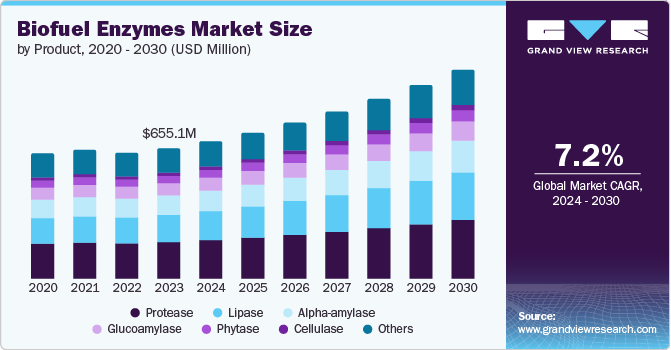

Biofuel Enzymes Market Size, Share & Trends Analysis grow at a CAGR of 7.2% from 2024 to 2030

The global biofuel enzymes market size was valued at USD 655.1 million in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. Biofuel enzymes catalyze the process of biomass to biofuel conversion at optimal production costs. Their application as sustainable and environment-friendly alternatives to fossil fuels has triggered a need for biofuel enzymes. The market is driven by increasing demand for biofuels and environmental concerns. In addition, the growing concerns about climate change and the need to reduce greenhouse gas emissions have led to a shift towards renewable energy sources.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/biofuel-enzymes-market/request/rs1

The market for biofuel enzymes is boosted by technological progress in the realms of biotechnology and enzymology. Advancement in these sectors has facilitated the production of enzymes that can fasten biomass conversion to biofuel. Such advances lead to better returns and lower production costs. In addition, increased research and development on enzyme stability has continuously improved situations in the food industry. Hence, genetic engineering and microbial fermentation methods have improved enzyme production on a large scale at an optimized cost.

From a regulatory aspect, the adoption of environment-friendly policies has encouraged the distribution of renewable energy. Several governments implement favorable policies and offer incentives concerning the use of biofuels to reduce emissions and dependency on fossil fuels. For instance, government policies such as subsidies and tax credits have fostered demand for biofuel enzymes. In addition to these policies, significant investments in research and development programs for biofuel enzymes are anticipated to drive market growth.

Product Insights

Protease dominated the market and accounted for a share of 28.0% in 2023. Proteolytic enzymes break down proteins in biomass production. Additionally, they improve overall biofuel production by promoting a flexible cycle. Furthermore, advancements in protease technology are leading to the development of more efficient and cost-effective enzymes, thus strengthening its dominance.

The lipase segment is expected to register the fastest CAGR of 8.6% during the forecast period owing to the growing interest in second-generation biomass that uses lipid feeders such as algae. Lipases are very good at breaking down these fats and oils, which act as catalysts for producing ideal biofuels from different sources. In addition, advances in lipase engineering are expected to increase access to a wider range of raw materials and strengthen their market position.