Cryptocurrency Market growing at a CAGR of 14.5% from 2026 to 2033

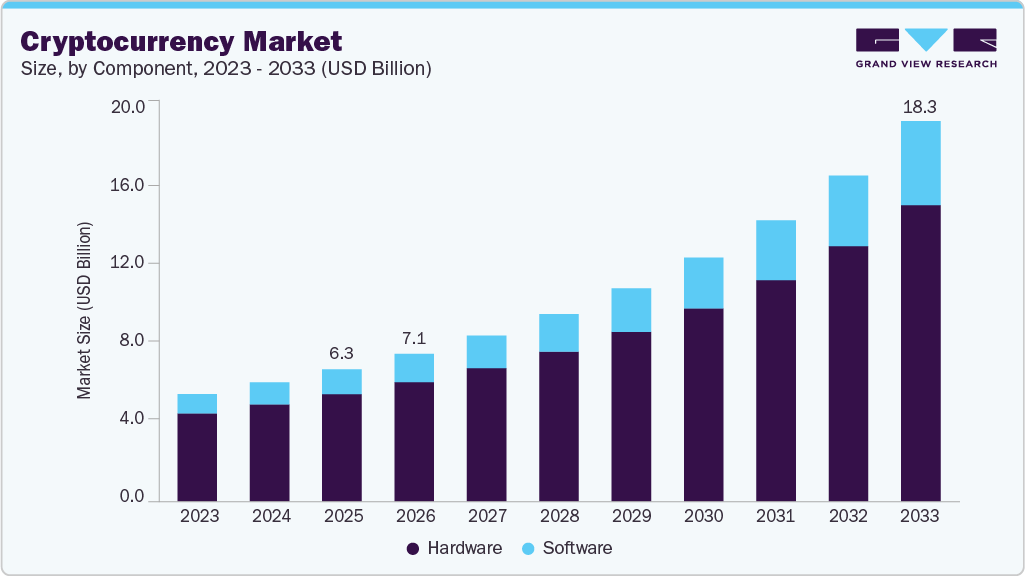

The global cryptocurrency market size is estimated at USD 6.34 billion in 2025 and is projected to reach USD 18.26 billion by 2033, growing at a CAGR of 14.5% from 2026 to 2033. The increasing adoption of distributed ledger technology is expected to drive the growth of the cryptocurrency industry during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the global cryptocurrency market with the largest revenue share of 31.0% in 2025.

- The cryptocurrency industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By component, the hardware segment led the market with the largest revenue share of 81.2% in 2025.

- By hardware, the application-specific integrated circuit segment accounted for the largest market revenue share in 2025.

- By software, the exchange software accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.34 Billion

- 2033 Projected Market Size: USD 18.26 Billion

- CAGR (2026-2033): 14.5%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/cryptocurrency-market-report/request/rs1

Moreover, increasing usage of cryptocurrencies for cross-border remittances is expected to fuel market expansion due to the reduction in consumer fees and exchange charges. Recent developments in Artificial Intelligence (AI) are expected to have a huge impact on the cryptocurrency industry. The rising popularity of AI-based cryptocurrency platforms has inspired several businesses to focus on the development of AI technology. For instance, in November 2024, VanEck launched a new exchange-traded note (ETN) focused on the Sui blockchain, expanding access to decentralized finance (DeFi) investments for European investors. This ETN is listed on Euronext Paris and Amsterdam, enabling investors to gain exposure to the SUI token without the need to purchase or hold it directly. The Sui blockchain, developed by Mysten Labs, is designed for high transaction speeds and scalability, enabling multiple transactions to be processed simultaneously, thereby addressing the limitations faced by older blockchains like Bitcoin and Ethereum.

The growing prominence of cryptocurrency as a decentralized asset class has drawn significant investment from private venture firms, contributing to the market’s ongoing expansion. In November 2024, the cryptocurrency industry reached a remarkable milestone, with its total market capitalization hitting a record high of USD 3.2 trillion, according to CoinGecko. This surge in value reflects a growing interest and investment in various cryptocurrencies, driven by factors such as increased institutional adoption, advancements in blockchain technology, and the expansion of decentralized finance (DeFi) platforms.

One of the key factors driving the growth of digital currency is the increasing number of businesses that now accept cryptocurrency as a legitimate payment method. In addition, the adoption of digital currency by major corporations such as Tesla Inc. and MasterCard Inc. is anticipated to boost industry expansion. For instance, in November 2021, MasterCard Inc., a financial services company, allowed its network partners to enable their customers to purchase, trade, and hold digital currency using a digital wallet. Moreover, the business offered digital currency as a reward for the clients who participated in loyalty programs.

Government bodies across the globe are focusing on devising laws to regulate cryptocurrencies. The European Union has developed the Markets in Crypto Assets (MiCA) law to create a legal framework specifically designed for the crypto asset market. Additionally, in February 2022, the Indian government took a step towards legalizing cryptocurrency by announcing a 30.0% tax on any income generated from the transfer of digital currencies. Cryptocurrencies, such as Bitcoin, have been gaining traction in high-inflation countries, including Argentina, Zimbabwe, and Brazil, as their local currencies devalue.

Although Bitcoin is a cutting-edge financial technology, its growth is expected to be constrained by the lack of regulations and a unified standard for exchanging digital currency. Regulators from around the world are concerned about the use of cryptocurrencies for illicit purposes, which poses a significant barrier to the market’s expansion. However, law enforcement agencies are making efforts to seize illegally acquired cryptocurrency, which bodes well for the market growth.

Cryptocurrency Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 7.08 billion |

|

Revenue forecast in 2033 |

USD 18.26 billion |

|

Growth rate |

CAGR of 14.5% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2025 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, process, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Advanced Micro Devices, Inc.; Binance; Bit fury Group Limited; Bit Go, Inc.; Bit Main Technologies Holding Company; Intel Corporation; NVIDIA Corporation; Ripple; Xapo Holdings Limited; Xilinx, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |