Data Center As A Service Market Size, Share & Trends Analysis growing at a CAGR of 23.3% from 2025 to 2030

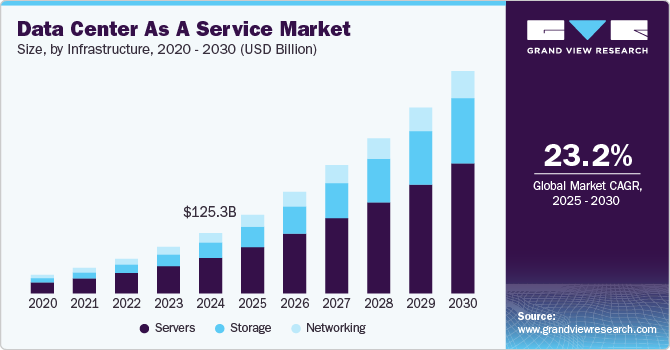

The global data center as a service market size was estimated at USD 125.35 billion in 2024 and is projected to reach USD 461.44 billion by 2030, growing at a CAGR of 23.3% from 2025 to 2030. The rising use of advanced technologies such as cloud, AI, IoT, and machine learning offers a wide array of benefits to organizations.

Key Market Trends & Insights

- North America data center as a services market held a significant revenue share of around 36.6% in 2024.

- The demand for data center as-a-service in the U.S. is experiencing significant growth.

- Based on infrastructure, the servers segment dominated the industry with a revenue share of 59.0% in 2024.

- In terms of enterprise size, the large enterprises segment dominated the industry with a revenue share of 56.5% in 2024.

- On the basis of verticals, the retail segment dominated the market and accounted for a 24.4% share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 125.35 billion

- 2030 Projected Market Size: USD 461.44 billion

- CAGR (2025-2030): 23.3%

- North America: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/data-center-as-a-service-market-report/request/rs1

The application of artificial intelligence in data centers is growing exponentially, owing to benefits such as greater efficiency in temperature management and predictive maintenance in data centers. For instance, DeepMind AI reduced Google’s data center cooling by 40% and improved energy efficiency by reducing overall emissions. Cloud helps in delivering a diverse set of applications, managing data, and restoring and creating backups and offers the ideal storage capacity. Furthermore, significant cost savings associated with the use of cloud-based platforms are prompting commercial establishments as well as government agencies to migrate to cloud storage and opt for cloud-based platforms, which is subsequently expected to drive the demand for data centers.

The rising dependency on data is increasing in day-to-day business operations and financial transactions. Modern data centers are emerging as an economic warehouse facility for the digitally connected world. These data centers are more than storage facilities; they offer advanced technological analysis, scaling, networking, storage, security, and computing facilities for platforms and applications. Governments and companies worldwide rely on data centers to store sensitive data related to operational and proprietary assets in a centralized and secure digital environment.

In addition, the rising need for enhanced disaster recovery and business continuity solutions also fuels the demand for the DCaaS industry. With increasing reliance on digital systems, businesses are highly vulnerable to disruptions caused by natural disasters, cyberattacks, or system failures. DCaaS providers offer redundancy, failover capabilities, and geographically dispersed data centers, ensuring uninterrupted access to critical data and applications. This resilience is a major selling point for enterprises looking to safeguard their operations against unforeseen events.

Advancements in networking technologies, such as 5G and software-defined networking (SDN), are further accelerating the growth of the DCaaS market. These technologies enable faster and more reliable connections between data centers and end-users, enhancing the overall performance of DCaaS solutions. With 5G facilitating low-latency and high-bandwidth connectivity, the adoption of edge computing is also increasing, driving demand for localized DCaaS offerings that support real-time data processing closer to the source.

Furthermore, the expansion of the DCaaS market is supported by increasing regulatory requirements and compliance needs. Many industries like finance, healthcare, and government operate under strict data privacy and security regulations. DCaaS providers offer advanced security measures, data encryption, and compliance certifications, ensuring that businesses can meet regulatory standards without the complexity of managing these requirements internally.

Infrastructure Insights

The servers segment dominated the industry with a revenue share of 59.0% in 2024. Academic institutions, defense agencies, and government agencies are aggressively adopting new, innovative solutions based on the latest digital technologies, such as artificial intelligence (AI), internet of things (IoT), and machine learning (ML), thereby driving the need for sophisticated, hyper-converged IT infrastructure comprising high-performance computing servers to run complex software-defined solutions and process large volumes of data. The strong emphasis on maintaining a pool of servers to ensure adequate processing power to process large volumes of data bodes well for the segment’s growth over the forecast period. In April 2021, Alibaba, a multinational technology company based in China, expanded its Zhongdu Grassland project data center in Zhangbei County, China. The latest expansion involved 10 data center buildings with over 200,000 server cabinets. The expansion fell under the company’s plans to expand to over 1 billion servers. Such developments are expected to contribute to the segment’s growth over the forecast period.

The storage segment is anticipated to grow significantly with a CAGR of 17.7% over the forecast period. The rising volumes of computing data across the globe are also driving the demand for storage systems to ensure quick access to the data. Several countries focus on establishing virtual data storage systems to reduce their reliance on overseas organizations and strengthen data security. Infrastructure software enables the digital storage system to control, monitor, secure, and manage data without excessive operational costs. These are the primary factors expected to drive the data center as a service market demand.