register,a British technology news provider, revealed that more than a third of enterprises (38.3%) plan to implement liquid cooling technologies by 2026, up from 20.1% in early 2024. Liquid cooling is favored for its efficiency in managing heat in high-performance computing and dense server configurations.

The increasing demand for reliable and resilient power solutions to prevent downtime and ensure business continuity also contributes to the growth of the market. With data centers handling mission-critical workloads, even a minor power failure can result in substantial financial losses. As a result, data center operators are investing in redundant power systems, smart grid technology, and real-time power monitoring to enhance reliability. The growing frequency of extreme weather events and natural disasters further emphasizes the need for resilient power backup systems, including microgrids and on-site power generation.

Moreover, the expansion of 5G networks and the growing use of edge data centers are influencing power requirements. As edge computing brings data processing closer to users, smaller but highly efficient power systems are needed to support localized data centers. This shift is driving the demand for compact, modular, and AI-powered power solutions that can optimize energy consumption while ensuring high availability. With the increasing digitalization of industries and the proliferation of connected devices, the data center power market is expected to continue growth in the coming years.

Component Insights

The solutions segment dominated the market and accounted for a revenue share of over 72.0% in 2024, driven by the rising adoption of AI-driven power management systems. With artificial intelligence and machine learning being integrated into power distribution and monitoring solutions, data centers can optimize energy consumption, predict failures, and enhance overall efficiency. Smart power management tools allow real-time monitoring of power usage, helping operators reduce energy wastage and improve sustainability.

The services segment is anticipated to grow at a CAGR of 14.9% during the forecast period, driven by the increasing complexity of power infrastructure and the need for continuous monitoring, maintenance, and optimization. As data centers expand to support cloud computing, AI workloads, and high-performance computing, operators are relying more on specialized service providers to ensure power reliability, efficiency, and compliance with regulatory standards.