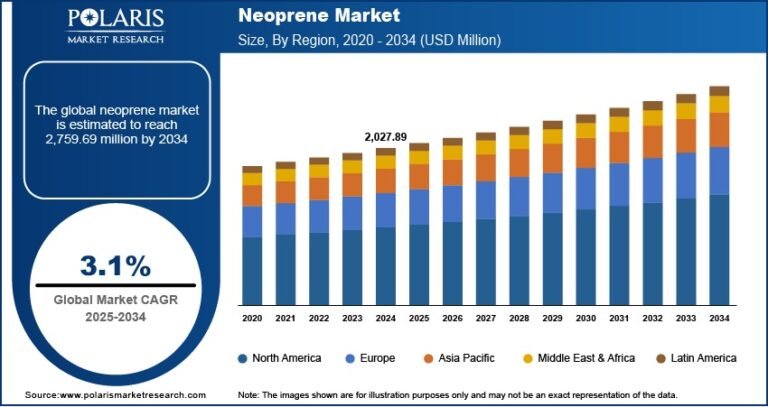

Data Center Market growing at a CAGR of 11.3% from 2026 to 2033

The global data center market size was estimated at USD 383.82 billion in 2025 and is anticipated to reach USD 902.19 billion by 2033, growing at a CAGR of 11.3% from 2026 to 2033, driven primarily by the exponential rise in data generation across industries. The market is undergoing rapid transformation as enterprises, governments, and hyperscale cloud providers aggressively expand digital infrastructure to support the exponential rise in data generation, artificial intelligence (AI) workloads, and cloud-based applications.

Key Market Trends & Insights

- North America held 38.3% revenue share of the data center market.

- In the U.S., the increasing reliance on hyperscale and colocation data centers is accelerating the demand for industrial and commercial LED lighting market.

- By component, hardware segment held the largest revenue share of over 67.0% in 2025.

- By type, on-premise segment held the largest revenue share in 2025.

- By server rack, 10-19kW segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 383.82 Billion

- 2033 Projected Market Size: USD 902.19 Billion

- CAGR (2026-2033): 11.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/data-center-market-report/request/rs1

The rapid shift toward cloud computing, as enterprises increasingly adopt public, private, and hybrid cloud models to enhance scalability, reduce capital expenditure, and improve operational efficiency. Organizations are moving critical applications, workloads, and data to cloud platforms to gain flexibility, faster deployment, and better resource optimization. This widespread adoption has compelled major hyperscalers such as Amazon Web Services, Microsoft Azure, Google Cloud, and Alibaba Cloud to aggressively expand their global regions and availability zones to meet rising demand. These expansions support low-latency access, improved redundancy, local data sovereignty compliance, and greater service availability across industries. As more businesses embrace digital transformation, cloud-first strategies continue to accelerate the construction of hyperscale data centers worldwide, reinforcing cloud computing as a central catalyst for market growth.

Moreover, the proliferation of edge computing is significantly contributing to the growth of the data center industry. As the volume of data generated by IoT devices and real-time applications increases, there is a growing need for low-latency processing. Edge data centers located closer to the source of data generation reduce latency and improve application performance. This trend is particularly prominent in sectors such as autonomous vehicles, healthcare, and smart cities, where real-time data processing is critical.

Sustainability initiatives are also playing a pivotal role in driving growth in the data center market. Operators are prioritizing energy-efficient designs, renewable energy adoption, and next-generation cooling systems to minimize environmental impact. Governments and regulatory authorities are also pushing for greener data center practices, accelerating investment in sustainable infrastructure. Meanwhile, continuous technological advancements, such as liquid cooling, AI-driven management systems, and modular data center architectures, are significantly improving performance while reducing operational costs. These innovations are motivating enterprises to upgrade and modernize their data environments, further supporting the expansion of the overall market.

Component Insights

The hardware segment accounted for the largest market share of over 67.0% in 2025 in the data center market. The rising demand for high-performance computing (HPC) and AI workloads is a major driver of growth in the data center hardware segment. AI training, machine learning, and complex computational tasks require powerful GPUs and accelerator-based servers that can handle extremely high processing loads. These applications also require high-density racks, ultra-fast NVMe storage, and advanced networking technologies, such as 100G, 400G, and increasingly 800G Ethernet, to support rapid data transfer. As workloads intensify, data centers must adopt more energy-efficient cooling systems to manage the heat generated by dense compute environments. This shift toward performance-driven infrastructure is accelerating investments in next-generation servers, networking gear, and cooling hardware.

The software segment is anticipated to grow at a CAGR of 12.6% during the forecast period. The growing complexity of modern data centers, particularly hyperscale, multi-site, and hybrid environments are likely to help the software segment growth. Operators require DCIM & other platforms to gain real-time visibility into power, cooling, space, and equipment performance across their facilities. These tools support capacity planning, asset tracking, energy optimization, and predictive maintenance, helping reduce downtime and improve operational efficiency. As data centers scale and diversify, DCIM software has become essential for centralized management, automation, and informed decision-making in increasingly dynamic infrastructure environments.

Hardware Insights

The server segment dominated the market and accounted for a revenue share of over 34.0% in 2025. Modern servers are becoming more powerful and energy-efficient due to the continuous advancements in processor technology, memory, and storage solutions. For example, the integration of ARM-based processors into server designs has been gaining traction, offering a more energy-efficient and cost-effective alternative to traditional x86-based servers.

The uninterruptible power supply segment is expected to grow at the fastest CAGR over the forecast period. The growing power requirements of modern data centers, particularly hyperscale and AI-intensive facilities, are driving strong demand for UPS systems. High-density server racks, GPU clusters, and storage arrays consume substantial electricity, making a continuous and reliable power supply critical to prevent downtime and protect sensitive workloads. UPS systems provide backup power, voltage regulation, and surge protection, ensuring operational continuity even during outages or fluctuations. As data centers scale in size and complexity, the need for robust, high-capacity, and energy-efficient UPS solutions becomes increasingly essential to maintain uptime, meet service-level agreements, and safeguard infrastructure.

Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 425.28 billion |

|

Revenue forecast in 2033 |

USD 902.19 billion |

|

Growth rate |

CAGR of 11.3% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report vertical |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component,type, server rack density,redundancy, PUE,design,tier level,enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Alibaba Cloud; Amazon Web Services Inc.; AT&T Intellectual Property; Lumen Technologies (CenturyLink); China Telecom Americas, Inc.; CoreSite; CyrusOne; Digital Realty; Equinix, Inc.; Google Cloud; IBM Corporation; Microsoft; NTT Communications Corporation; Oracle; Tencent Cloud |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |