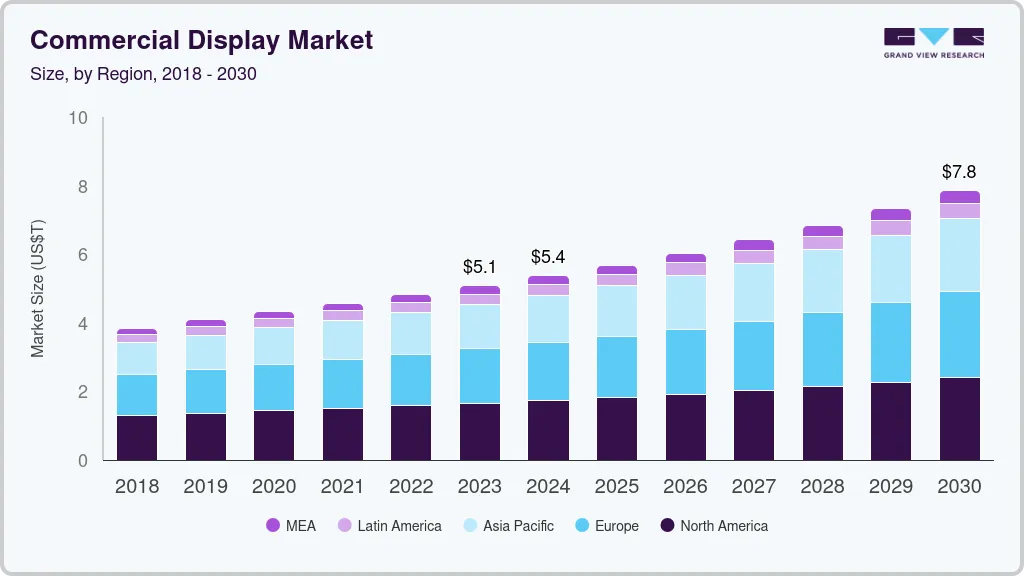

Commercial Display Market Size, Share & Trends Analysis growing at a CAGR of 6.7% from 2025 to 2030

The global commercial display market size was estimated at USD 53.65 billion in 2024 and is projected to reach USD 78.48 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The key drivers attributing to the market expansion include the escalating demand for digital signage, decreasing display panel cost, growing investments for promoting brand awareness, and increased use in transportation, healthcare, and corporate industry due to expanding the transport sector and infrastructural developments being carried out in the emerging countries.

Key Market Trends & Insights

- North America dominated the commercial display industry with a share of 32.28% in 2024.

- The Asia Pacific region is experiencing the fastest growth in the commercial display industry, driven by increasing demand across various sectors.

- By product, the digital signage segment dominated the market with a revenue share of over 53.73% in 2024.

- By component, the hardware segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.65 Billion

- 2030 Projected Market Size: USD 78.48 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/commercial-display-market/request/rs1

The rising use of 3D digital signage for effective branding and promotion of the product is anticipated to provide a lucrative platform for market growth over the forecast period. Innovation in display panel manufacturing methods has resulted in significant cost reduction which is expected to favorably impact market growth. Regulations in pharmaceutical marketing have resulted in the abolishment of traditional practices of distributing branded pens and notepads to doctors, thereby turning to 3D digital signage as a viable marketing tool. Reduction of Ultra-HD display prices over the course of 2020 owing to the growing number of quality display options is expected to catalyze growth over the forecast period. Further availability of energy-efficient displays such as OLED & AMOLED may reduce the operational cost while advertising. The U.S. is anticipated to hold the largest market share in the North American region owing to high growth potential in transportation, healthcare, education, and corporate application sectors which are further expected to drive market growth over the forecast period. Emphasis on increasing brand equity, enhancing brand awareness and perception has resulted in adoption across the corporate sector.

Furthermore, State-of-the-art technologies, such as micro-LED, mini-LED, OLED, and AMOLED, are being incorporated in the latest commercial-grade TVs by manufacturers such as Sony Corporation, LG Display Co., Ltd, and SAMSUNG. Moreover, these players are launching various types of TV panels, such as flexible and rollable panels. In the healthcare sector, these products are widely used in hospitals, clinics, and multi-specialty healthcare centers. Additionally, the hospitality sector is also one of the prominent verticals attributing to the growth of the market owing to the rising number of QSR, restaurants, cafes, bars, hotels, and motels. Such establishments require a large number of display solutions for various applications such as advertisement, menu & food display, and entertainment, thus anticipating to exhibit steady growth over the next six to eight years in the commercial display industry.