Automotive eCall Market Size, Share & Trends Analysis growing at a CAGR of 12.6% from 2025 to 2030

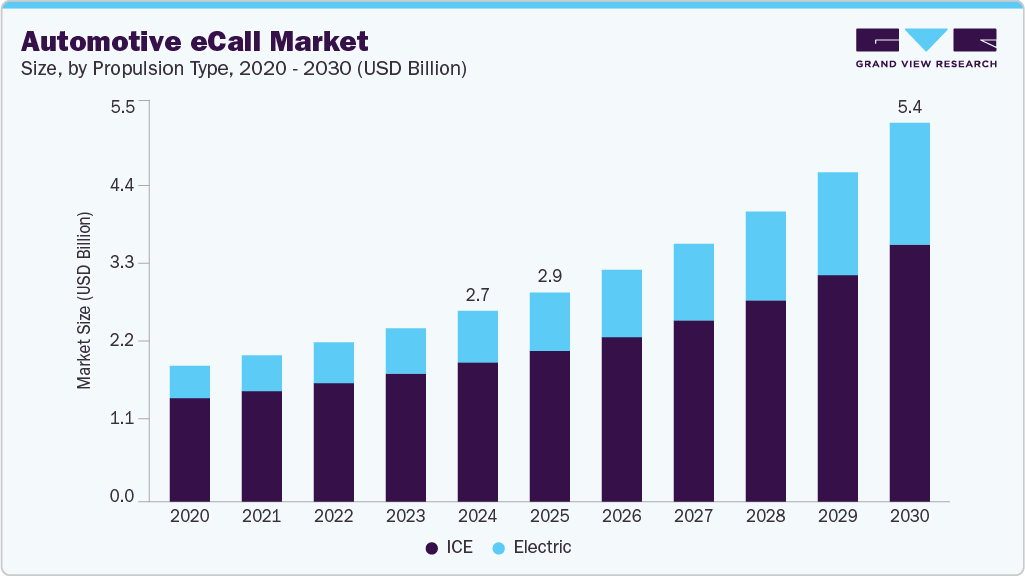

The global automotive eCall market size was estimated at USD 2.72 billion in 2024 and is projected to reach USD 5.39 billion by 2030, growing at a CAGR of 12.6% from 2025 to 2030. The automotive eCall market is driven by a mix of regulatory mandates, technological advancements, and changing consumer preferences for improved vehicle safety.

Key Market Trends & Insights

- Europe automotive eCall market dominated with a share of 39.8% of global revenue in 2024.

- Germany automotive eCall market is witnessing growh due to country’s strong automotive safety culture.

- By propulsion type, the ICE segment dominated the target market and accounted for the largest revenue share of 72.8% in 2024.

- By trigger type, the automatically initiated eCall segment dominated the automotive eCall market with a market share of 66.3%.

- By vehicle type, the passenger cars segment led the market and accounted with a share of 72.8% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.72 Billion

- 2030 Projected Market Size: USD 5.39 Billion

- CAGR (2025-2030): 12.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-ecall-market-report/request/rs1

A key factor is the implementation of government regulations that require eCall systems in new vehicles. For instance, the European Union mandated that all new cars and light commercial vehicles sold from April 2018 onward must be equipped with the eCall system. Similar regulations exist or are being considered in Russia (under the ERA-GLONASS system), China, and Brazil. These mandates ensure consistent integration of eCall features across more vehicles, driving steady market demand. Another significant driver is the global focus on improving road safety. With rising rates of road accidents and fatalities, eCall systems have become an important safety solution. These systems automatically alert emergency services during a serious crash, transmitting the vehicle’s location and other key data, thereby drastically reducing response times. This capability can be life-saving, particularly in remote areas or during off-peak hours, and has gained strong support from public safety authorities and consumers alike.

Technological advancements are also fueling the growth of the eCall market. Improvements in telematics, global navigation satellite systems (GNSS), and mobile communication technologies-particularly the rollout of 4G and 5G-have enhanced the effectiveness and reliability of eCall systems. These technologies enable faster data transmission and more accurate location tracking, making the systems more valuable to both users and emergency responders. Additionally, as automotive technology evolve toward fully connected and autonomous vehicles, eCall becomes a foundational component of the broader intelligent transportation ecosystem.

The insurance industry further contributes to the market’s momentum by recognizing the value of eCall systems in reducing accident-related losses and verifying claims. Many insurers now offer incentives or discounts to policyholders whose vehicles are equipped with telematics-based safety systems, including eCall. This reinforces adoption, especially in markets where consumers are highly cost-conscious.

Despite strong growth prospects, the automotive eCall market faces several restraints that could hinder its widespread adoption and scalability. One of the primary challenges is the high cost of system integration, especially for manufacturers producing low-cost or economy vehicles. While premium and mid-range vehicles can absorb the additional cost of telematics hardware and connectivity services, budget models often operate on thinner profit margins, making it difficult for automakers to include eCall systems without impacting vehicle affordability.

Automotive eCall Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.98 billion |

|

Revenue forecast in 2030 |

USD 5.39 billion |

|

Growth rate |

CAGR of 12.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2024 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Propulsion type, trigger type, vehicle type, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Continental AG; Robert Bosch GmbH; Telit Cinterion; Thales; DENSO CORPORATION; Infineon Technologies AG; Valeo; STMicroelectronics; u-blox; Visteon Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |