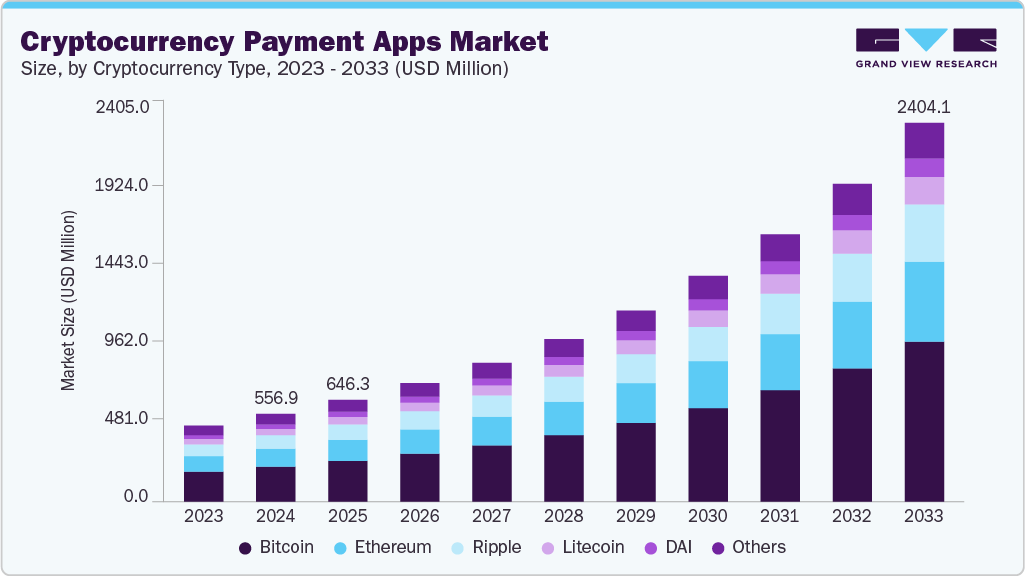

Cryptocurrency Payment Apps Market Size, Share & Trends Analysis growing at a CAGR of 17.8% from 2025 to 2033

The global cryptocurrency payment apps market size was estimated at USD 556.9 million in 2024 and is projected to reach USD 2,404.1 million by 2033, growing at a CAGR of 17.8% from 2025 to 2033. The emergence of Web3 and blockchain technology created the need for cryptocurrency payment apps to enable individuals to conduct seamless transactions.

Key Market Trends & Insights

- North America dominated the cryptocurrency payment apps industry and accounted for a share of 34.6% in 2024

- Based on cryptocurrency type, the Bitcoin segment dominated the market in 2024 and accounted for the largest share of 39.9%

- Based on payment type, the in-store payment segment held the largest market share in 2024

- Based on type, the Android segment dominated the market in 2024.

- Based on end user, the businesses segment dominated the market in 2024

Market Size & Forecast

- 2024 Market Size: USD 556.9 Million

- 2033 Projected Market Size: USD 2,404.1 Million

- CAGR (2025-2033): 17.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/cryptocurrency-payment-apps-market-report/request/rs1

The growing adoption of cryptocurrencies globally is the key driver for the market’s expansion. People are encouraged to use cryptocurrency payment platforms owing to the decentralized nature of the blockchain, which eliminates mediators such as banks from the payment processing system. It reduces the processing time and accelerates the transaction speed, consequently adding to the increasing popularity of such platforms. In addition, the growing prevalence of cryptocurrencies as an investment option among millennials is also fueling the growth of the cryptocurrency payment apps industry.

One of the most transformative trends in the market is the increasing interoperability between crypto payment platforms and traditional banking systems. Crypto apps now allow users to seamlessly convert digital assets into fiat currencies and vice versa, enabling easier withdrawals, direct-to-bank transfers, and debit card functionalities. This fusion is bridging the gap between old and new financial infrastructures, encouraging a smoother transition for users hesitant to move entirely into decentralized finance (DeFi). Thus, increasing integration of cryptocurrency payment apps with traditional financial systems can be attributed to the market’s growth.

The proliferation of mobile payment adoption and advancements in cybersecurity are further propelling the market. Cryptocurrency payment apps are leveraging biometric authentication, multi-signature wallets, and hardware-based security modules to enhance transaction safety. Coupled with the increasing global smartphone penetration, especially in emerging economies, these innovations are making digital asset payments more accessible and secure for a broader audience. In addition, the continual developments and innovations to enhance the consumer’s experience in the blockchain space are expected to create a positive outlook for the market.

The expansion of the DeFi and Web3 ecosystem is playing a pivotal role in advancing cryptocurrency payment apps. However, a lack of awareness about the benefits offered by cryptocurrency payment apps is expected to restrain the growth of the market over the forecast period. In addition, the lack of trust among the users, as no centralized regulator is authenticating this transaction, is one of the major obstacles to the market’s growth. However, the significant efforts taken by some of the market players are anticipated to establish market growth.

Cryptocurrency Type Insights

The bitcoin segment dominated the cryptocurrency payment apps market in 2024 and accounted for the largest share of 39.9%. Dominance is attributable to Bitcoin being the pioneer of the industry. In addition, it guarantees the uncompromised security of the payment systems owing to the proof-of-work mechanism ensured by the users of the decentralized Bitcoin network. Bitcoin, as a blockchain-based currency, needs volunteers to sign hashes that use cryptography to verify transactions over the bitcoin network. This method ensures that transactions are typically irreversible; as a result, Bitcoin has high data security, driving the segment’s growth.

The Ethereum segment is expected to witness a significant CAGR over the forecast period. The major factor of growth is that Ethereum paved the way for Non-Fungible Tokens (NFTs) and laid the foundation for the digital asset revolution. It was the earliest smart-contract-enabled network. In addition, it has become considerably easier to define ownership and control transferability of NFTs due to smart contracts, which is expected to create further opportunities for the market.