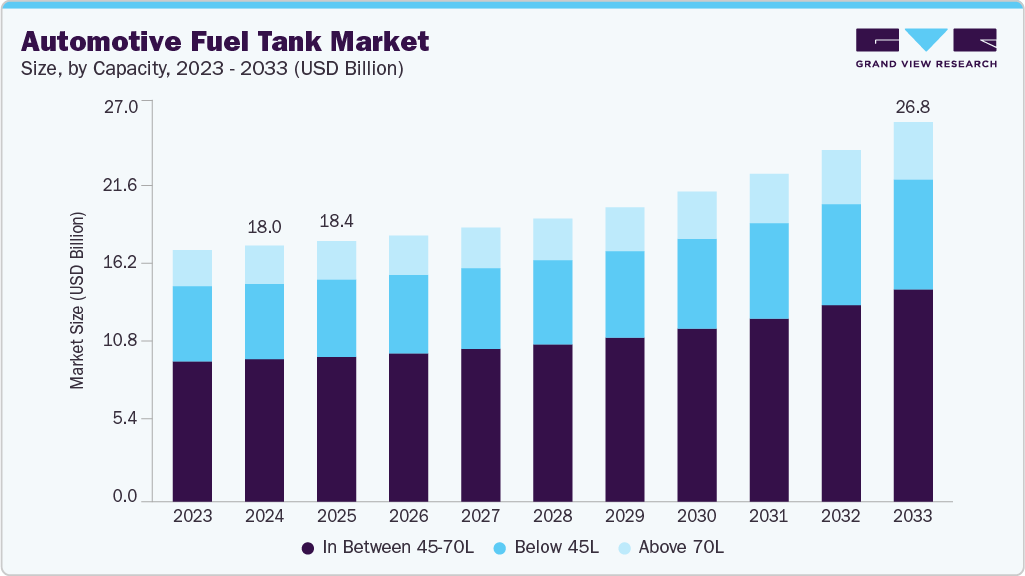

Automotive Fuel Tank Market Size, Share & Trends Analysis growing at a CAGR of 4.8% from 2025 to 2033

The global automotive fuel tank market size was estimated at USD 18.03 billion in 2024, and is projected to reach USD 26.81 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The market growth is driven by the sustained demand for internal combustion engine (ICE) vehicles, especially in emerging markets across Asia Pacific, Latin America, and parts of Africa.

Key Market Trends & Insights

- Asia Pacific dominated the automotive fuel tank market with the largest market revenue share of 45.6% in 2024.

- The automotive fuel tank industry in the U.S. held a dominant position in 2024.

- By capacity, the in between 45-70L segment accounted for the largest share of 55.6% in 2024.

- By material, the plastics segment held the largest market share in 2024.

- By vehicle type, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.03 Billion

- 2033 Projected Market Size: USD 26.81 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/automotive-fuel-tank-market-report/request/rs1

Technological advancements are reshaping the automotive fuel tank industry, with OEMs increasingly shifting from traditional metal tanks to high-performance plastic and multi-layer composite tanks. These modern tanks offer superior corrosion resistance, lower weight, and enhanced compatibility with stringent evaporative emission norms. Multi-layer plastic tanks are especially prevalent in regions such as North America and Europe due to their ability to minimize hydrocarbon emissions. Moreover, innovations in blow-molding and welding techniques have enabled the production of complex tank geometries that improve vehicle packaging and safety.

Leading market players are making strategic investments in capacity expansion, material R&D, and localized production facilities to cater to growing regional demand and evolving emission standards. Automotive component suppliers are forming partnerships with polymer companies to develop advanced fuel tank materials, such as high-density polyethylene (HDPE) and barrier resins. Furthermore, several OEMs and Tier 1 suppliers are investing in modular fuel tank systems that can be easily integrated into hybrid vehicle architectures. Emerging markets are also witnessing increased foreign direct investment (FDI) in automotive manufacturing, which indirectly boosts demand for OEM fuel tank supplies.

Regulations play a pivotal role in shaping the automotive fuel tank industry. Stringent environmental standards, such as Euro 6/7 in Europe and EPA Tier 3 in the U.S., require fuel tanks to incorporate vapor recovery and emissions-control systems. These rules are driving demand for advanced materials and multilayer constructions that can contain fuel vapors more effectively. In addition, safety regulations related to crash performance and fuel leakage prevention have spurred the adoption of impact-resistant tank designs. Compliance requirements compel manufacturers to innovate continuously while ensuring cost-effectiveness.

Despite steady demand, the automotive fuel tank industry faces several restraints. The accelerating shift toward electric vehicles (EVs) globally poses a structural threat, as EVs do not require conventional fuel tanks. Several countries, including the UK, Germany, and parts of North America, have already announced bans or phasedown plans for new ICE vehicle sales over the next decade. Moreover, rising raw material costs, particularly for specialized plastics and metals, are affecting profitability and supply chain efficiency.