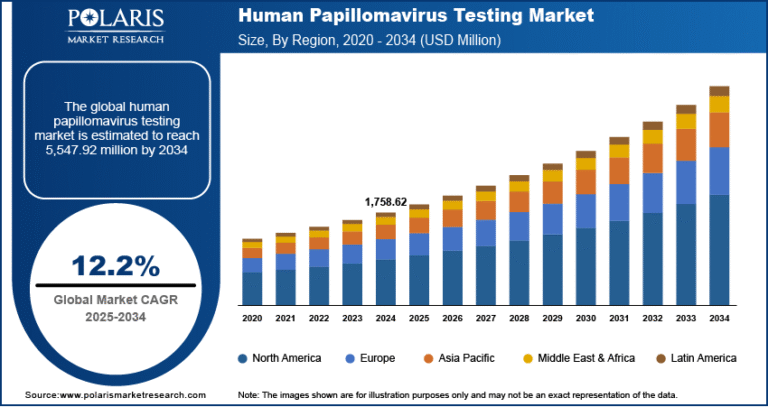

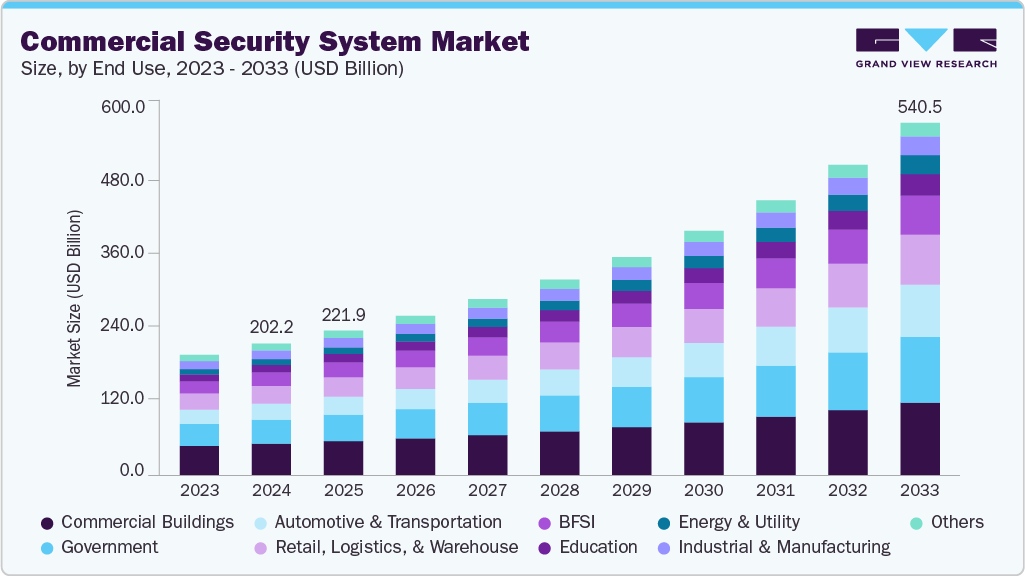

Commercial Security System Market Size, Share & Trends Analysis growing at a CAGR of 11.8% from 2025 to 2033

The global commercial security system market size was estimated at USD 202.23 billion in 2024 and is projected to reach USD 540.47 billion by 2033, growing at a CAGR of 11.8% from 2025 to 2033. This growth is driven by the rising need for real-time surveillance, access control, and threat detection across commercial facilities to ensure safety and regulatory compliance.

Key Market Trends & Insights

- North America dominated the global commercial security system market with the largest revenue share of 37.3% in 2024.

- The commercial security system market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, the hardware segment held the highest market share of 57.2% in 2024.

- By end use, the commercial buildings segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 202.23 Billion

- 2033 Projected Market Size: USD 540.47 Billion

- CAGR (2025-2033): 11.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/commercial-security-system-market-report/request/rs1

The current state of the global commercial security system industry reflects increasing concerns over safety and asset protection across various industries. Growing urbanization and expanding commercial infrastructure increase the demand for integrated security solutions. Technological advancements such as AI-powered surveillance, IoT-enabled devices, and cloud-based management platforms enhance the effectiveness and accessibility of security systems. In addition, rising awareness about workplace safety and the need to mitigate risks related to theft, vandalism, and unauthorized access support the widespread adoption of these systems.

Moreover, the market is influenced by ongoing developments in smart security technologies that improve real-time monitoring and threat detection capabilities. Integrating biometric authentication, video analytics, and automated response mechanisms enhances operational efficiency and reduces human intervention. Increasing emphasis on cybersecurity and physical security drives the adoption of unified platforms that protect digital and physical assets. Furthermore, expanding commercial sectors such as retail, healthcare, and logistics generate demand for customized security solutions tailored to specific operational requirements.

Furthermore, regulatory frameworks encouraging stringent security measures and data privacy standards across regions contribute to market growth. Investments in smart city initiatives and complex infrastructure protection create additional avenues for deploying advanced commercial security systems. The continuous evolution of security technologies and rising security awareness among businesses support sustained market expansion. This dynamic environment encourages innovation and adoption of comprehensive security strategies that address emerging threats and operational challenges.

Component Insights

The hardware segment led the market with the largest revenue share of 57.2% in 2024, due to its foundational role in establishing physical security infrastructure. Components such as surveillance cameras, sensors, fire protection devices, and access control hardware form the backbone of security solutions, enabling real-time detection and response to threats. The widespread deployment of these devices across commercial facilities reflects ongoing investments in upgrading and expanding security coverage. In addition, advancements in hardware technology, including high-resolution imaging and sensor accuracy, enhance the effectiveness of security operations.