Carrier Screening growing at a CAGR of 11.95% from 2025 to 2033

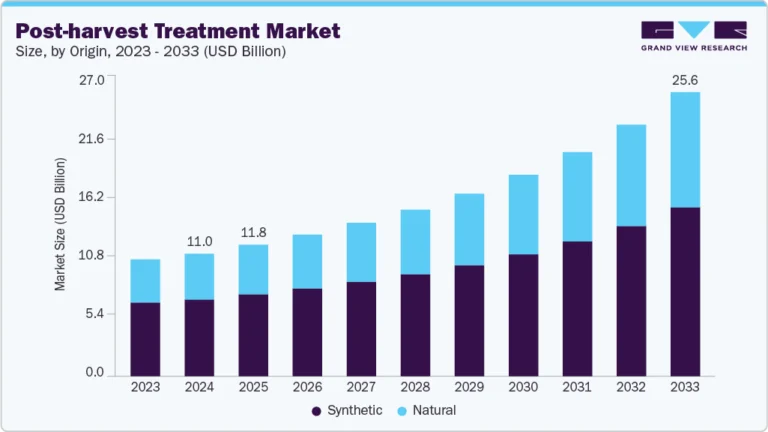

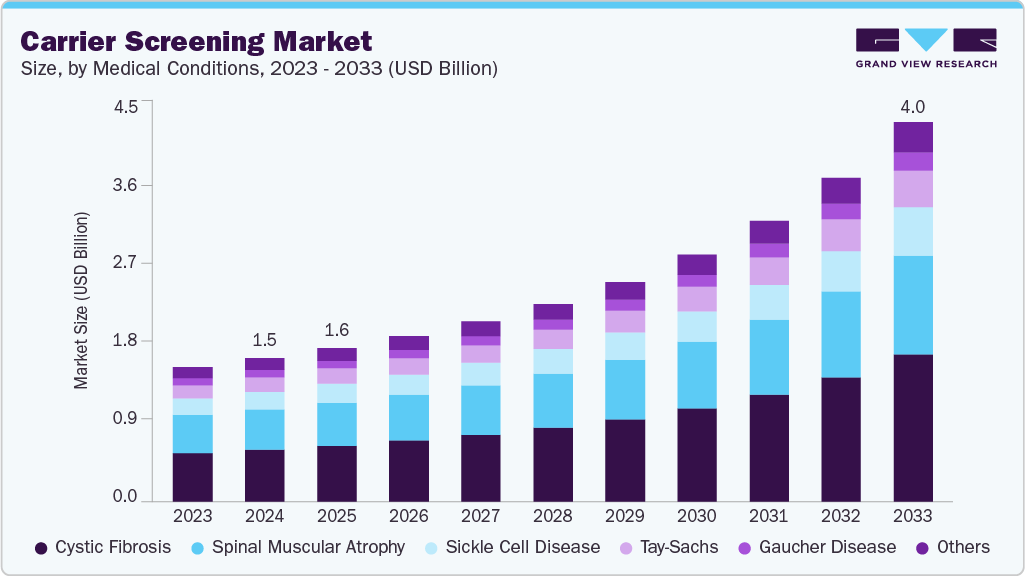

The global carrier screening market size was estimated at USD 1,532.24 million in 2024 and is projected to reach USD 4,045.29 million by 2033, growing at a CAGR of 11.95% from 2025 to 2033. The rising prevalence of genetic disorders, technological advancements in genetic testing, growing awareness, and demand for personalized medicine are major factors driving the market’s growth.

Key Market Trends & Insights

- North America carrier screening market dominated with the largest revenue share of 46.95% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- Based on medical conditions, the cystic fibrosis segment dominated the global market and accounted for the largest revenue share of 36.0% in 2024.

- Based on type, the expanded carrier screening segment held the largest revenue share of 74.1% in 2024.

- On the basis of technology, the DNA sequencing segment held the largest revenue share of 44.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,532.24 Million

- 2033 Projected Market Size: USD 4,045.29 Million

- CAGR (2025-2033): 11.95%

- North America: Largest Market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/carrier-screening-market-report/request/rs1

For instance, according to the World Health Organization, around 10 in every 1,000 individuals are affected by rare single-gene disorders, translating to between 70 million and 80 million people worldwide living with such conditions. Sickle cell disease (SCD) alone impacts more than 100,000 people in the U.S., with a particularly high prevalence among people of African American origin.

The growing technological advancement in screening techniques, particularly in next-generation sequencing (NGS) and bioinformatics, has transformed the carrier screening market by improving accuracy, speed, and affordability. Traditional genetic screening tests typically focused on a limited set of conditions, targeting specific populations or high-risk groups. In contrast, modern NGS-based panels screen hundreds of genetic mutations in a single run, providing a much broader and more comprehensive assessment. For instance, in February 2025, F. Hoffmann-La Roche AG (Switzerland) introduced a new category of next-generation sequencing by expansion (SBX) technology, which is playing a vital role in decoding complex diseases like cancer, immune disorders and neurodegenerative conditions. This technology uses high throughput sensor module along with synthetic molecules in order to determine the DNA sequence of a target molecule.

Moreover, the expansion of the carrier screening industry is propelled by rising awareness of genetic risks and the global shift toward personalized medicine. Individuals and couples are becoming increasingly proactive in managing reproductive health, seeking genetic counseling along with screening. This reflects a growing understanding that carrier status has direct implications for family planning, pregnancy outcomes, and the health of future generations.

The foundation of carrier screening lies in raising awareness to improve health outcomes through early detection programs. Early programs such as Tay-Sachs disease screening in Ashkenazi Jewish communities demonstrated how education and testing could drastically reduce disease prevalence. Similarly, community-driven sickle cell screening efforts in African American populations underscored the importance of proactive engagement, though later government-led initiatives revealed the risks of poor implementation and misinformation. These historical lessons emphasize a broader trend toward personalized medicine, where individuals and communities increasingly seek genetic insights to make informed reproductive and healthcare decisions.

Carrier Screening Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,639.80 million |

|

Revenue forecast in 2033 |

USD 4,045.29 million |

|

Growth rate |

CAGR of 11.95% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Medical conditions, type, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Myriad Genetics, Inc.; BGI Genomics; Illumina, Inc.; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Laboratory Corporation of America Holdings (LabCorp); Otogenetics Corporation; MedGenome, GeneTech (ATS Genetech Pvt Ltd); CENTOGENE GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |