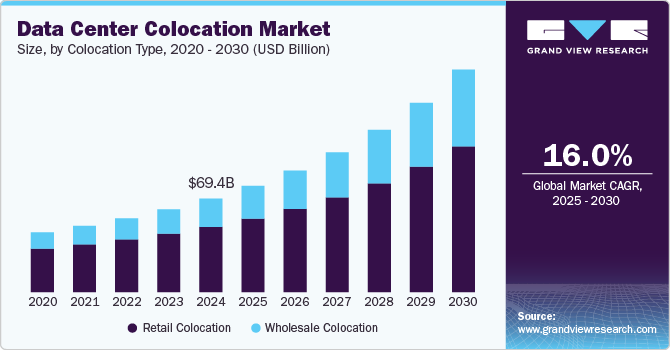

Data Center Colocation Market Size, Share & Trends Analysis growing at a CAGR of 16.0% from 2025 to 2030

The global data center colocation market size was estimated at USD 69.41 billion in 2024 and is projected to reach USD 165.45 billion by 2030, growing at a CAGR of 16.0% from 2025 to 2030. Data centers play a crucial role in modern corporate operations by managing business applications and supporting IT infrastructure.

Key Market Trends & Insights

- The data center colocation industry in North America held a largest share of 39.0% in 2024

- The data center colocation industry in the U.S. is expected to grow significantly at a CAGR of 14.9% from 2025 to 2030.

- By colocation type, the retail colocation segment dominated the data center colocation industry and accounted for a revenue share of nearly 70.0% in 2024.

- By tier level, the tier 3 segment accounted for a largest revenue share of over 58.0% in 2024

- By enterprise size, the large enterprises segment accounted for a largest revenue share of over 49.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 69.41 Billion

- 2030 Projected Market Size: USD 165.45 Billion

- CAGR (2025-2030): 16.0%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/data-center-colocation-market/request/rs1

As companies increasingly rely on data, the demand for robust IT solutions has grown, leading to greater adoption of cloud services. Colocation data centers provide businesses with the flexibility to scale IT resources efficiently. Additionally, the high costs associated with building and maintaining in-house data centers, especially for organizations with fluctuating data needs, have been a significant factor driving market growth.

The rise of technologies such as cloud computing, autonomous vehicles, IoT, and advanced robotics has driven demand for faster data processing and higher bandwidth. These technologies require low latency and high-speed network connectivity, making colocation data centers an ideal solution. By strategically locating facilities closer to end users, colocation providers enhance storage and networking capabilities. In the data center colocation industry, the expansion of 5G technology is expected to further boost colocation deployments, particularly in remote areas.

Additionally, the growing adoption of cloud data centers, driven by cost efficiency, is accelerating market growth. SMEs are increasingly turning to cloud solutions to reduce IT expenses, eliminate the need for dedicated IT staff, and benefit from scalable, low-cost infrastructure. To strengthen their market position, major industry players are engaging in strategic initiatives such as partnerships, acquisitions, and mergers.

Customers can leverage Digital Exchange to deploy IT infrastructure on demand, creating a foundation for modernizing operations in an increasingly digital landscape. The rise of 5G, AR, VR, and AI has significantly increased the demand for higher bandwidth to facilitate seamless data sharing between businesses. Additionally, the growing adoption of autonomous vehicles and advanced robotics has driven the need for low-latency solutions, further boosting the demand for colocation services. By allowing cloud service providers to establish data centers closer to end users, colocation ensures faster data transfers and higher bandwidth.