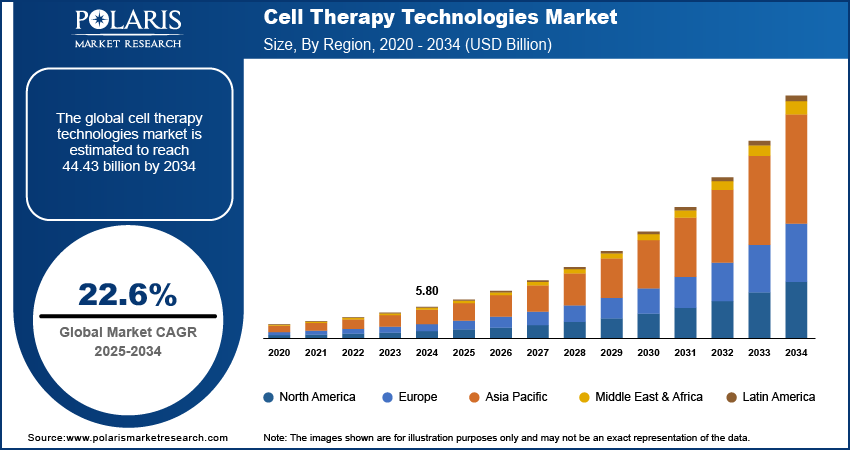

Cell Therapy Technologies Market to Hit USD 44.43 Billion by 2034 | CAGR: 22.6%

The cell therapy technologies market was valued at USD 5.80 billion in 2024 and is projected to grow from USD 7.09 billion in 2025 to reach approximately USD 44.43 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 22.6% during the forecast period from 2025 to 2034. This rapid growth is driven by continuous advancements in biotechnology, along with increasing demand for innovative and efficient cell processing solutions that support the development and commercialization of cell-based therapies.

This market is centered on the tools, equipment, and reagents used to develop and deliver cell-based therapies. These technologies are crucial for regenerative medicine, cancer treatment, and immune disorders. Increasing investments in biotech research and clinical trials drive market expansion. The demand for automation, scalability, and standardization in cell manufacturing processes is growing. Regulatory support and partnerships between biotech firms and healthcare providers further bolster the market.

Key Report Highlights:

- By therapy type, the autologous therapies segment holds a larger cell therapy technologies market share due to their lower risk of immune rejection and increasing adoption in personalized medicine. These therapies are widely used in regenerative medicine and oncology treatments, contributing to their dominance in the market.

- By technology, the viral vector technology segment leads the market, as it plays a crucial role in gene and cell therapy applications by enabling precise genetic modifications. Its established use in developing advanced therapies, such as CAR-T cell therapy, ensures its widespread adoption and high market demand.

- By application, oncology was the dominant segment in 2024 due to the rising prevalence of cancer and the growing adoption of cell-based immunotherapies. The increasing number of regulatory approvals for cell therapy products in oncology has strengthened its position in the market.

- By region, North America holds the largest share of the cell therapy technologies market revenue. This is attributed to the region’s advanced healthcare infrastructure, substantial investments in research and development, and a supportive regulatory environment.

Market Overview: Key Figures at a Glance

- Market Value in 2024: USD 5.80 billion

- Projected Market Size in 2034: USD 44.43 billion

- Anticipated CAGR 2025-2034: 22.6%

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Market Growth Drivers:

Increasing Government Funding and Support:

- Governments are boosting R&D funding for cell-based therapies to treat cancer and degenerative diseases.

- The U.S. NIH offers grants to advance cell therapy innovations.

- The EU supports collaborative research in regenerative medicine.

- Public funding accelerates clinical applications and market growth.

Advancements in Gene Editing Technologies:

- Breakthroughs in gene editing, especially CRISPR-Cas9, enhance precision in modifying patient-derived cells.

- CRISPR enables correction of genetic defects, improving personalized therapy outcomes.

- These innovations reduce immune rejection risks and support treatment of previously untreatable diseases.

- Demand for advanced, targeted therapies is driving market expansion.

Rising Prevalence of Chronic Diseases and Aging Population:

- Chronic illnesses like diabetes, cancer, and cardiovascular diseases are increasing globally.

- WHO projects that by 2030, 1 in 6 people will be aged 60+, with higher disease incidence.

- Cell therapies support tissue regeneration and immune modulation for chronic conditions.

- Growing patient need is fueling demand for cell therapy technologies.

Market Key Players:

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- Agilent Technologies Inc.

- Avantor, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Techne Corporation

- Corning Incorporated

- Danaher Corporation

- Fresenius SE & Co. KGaA

- Lonza Group AG

- Merck KGaA

- Sartorius AG

- Terumo Corporation

- Thermo Fisher Scientific Inc.