Automotive Cyber Security Market Size, Share & Trends Analysis growing at a CAGR of 20.93% from 2023 to 2030

The global automotive cyber security market size was estimated at USD 3,090.6 million in 2022 and is projected to reach USD 14,258.5 million by 2030, growing at a CAGR of 20.93% from 2023 to 2030. Automotive cyber security is undergoing a fast revolution that is driven by socio-economic and environmental trends due to new manufacturing methods and consumer-challenging technologies.

Key Market Trends & Insights

- Asia Pacific accounted for a 36.80% market share in 2022 and is expected to grow steadily during the forecast period.

- Based on application, the infotainment segment dominated the market with a share of 36.27% in 2022 and is expected to expand at a significant growth rate during the forecast period.

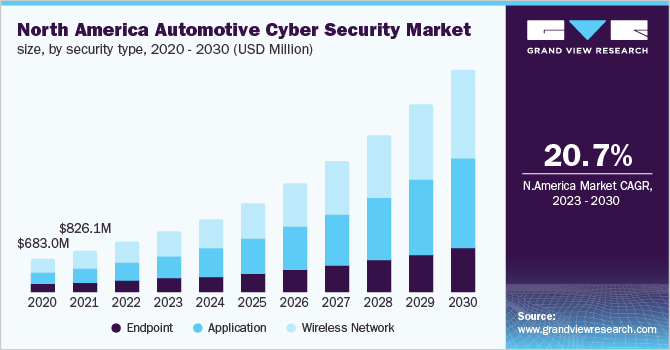

- Based on security insights, the wireless network security dominated the market with a share of 42.5% in 2022.

- Based on vehicle type, the EV segment led the market and is poised to expand at a CAGR of 28.57% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3,090.6 Million

- 2030 Projected Market Size: USD 14,258.5 Million

- CAGR (2023-2030): 20.93%

- Asia Pacific: Largest market in 2022

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/automotive-cyber-security-market/request/rs1

Vehicle connectivity is expanding quickly, creating many chances for innovative new features and appealing business strategies. The risk of cyber-attacks on automotive networks is also rising at the same time. Cyber-attacks have resulted in financial losses and damage to vehicular safety and reliability. With the incorporation of technologies like artificial intelligence, machine learning, private 5G, edge computing, and high-performance processing units, autonomous vehicles have made significant improvements recently. Edge computing assists autonomous EVs in managing a large amount of information at the edge to reduce latency and enable vehicles to make decisions based on data in real time.

Moreover, due to the adopting technologies, it is crucial for the suppliers and manufacturers in the automobile industry to adopt National Highway Traffic Safety Administration NHTSA’s rules and prioritize vehicle cyber security. Setting internal procedures and policies to ensure systems will be secure in anticipated real-world circumstances, including the presence of potential vehicle cyber security threats, is another aspect of giving vehicle cyber security a high priority. The environment for automotive cyber security is dynamic and is anticipated to evolve frequently.

There are numerous cybersecurity vulnerabilities specific to the automobile sector. A vehicle’s safety and advanced driver assistance systems could be damaged by cybercriminals, or even worse, they could alter any automated capabilities to directly cause a disaster. Security experts are concentrating on research and development on integrating defense mechanisms to counter the growing cyberattacks on EVs. Integrating a defense mechanism becomes a crucial design element as self-driving software and hardware characteristics undergo technical advancements.