Automotive Tire Market to Reach USD 417.9 Billion by 2034, Growing at a CAGR of 4.10%

The global automotive tire market reached a valuation of USD 278.3 billion in 2024 and is expected to grow at a CAGR of 4.10% from 2025 to 2034. This growth is driven by rising vehicle production and the consistent demand for tire replacements.

Market Definition

The automotive tire market encompasses the production, distribution, and sale of tires designed for various types of vehicles, including passenger cars, commercial vehicles, and two-wheelers. Tires are essential components that provide traction, support vehicle load, absorb shocks, and ensure safe handling and fuel efficiency. This market includes both original equipment manufacturer (OEM) tires supplied to vehicle manufacturers and replacement tires sold in the aftermarket. It is influenced by factors such as vehicle production rates, road safety regulations, technological advancements in tire materials and design, and consumer demand for durability and performance.

Key Findings and Essential Insights

In 2024, Asia Pacific accounted for the highest revenue share in the global Automotive tire market market.

Based on Automotive Tire,the Passenger Cars , Heavy Commercial Vehicles is expected to gain significant traction over the forecast period.

Market Overview: Key Figures at a Glance

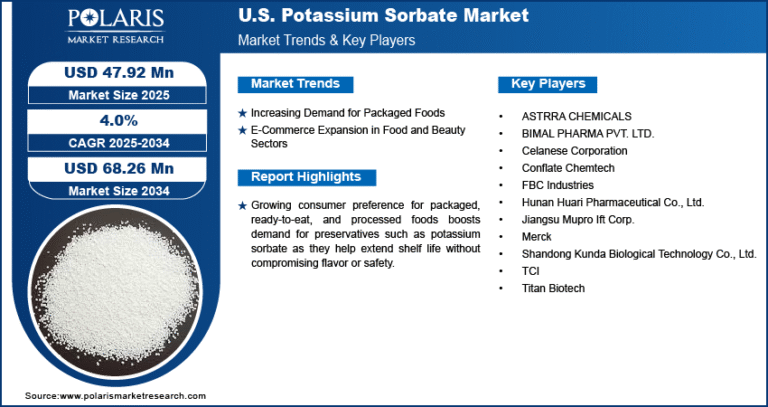

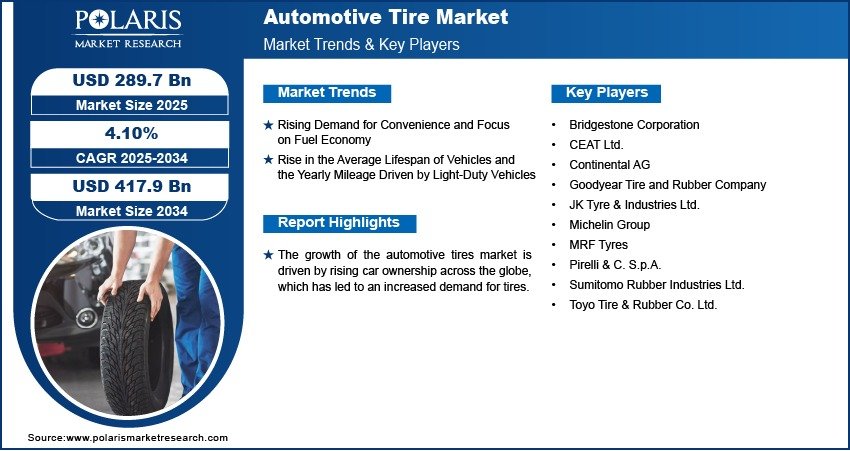

Market size value in 2025 -USD 289.7 billion

Revenue forecast in 2034-USD 417.9 billion

CAGR – 4.10% from 2024 – 2032

Get access to the full report or request a complimentary sample for in-depth analysis:

https://www.polarismarketresearch.com/industry-analysis/automotive-tire-market/request-for-sample

Market Growth Drivers

The automotive tire market is poised for steady growth over the next decade, driven by a combination of technological advancements, rising vehicle production, and evolving consumer preferences. Here are the key market growth drivers fueling this expansion

1. Rising Global Vehicle Production and Sales

The primary driver of tire demand is the increase in production and sales of passenger cars, commercial vehicles, and two-wheelers globally. Developing regions such as Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization and income growth, which in turn boosts automobile ownership and replacement tire demand.

2. Increasing Vehicle Parc (Vehicle-in-Use)

The growing number of vehicles on the road, especially in emerging economies, creates sustained demand for replacement tires. Tires typically require replacement every 3–5 years depending on usage, climate, and road conditions. This aftermarket segment is a key revenue generator for tire manufacturers.

3. Advancements in Tire Technology

Innovations such as run-flat tires, airless tires, low rolling resistance technology, and smart tires equipped with pressure and temperature sensors are enhancing performance, safety, and fuel efficiency. These technologically advanced tires are gaining popularity among both OEMs and consumers, driving market value.

Market Key Players

The competitive landscape features a mix of long-standing companies and emerging contenders. Leading players are actively pursuing R&D initiatives and strategic moves to strengthen their market position. Notable participants include

- Bridgestone Corporation

- CEAT Ltd.

- Continental AG

- Goodyear Tire and Rubber Company

- JK Tyre & Industries Ltd.

- Michelin Group

- MRF Tyres

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries Ltd.

- Toyo Tire & Rubber Co. Ltd.