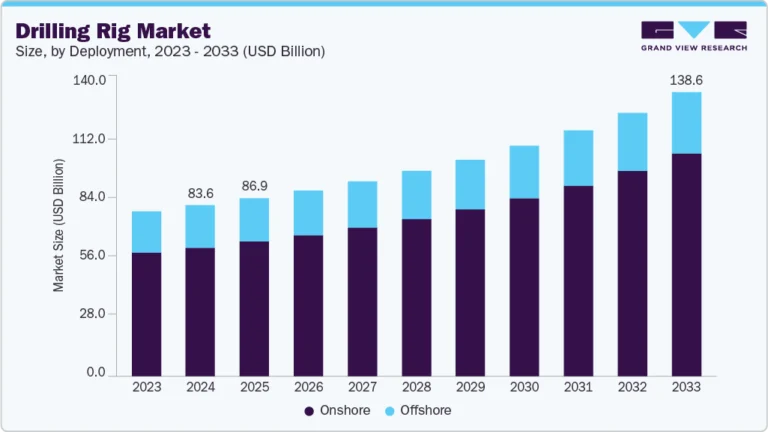

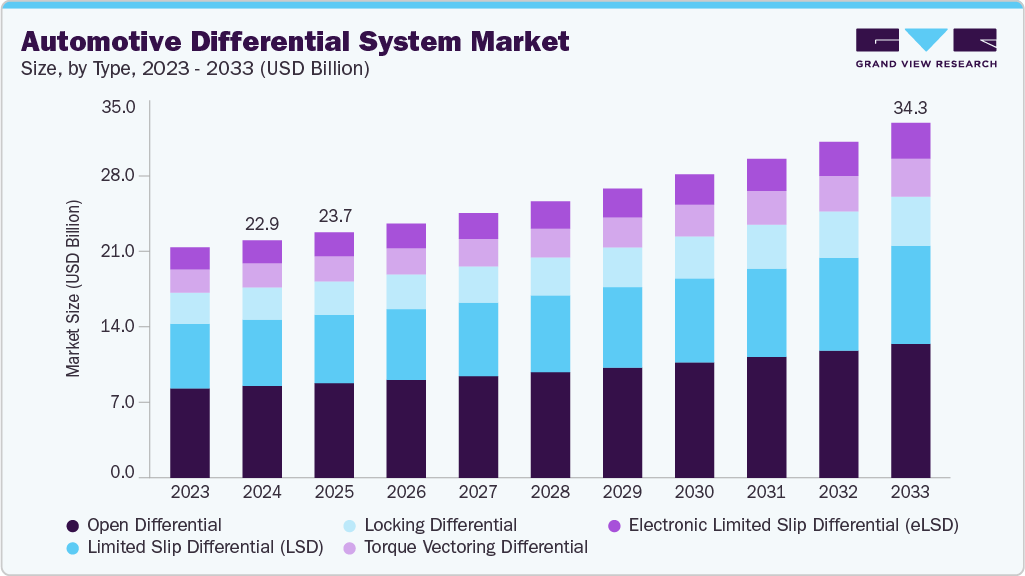

Automotive Differential System Market Size, Share & Trends Analysis growing at a CAGR of 4.7% from 2025 to 2033

The global automotive differential system market size was estimated at USD 22.95 billion in 2024, and is projected to reach USD 34.33 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. This growth is driven by the rising demand for all-wheel-drive (AWD) and four-wheel-drive (4WD) systems in SUVs and off-road vehicles, the increasing integration of advanced differential technologies such as electronic limited-slip differentials (eLSD) and torque vectoring systems in performance and electric vehicles, and the global push toward fuel efficiency and vehicle stability.

Key Market Trends & Insights

- The Asia Pacific automotive differential system market accounted for a 43.6% share of the overall market in 2024.

- The automotive differential system industry in China held a dominant position in 2024.

- By Type, the open differential segment accounted for the largest share of 38.7% in 2024.

- By Drive Type, the front-wheel drive (FWD) segment held the largest market share in 2024.

- By Vehicle Type, the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.95 Billion

- 2033 Projected Market Size: USD 34.33 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-differential-system-market-report/request/rs1

In addition, the electrification of powertrains and the growth of hybrid and electric vehicle (EV) sales fuel demand for differentials compatible with new propulsion architectures. The primary factors propelling the market growth are the rising stringency of government regulations related to fuel efficiency and emissions. Regulatory bodies across developed and emerging economies are mandating automakers to reduce carbon footprints and enhance fuel economy. For instance, the U.S. Department of Energy (DOE) continues to fund advanced vehicle technologies programs that aim to improve energy efficiency in light-duty and heavy-duty vehicles. Differential systems with optimized gear designs and electronic control can minimize power losses and contribute to better fuel economy. As a result, automotive manufacturers are increasingly integrating efficient differential systems into new vehicle models to comply with regulations, thereby boosting the market.

Another significant trend boosting the market is the rapid penetration of electric vehicles (EVs) into the mainstream automotive sector. EVs often use dual-motor setups or need advanced torque vectoring, which requires advanced differential technologies. According to the U.S. Department of Energy’s Alternative Fuels Data Center, EV sales have grown exponentially, supported by tax credits, public infrastructure investments, and R&D grants. The demand for software-controlled and electronically actuated differentials is growing within this segment, as these systems help manage torque distribution more precisely in EV platforms. This shift is reshaping drivetrain design and propelling the market growth for differential systems adapted to electrification.

The rising popularity of SUVs and off-road vehicles also propels the market growth, especially for limited-slip and locking differential systems. In the U.S., data from the National Highway Traffic Safety Administration (NHTSA) shows that SUVs account for an increasing share of new vehicle sales. These vehicles require differentials capable of handling rough terrains and steep gradients, particularly in regions with diverse driving environments. Consequently, automakers are expanding their offerings with advanced differential technologies to meet consumer expectations for both on-road comfort and off-road capabilities, thereby boosting the adoption of these systems.

Automotive Differential System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.71 billion |

|

Revenue forecast in 2033 |

USD 34.33 billion |

|

Growth rate |

CAGR of 4.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, drive type, vehicle type, component, propulsion type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Eaton; Dana Limited; BorgWarner Inc.; ZF Friedrichshafen AG; GKN Automotive Limited; American Axle & Manufacturing, Inc.; JTEKT Corporation; Linamar Corporation; HYUNDAI WIA CORP.; Musashi Seimitsu Industry Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |