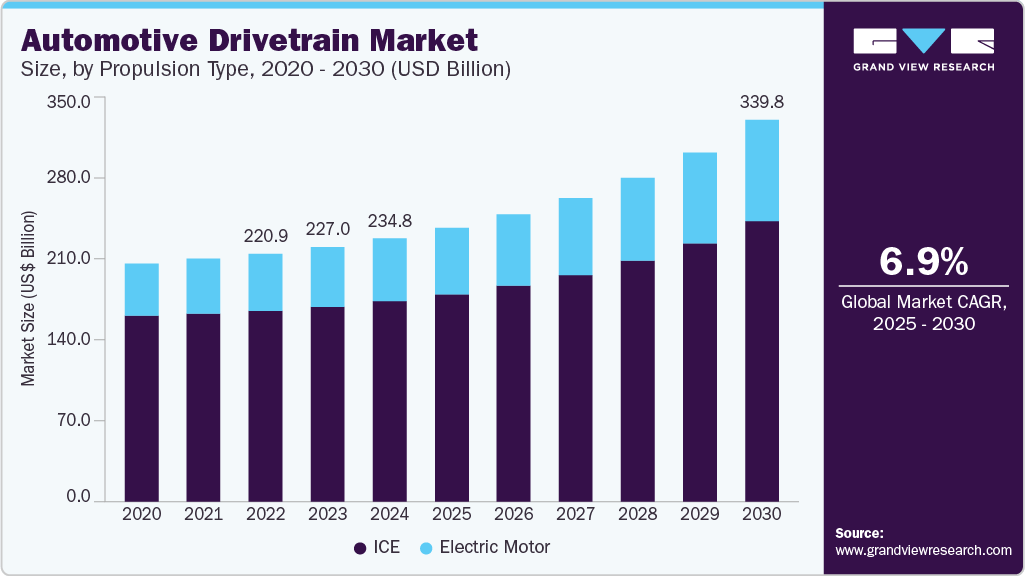

Automotive Drivetrain Market Size, Share & Trends Analysis growing at a CAGR of 6.9% from 2025 to 2030

The global automotive drivetrain market size was estimated at USD 234.77 billion in 2024 and is projected to reach USD 339.89 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The market is driven by several key factors, including the rising prevalence of infectious diseases among companion and livestock animals, increasing pet ownership, and growing awareness of animal health.

Key Market Trends & Insights

- The Asia Pacific automotive drivetrain market dominated the global market and accounted for 43.2% of the global revenue in 2024.

- The automotive drivetrain market in China is embracing significant advancements in drivetrain technologies.

- In terms of segment, the ICE segment dominated the target market and accounted for the largest revenue share of 76.1% in 2024.

- In terms of segment, the FWD segment dominated the automotive drivetrain market with a revenue share of 50.9% in 2024.

- In terms of segment, the passenger cars segment led the market and accounted for more than 73.0% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 234.77 Billion

- 2030 Projected Market Size: USD 339.89 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/automotive-drivetrain-market-report/request/rs1

As global fuel prices fluctuate and environmental concerns intensify, both manufacturers and consumers are prioritizing drivetrain technologies that offer improved fuel economy without compromising power or reliability. Advanced drivetrains, including all-wheel drive (AWD) and hybrid systems, enhance vehicle performance, traction, and safety, especially under challenging road and weather conditions, thus gaining wider adoption across passenger and commercial vehicle segments.

As global fuel prices fluctuate and environmental concerns intensify, both manufacturers and consumers are prioritizing drivetrain technologies that offer improved fuel economy without compromising power or reliability. Advanced drivetrains, including all-wheel drive (AWD) and hybrid systems, enhance vehicle performance, traction, and safety, especially under challenging road and weather conditions, thus gaining wider adoption across passenger and commercial vehicle segments.

Another major driver is the electrification of the automotive industry, with automakers rapidly transitioning from traditional internal combustion engines (ICEs) to hybrid and fully electric vehicles (EVs). Electric drivetrains eliminate the need for complex mechanical transmissions and rely on more efficient motor systems, which significantly reduce maintenance costs and emissions. The push for zero-emission vehicles, supported by government incentives and regulatory mandates across North America, Europe, and Asia Pacific, is further accelerating the demand for innovative drivetrain solutions tailored to EV architectures.

Additionally, technological advancements in automotive engineering, such as the integration of electronic control units (ECUs), advanced driver-assistance systems (ADAS), and smart transmission systems, are transforming drivetrain functionality. These developments enable real-time adjustments in power distribution and torque, improving driving dynamics, safety, and overall user experience. As consumer expectations evolve and automakers strive for competitive differentiation, investment in smarter and more adaptable drivetrain technologies continues to grow, positioning the drivetrain segment as a critical component of next-generation mobility solutions.