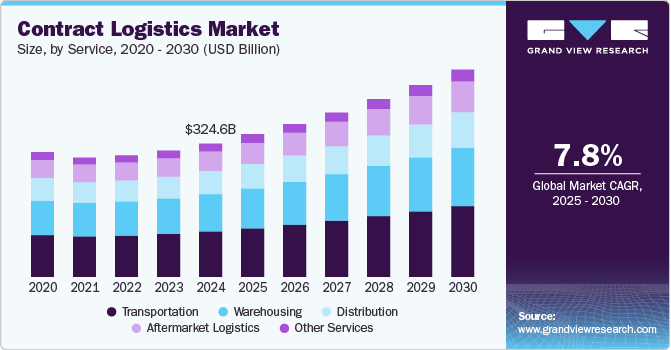

Contract Logistics Market Size, Share & Trends Analysis growing at a CAGR of 7.8% from 2025 to 2030

The global contract logistics market size was estimated at USD 324.6 billion in 2024 and is projected to reach USD 503.3 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The market is gaining momentum, driven by rapid e-commerce growth, increasing globalization of supply chains, and rising pressure on businesses to streamline operations and reduce overhead.

Key Market Trends & Insights

- The Asia Pacific contract logistics market accounted for 34.2% of the global share in 2024.

- China held a substantial market share in 2024.

- By service, transportation segment accounted for the largest share of 34.4% in 2024.

- By type, outsourcing segment accounted for the largest share in 2024.

- By transportation mode, roadways segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 324.6 Billion

- 2030 Projected Market Size: USD 503.3 Billion

- CAGR (2025-2030): 7.8%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/contract-logistics-market-report/request/rs1

Companies increasingly outsource to third-party logistics (3PL) providers to focus on core business operations and reduce costs. However, managing end-to-end visibility across complex, multi-modal logistics networks remains a key challenge. Adopting automation, artificial intelligence (AI), and digital logistics platforms presents a major growth opportunity for the market.

The rapid growth of e-commerce is a key market driver. In 2024, U.S. e-commerce sales reached USD 1.19 trillion, up 8.1% year-over-year, accounting for 16.1% of total retail sales. India’s market is also expanding quickly, projected to grow from USD 123 billion in 2024 to USD 292.3 billion by 2028 at a CAGR of 18.7%. This growth is fueling demand for faster, scalable, and tech-enabled logistics. Contract logistics providers are addressing this need with integrated warehousing, efficient last-mile delivery, and real-time visibility to support the evolving digital retail landscape.

Globalization of supply chains drives demand for contract logistics. Businesses sourcing and distributing across borders increasingly depend on third-party providers to manage complex, multi-country operations. This reliance fuels growth in integrated logistics solutions that deliver efficiency, ensure compliance, and strengthen resilience in global trade. These solutions also help companies reduce costs, streamline supply chains, and quickly adapt to evolving regulatory and geopolitical conditions.

Companies increasingly outsource to third-party logistics (3PL) providers to focus on core operations and reduce costs. The U.S. Logistics Costs Report (CSCMP) highlights that outsourced logistics helps companies mitigate rising warehousing and transportation expenses, which reached over 8.7% of GDP in the U.S. alone. In addition, compliance with complex international regulations, including the EU Import Control System 2 (ICS2) and the U.S. FDA’s Food Safety Modernization Act (FSMA), makes outsourcing a strategic necessity for many businesses.

High dependency on fuel prices and fluctuating transportation costs remain a major market restraint. Volatility in global oil prices directly impacts freight rates and overall logistics expenses, putting pressure on service provider margins. In addition, infrastructure challenges in emerging markets, such as poor road connectivity, limited warehousing, and port congestion, disrupt supply chain continuity. These factors restrict scalability and reduce service reliability across affected regions.

Contract Logistics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 345.9 billion |

|

Revenue forecast in 2030 |

USD 503.3 billion |

|

Growth rate |

CAGR of 7.8% from 2025 to 2030 |

|

Actual data |

2018 – 2024 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Service, type, transportation mode, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

DHL Supply Chain (a division of Deutsche Post AG); GXO Logistics, Inc.; United Parcel Service, Inc.; DB Schenker; Kuehne + Nagel International AG; DSV A/S; Nippon Express Co., Ltd.; CEVA Logistics; GEODIS SA; Ryder System, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |