Data Center Containment Market growing at a CAGR of 12.7% from 2025 to 2033

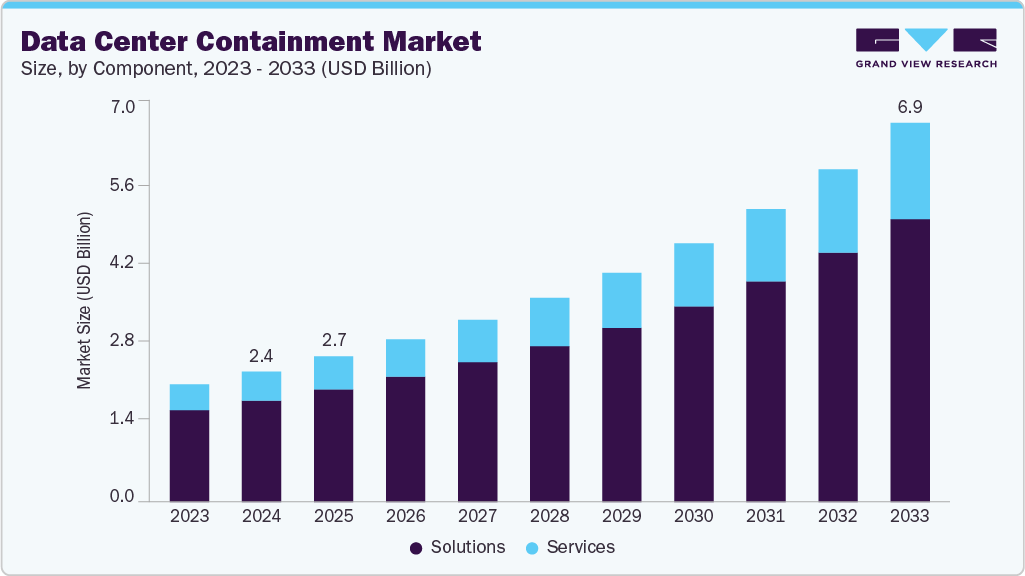

The data center containment market size was estimated at USD 2.38 billion in 2024 and is projected to reach USD 6.92 billion by 2033, growing at a CAGR of 12.7% from 2025 to 2033, driven by the growing demand for energy efficiency and cost-effective thermal management solutions in modern data centers.

Key Market Trends & Insights

- In terms of region, North America held the largest revenue share of 40.8% of the global market in 2024.

- The data center containment industry in the U.S. is expected to grow significantly over the forecast period.

- By component, solutions led the market and held the highest revenue share of 77.8% in 2024.

- By containment, the hot aisle containment (HAC) segment held the dominant position in the market and accounted for the largest revenue share in 2024.

- By end use, the healthcare segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.38 Billion

- 2033 Projected Market Size: USD 6.92 Billion

- CAGR (2025-2033): 12.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/data-center-containment-market-report/request/rs1

As data centers become increasingly power-intensive due to the rise of AI, big data, and cloud computing, operators are under pressure to reduce energy consumption without compromising performance.

Containment systems offer a proven method to improve cooling efficiency by separating hot and cold airflows, minimizing mixing, and thus optimizing the performance of cooling infrastructure. This leads to substantial reductions in energy usage, operational costs, and carbon footprint, which are critical concerns for enterprises and colocation providers alike. The rapid expansion of hyperscale data centers and the adoption of modular and prefabricated data center designs also contribute to the growth of the data center containment industry. As businesses continue to digitize operations and migrate to the cloud, the need for high-density computing environments grows. Containment solutions enable these high-density environments to be effectively cooled and maintained, supporting scalable and flexible infrastructure deployment. Moreover, regulatory pressures and green building initiatives in several regions are encouraging the use of containment systems to meet energy efficiency standards such as those set by ASHRAE and other environmental guidelines.

For instance, in October 2024, Microsoft announced the construction of its first data centers using a hybrid of mass timber, steel, and concrete, aiming to lower carbon emissions linked to traditional building materials significantly. This approach is expected to cut the embodied carbon footprint by 35% compared to steel structures and 65% compared to precast concrete.

In addition, increasing awareness of sustainability and the total cost of ownership (TCO) in data center operations is pushing companies to invest in long-term infrastructure improvements. Containment technologies extend the lifespan of IT equipment by maintaining optimal temperature conditions, thereby reducing the frequency of hardware failures and maintenance needs. The proliferation of edge data centers, driven by the Internet of Things (IoT), 5G rollout, and latency-sensitive applications, is also contributing to market growth, as these compact facilities require innovative containment solutions to manage thermal loads in constrained spaces.

Containment Insights

The hot aisle containment (HAC) segment dominated the market with a revenue share of 36.7% in 2024, driven by the increasing need for effective heat removal in high-density data centers. As server rack densities continue to rise with the adoption of AI, machine learning, and high-performance computing (HPC), traditional cooling methods struggle to manage heat dissipation efficiently. HAC systems isolate and redirect hot exhaust air directly to cooling units, preventing recirculation and improving thermal management. This makes HAC particularly valuable in environments where overheating can lead to equipment failure and downtime.

The cold aisle containment (CAC) segment is anticipated to grow at a CAGR of 11.1% during the forecast period, driven by the rising adoption of high-density computing infrastructure, such as hyper-scale and edge data centers. With the deployment of high-performance servers and GPUs, heat generation has increased, necessitating more efficient thermal management. CAC provides a targeted cooling approach, ensuring that cold air is delivered precisely where it is needed, thereby preventing hotspots and improving overall cooling performance. This capability is particularly valuable in modern data centers where traditional cooling methods may fall short.

Component Insights

The solutions segment dominated the market in 2024 in terms of revenue, driven by the increasing complexity of data center cooling requirements and the demand for integrated, customized, and intelligent containment systems. One of the primary growth drivers is the rising adoption of hybrid containment solutions, which combine CAC, HAC, and vertical exhaust ducting to optimize airflow management. As data centers evolve to support higher-density workloads, operators seek flexible and scalable solutions that can be tailored to specific facility layouts and cooling needs. This trend is particularly evident in hyperscale and colocation data centers, where efficiency and adaptability are critical.

The services segment is expected to grow at a significant CAGR over the forecast period due to the rising trend of outsourcing data center operations. Many enterprises are shifting toward colocation and managed service providers to reduce capital expenditure and operational burden. These third-party providers, in turn, rely heavily on specialized service firms to install and manage containment solutions that enhance energy efficiency and support their service level agreements (SLAs). As a result, there’s a growing ecosystem of containment service partners who play a critical role in enabling seamless and efficient data center operations.

Data Center Insights

The large data centers segment dominated the market in 2024 in terms of revenue, driven by the growing demand for hyperscale computing, energy efficiency, and sustainable operations. One of the primary growth drivers is the exponential increase in data consumption, driven by cloud computing, artificial intelligence (AI), and big data analytics. As enterprises and hyperscalers like Google, Amazon, and Microsoft expand their infrastructure to support these workloads, large data centers require advanced containment solutions to manage the substantial heat generated by high-density server racks.

The hyperscale data centers segment is expected to grow at a significant CAGR over the forecast period. The growing demand for cloud services, generative AI, and high-performance computing (HPC) is driving hyperscale operators to scale their infrastructure while prioritizing energy efficiency rapidly. As AI server racks now often exceed power densities of 30-50kW, traditional cooling methods are no longer sufficient. This has led to the increased adoption of advanced thermal management solutions, with HAC emerging as a key strategy. HAC systems play a vital role in hyperscale data centers by effectively isolating and extracting heat, thereby reducing the risk of thermal throttling and system downtime in GPU- and CPU-intensive environments.

Data Center Containment Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 2.65 billion |

|

Revenue forecast in 2033 |

USD 6.92 billion |

|

Growth Rate |

CAGR of 12.7% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2033 |

|

Report enterprise size |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Containment, component, data center, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Data Clean Corporation; Degree Controls; Eaton Corporation plc; Future Facilities; Legrand S.A.; nVent; Polargy; Rittal GmbH & Co. KG; Schneider Electric SE; Siemon; STULZ GmbH; Subzero Engineering, Inc.; Upsite Technologies; Vertiv Group Corp. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |