Coiled Tubing Market growing at a CAGR of 3.9% from 2025 to 2033

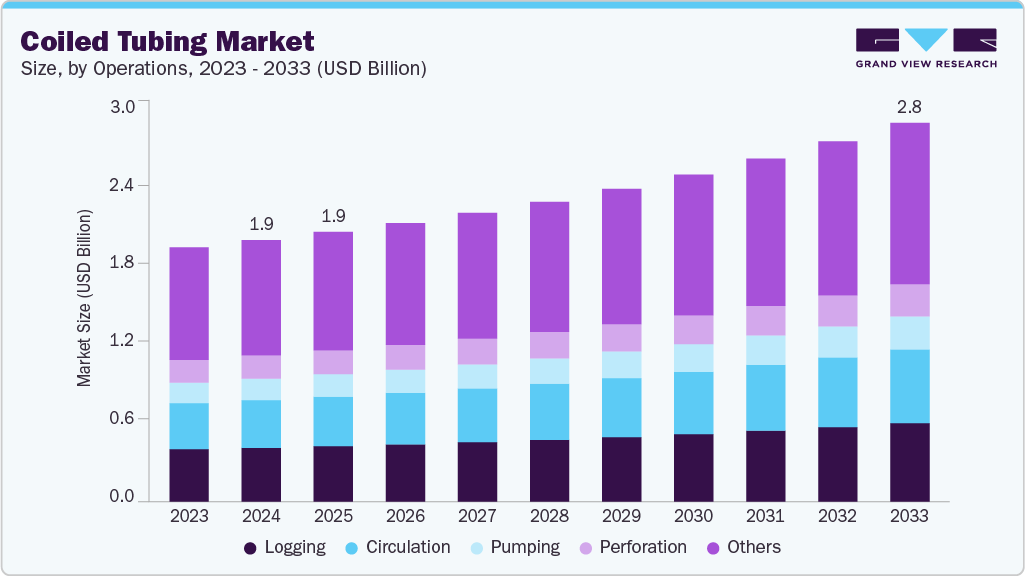

The global coiled tubing market size was estimated at USD 1.93 billion in 2024 and is projected to reach USD 2.79 billion by 2033, growing at a CAGR of 3.9% from 2025 to 2033. According to the U.S. Energy Information Administration (EIA), global liquid fuel consumption is expected to reach 103.5 million barrels per day by the end of 2025, up from 100.4 million barrels per day in 2023.

Key Market Trends & Insights

- North America dominated the coiled tubing market with the largest market revenue share of 28.1%

- The coiled tubing market in the U.S. is expanding steadily due to growing activity in shale plays and mature oilfields.

- By services, well intervention & production segment is anticipated to register the fastest CAGR of 3.9% from 2025 to 2033.

- By operations, logging accounted for the largest market revenue share of over 20.6% in 2024.

- By application, offshore segment is anticipated to register the fastest CAGR of 4.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.93 Billion

- 2033 Projected Market Size: USD 2.79 Billion

- CAGR (2025-2033): 3.9%

- North America: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/coiled-tubing-ct-market/request/rs1

This surge prompts upstream companies to invest in enhanced oil recovery (EOR) and unconventional resources such as shale formations. Coiled tubing offers a quick and cost-effective solution for well intervention and workover operations, critical for maintaining and boosting production, especially in horizontal and multistage fracked wells across regions such as North America.

Technological advancements in coiled tubing equipment have played a crucial role in expanding its application scope. Innovations such as larger diameter tubes and stronger, corrosion-resistant materials have enabled deeper and higher-pressure operations. For instance, the U.S. Department of Energy (DOE) has supported R&D initiatives under the Office of Fossil Energy and Carbon Management to improve downhole tools and real-time data acquisition systems, which enhance the efficiency of coiled tubing interventions. These improvements are particularly important in unconventional plays such as the Permian Basin, where operational precision and speed are critical.

The growing need for well maintenance in aging oil fields is another major driver. Data from the International Energy Agency (IEA) shows that more than 70% of the global oil output comes from mature fields, many requiring frequent interventions to sustain output. In countries like Saudi Arabia and the U.S., where several large fields are over 40 years old, coiled tubing is used extensively for cleanouts, acid stimulation, and gas lifting. These applications help sustain production at a relatively low cost, supporting national oil production goals without major new field development.

Environmental regulations are increasingly shaping market dynamics in favor of coiled tubing. The U.S. Environmental Protection Agency (EPA) has set stricter emission and site impact regulations for oilfield operations, particularly concerning methane emissions and land use. Coiled tubing, which requires less surface disruption and fewer emissions than traditional rigs, aligns well with these regulatory goals. For instance, coiled tubing interventions typically reduce emissions by over 30% compared to conventional workover rigs, according to studies cited by the DOE. This makes it a preferred method in regions with stringent environmental compliance, such as California and the North Sea.

Offshore exploration projects are also contributing significantly to market growth. The International Association of Oil & Gas Producers (IOGP) reports that offshore production accounts for nearly 30% of global oil output. Projects in regions like the Gulf of Mexico and the Eastern Mediterranean are deploying coiled tubing for complex well-servicing operations due to its compact footprint and operational efficiency. The U.S. Bureau of Ocean Energy Management (BOEM) has recently approved multiple deepwater drilling permits, indicating a positive outlook for offshore activity and, by extension, coiled tubing demand.

Coiled Tubing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.99 billion |

|

Revenue forecast in 2033 |

USD 2.79 billion |

|

Growth rate |

CAGR of 3.9% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative Units |

Revenue in USD million/billion, volume in units, and CAGR from 2025 to 2033 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Services, operations, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Poland; UK; Russia; China; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa; Libya |

|

Key companies profiled |

Tenaris; Sandvik AB; HandyTube LLC.; NOV; SLB; Baker Hughes; Oshwin Overseas; Webco Industries; AMETEK Inc.; AMARDEEP STEEL |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |