Cell Sorting growing at a CAGR of 9.19% from 2025 to 2033

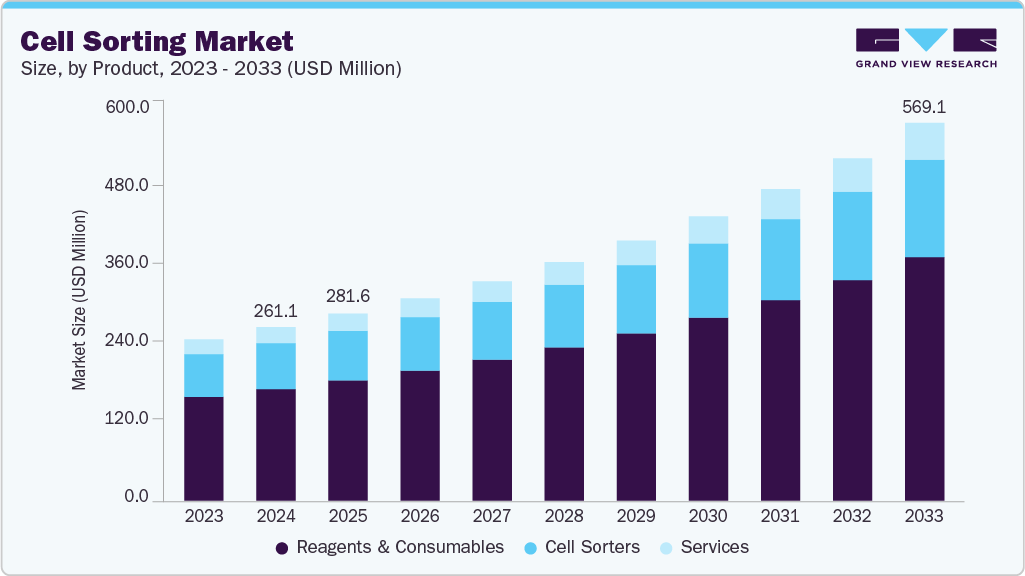

The global cell sorting market size was estimated at USD 261.1 million in 2024 and is projected to reach USD 569.1 million by 2033, growing at a CAGR of 9.19% from 2025 to 2033. The industry has witnessed significant advancements, driven by innovations such as high-speed sorting and advanced detection capabilities, which enhance precision and efficiency.

Key Market Trends & Insights

- The North America cell sorting market held the largest share of 43.61% of the global market in 2024.

- The cell sorting industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents and consumables segment held the highest market share of 64.29% in 2024.

- Based on technology, the fluorescence-based droplet cell sorting segment held the highest market share in 2024.

- By application, the research applications segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 261.1 Million

- 2033 Projected Market Size: USD 569.1 Million

- CAGR (2025-2033): 9.19%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/cell-sorting-market/request/rs1

Technological Innovations

The market for cell sorting has grown significantly due to technological advancements. The reliability of sorting results has been further improved by automation, software integration, and instrument sensitivity advancements, opening these technologies to a greater variety of labs and clinical settings. Because of this, adoption rates have increased for therapeutic and research applications, which has fueled market expansion. These advancements have made cell sorting tools essential in various fields, including research and clinical applications. Fluorescence-Activated Cell Sorting (FACS), in particular, is a significant contributor to the market’s growth due to its ability to provide quick and quantitative measurements of cell properties, making it an essential tool for sorting heterogeneous cell populations.

Moreover, its integration with proteomics, genomics, and high-throughput screening platforms has greatly expanded cell sorting’s market potential and usefulness. The global cell sorting market is experiencing sustained demand due to the new opportunities this convergence of technologies brings to academic, clinical, and industrial users.

Moreover, its integration with proteomics, genomics, and high-throughput screening platforms has greatly expanded cell sorting’s market potential and usefulness. The global cell sorting market is experiencing sustained demand due to the new opportunities this convergence of technologies brings to academic, clinical, and industrial users.

Market Concentration & Characteristics

The degree of innovation in the cell sorting industry is a key growth driver, as continuous technological advancements enhance efficiency and capabilities. For instance, in October 2023, in Japan, Sony launched the FP7000 Spectral Cell Sorter, supporting high parameter sorting with over 44 colors, advanced spectral unmixing, and automated workflows for efficient cell analysis. Cell sorting applications in research, diagnostics, and therapeutics are growing because of innovations such as automated sorting systems, microfluidic-based platforms, and integration with single-cell genomics and proteomics workflows.

The level of M&A activities in the cell sorting industry has been steadily increasing, as a significant market growth driver. Major players are pursuing strategic acquisitions and partnerships to expand their product portfolios, enhance technological capabilities, and strengthen their global presence. For instance, in February 2021, in the USA, Thermo Fisher Scientific acquired cell sorting technology assets from Propel Labs, including the Bigfoot Spectral Cell Sorter and 40 employees, expanding its flow cytometry and cell analysis portfolio. These mergers and acquisitions enable companies to access advanced cell sorting technologies, integrate complementary solutions, and enter new geographic markets more rapidly.

Cell Sorting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 281.6 million |

|

Revenue forecast in 2033 |

USD 569.1 million |

|

Growth rate |

CAGR of 9.19% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

BD; Bio-Rad Laboratories, Inc.; Danaher Corporation; Sony Group Corporation; Miltenyi Biotec; On-chip Biotechnologies Co., Ltd.; Cytonome/ST, LLC; Union Biometrica, Inc.; Thermo Fisher Scientific Inc.; uFluidix |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |