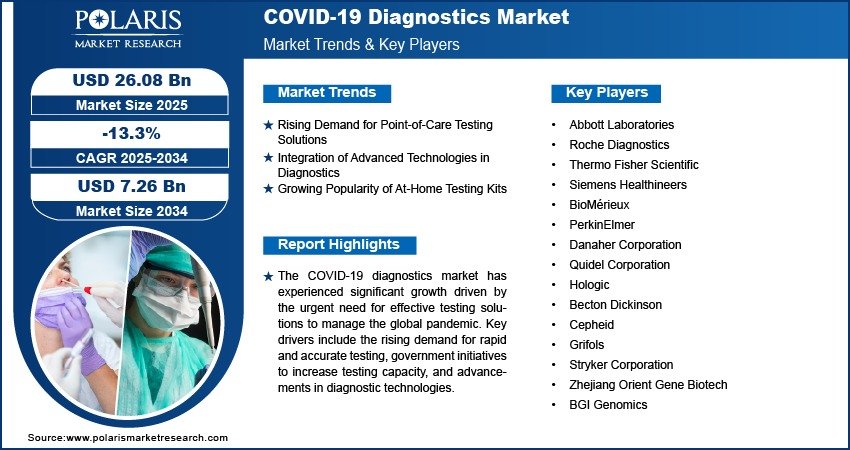

COVID-19 Diagnostics Market Projected to Reach $7.26 Billion by 2034, Declining at a CAGR of -13.3%

The global COVID-19 diagnostics market size was valued at USD 30.02 billion in 2024. The market is projected to decline from USD 26.08 billion in 2025 to USD 7.26 billion by 2034, exhibiting a CAGR of -13.3% during the forecast period of 2025 to 2034.

Industry Overview:

The COVID-19 diagnostics market witnessed exponential growth during the pandemic due to the urgent demand for rapid and accurate testing tools. However, as global vaccination rates increase and the pandemic transitions toward endemicity, the market is experiencing a notable decline. Despite this, the need for ongoing surveillance, identification of new variants, and prevention of future outbreaks ensures continued—though reduced—demand for COVID-19 diagnostic solutions. The industry is now shifting focus from large-scale emergency testing to more specialized and integrated diagnostic services within broader respiratory virus detection panels.

Key Market Trends:

-

Shift to Multiplex Testing: With declining exclusive COVID-19 testing demand, multiplex diagnostics that detect SARS-CoV-2 alongside influenza and RSV are gaining popularity. These tests enhance lab efficiency and are increasingly used in clinical settings.

-

Home Testing and Self-Diagnostics: The popularity of rapid antigen home test kits remains, especially for travel and workplace screening. Ease of use and quick results support ongoing demand in certain demographics.

-

Genomic Surveillance Tools: Governments and research bodies are investing in advanced genomic sequencing to track mutations and emerging variants, adding a niche segment within the market.

-

Integration with Digital Health Platforms: COVID-19 test data is increasingly being integrated into digital health records and mobile apps to aid public health monitoring, contact tracing, and vaccine passport systems.

-

Declining Mass Testing Programs: Many countries have phased out mass testing initiatives, especially for asymptomatic cases, leading to reduced volumes in centralized testing laboratories.

Market Size & Forecast:

|

Market Size Value in 2024 |

USD 30.02 billion |

|

Market Size Value in 2025 |

USD 26.08 billion |

|

Revenue Forecast by 2034 |

USD 7.26 billion |

Request for Free Sample:

Key Market Drivers & Barriers:

Drivers:

-

Continued emergence of new SARS-CoV-2 variants requiring ongoing monitoring.

-

Government surveillance programs and public health initiatives.

-

Integration of COVID-19 diagnostics into routine clinical testing, especially in elderly and immunocompromised populations.

Barriers:

-

Drastic drop in public and private testing demand post-peak pandemic phase.

-

Reduced funding and resource allocation for COVID-19-specific testing.

-

Market saturation and oversupply of test kits from previous years.

Market Opportunity:

Despite the declining overall trajectory, opportunities exist in specialized diagnostic areas. Companies focusing on multiplex respiratory panels and advanced molecular diagnostics are likely to benefit. Furthermore, developing regions still face testing access challenges, offering room for market penetration. Also, the integration of AI and machine learning into diagnostic interpretation and remote testing platforms could offer a competitive edge for innovative firms. Long-term opportunities may also arise from pandemic preparedness initiatives and future outbreaks where rapid testing infrastructure is essential.

In conclusion, while the COVID-19 diagnostics market is shrinking, it continues to evolve and reposition within the larger diagnostic landscape. Companies adapting to emerging trends and technological advancements will retain a foothold in this transitioning market.