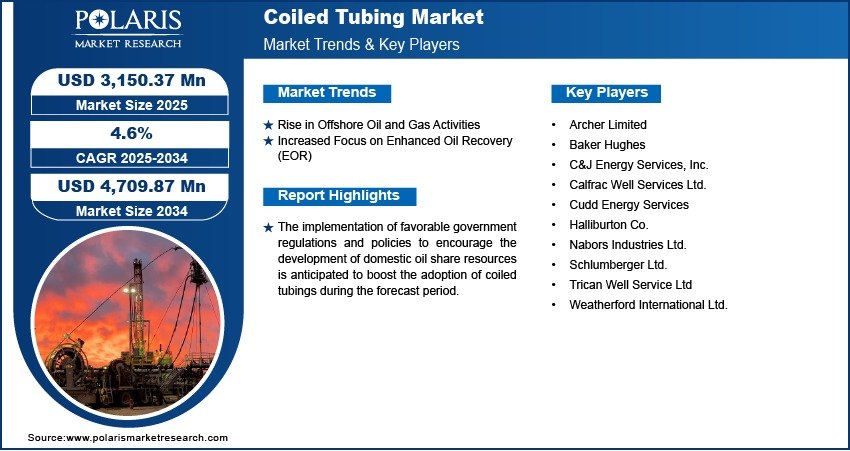

Coiled Tubing Market Projected to Reach USD 4,709.87 Million By 2034, Growing at a CAGR of 4.6%

The global Coiled Tubing market size was valued at USD 3,016.17 million in 2024 and is projected to grow from USD 3,150.37 million in 2025 to USD 4,709.87 million by 2034 , exhibiting a Compound Annual Growth Rate (CAGR) of 4.6% during the forecast period from 2025 to 2034 .

- Rising Demand for Enhanced Oil Recovery (EOR): With aging oil fields and increasing need for cost-effective well intervention techniques, coiled tubing is becoming essential for operations such as nitrogen lifting, acidizing, and well cleanouts.

- Growth in Unconventional Oil & Gas Production: The expansion of shale gas and tight oil exploration activities—particularly in North America—is driving demand for coiled tubing services due to their efficiency in horizontal drilling and fracturing operations.

- Adoption of Advanced Coiled Tubing Technologies: Innovations such as high-strength alloys, real-time downhole monitoring systems, and multi-phase flow control are enhancing operational efficiency and safety, thereby boosting adoption across the industry.

- Increasing Use in Well Intervention and Drilling Applications: Coiled tubing offers advantages like reduced downtime, faster deployment, and lower operational costs, making it a preferred choice for well maintenance and underbalanced drilling.

- Expansion into Emerging Markets: As oil and gas exploration picks up in regions such as Latin America, Africa, and Asia Pacific, there is growing demand for coiled tubing equipment and services to support new field developments.

- Market Size in 2024 – USD 3,016.17 million

- Market Size in 2025 – USD 3,150.37 million

- Projected Market Size by 2034 – USD 4,709.87 million

- CAGR (2025–2034) – 4.6%

Coiled tubing refers to a continuous length of metal pipe used in various well intervention and drilling operations within the oil and gas industry. It provides an efficient alternative to conventional jointed tubing by enabling rapid deployment, reducing rig time, and supporting complex downhole operations. Applications include well cleanouts, acid stimulation, sand removal, logging, and fracturing.

The market is experiencing steady growth driven by rising exploration and production activities, increased focus on mature field revitalization, and the growing preference for cost-effective and efficient well servicing solutions. Additionally, advancements in coiled tubing technology—such as improved corrosion resistance and enhanced fatigue life—are expanding its usability in harsh environments.

Technological innovation continues to shape the future of the coiled tubing industry. Companies are investing in digital monitoring tools, automation, and predictive maintenance systems to improve performance and reduce operational risks. Strategic partnerships between service providers and upstream operators are also accelerating the deployment of advanced coiled tubing solutions. As global energy demand rises and unconventional resources gain prominence, the coiled tubing market is poised for sustained growth over the next decade.