Automotive Biometric Market Size, Share & Trends Analysis growing at a CAGR of 16.3% from 2025 to 2033

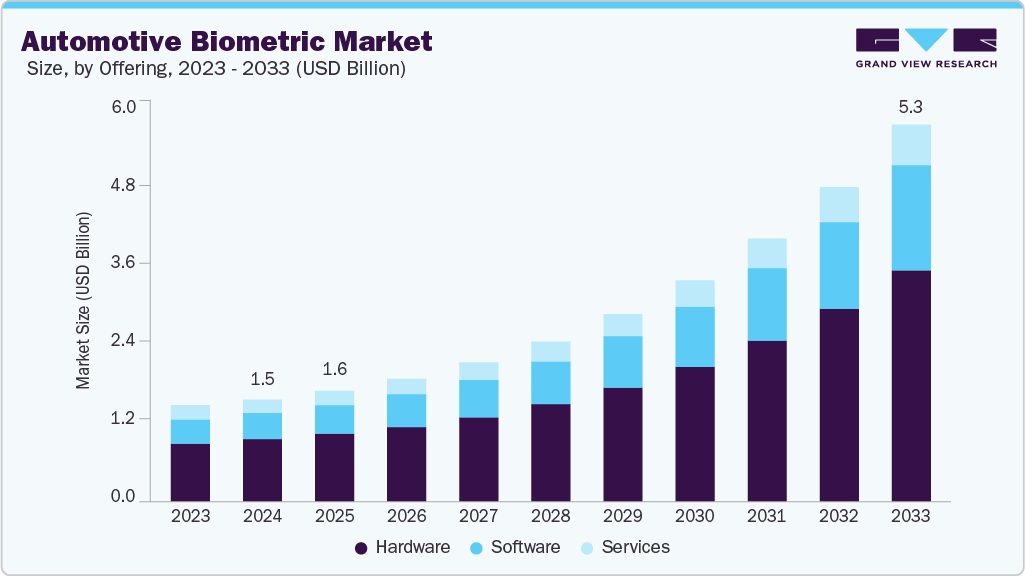

The global automotive biometric market size was estimated at USD 1.47 billion in 2024 and is projected to reach USD 5.33 billion by 2033, growing at a CAGR of 16.3% from 2025 to 2033.The market is gaining momentum, driven by rising demand for enhanced vehicle security through biometric authentication methods such as fingerprint and facial recognition.

Key Market Trends & Insights

- The Asia Pacific automotive biometric market accounted for a 37.8% share of the overall market in 2024.

- The automotive biometric industry in the U.S. held a dominant position in 2024.

- By technology, the fingerprint recognition segment accounted for the largest share of 38.6% in 2024.

- By component, the hardware segment held the largest market share in 2024.

- By application, the vehicle access control segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.47 Billion

- 2033 Projected Market Size: USD 5.33 Billion

- CAGR (2025-2033): 16.3%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/automotive-biometric-market-report/request/rs1

Increasing integration of biometrics with infotainment and connected car systems is enabling a personalized user experience, further propelling market adoption. Additionally, the growing focus on driver monitoring systems (DMS) aimed at improving safety and meeting regulatory compliance is accelerating the deployment of biometric technologies in vehicles. Advancements in artificial intelligence and machine learning present significant opportunities to improve biometric accuracy and usability, making these systems more reliable and user-friendly. However, high implementation costs and integration complexities remain major challenges, particularly limiting widespread adoption among mid and low-end vehicle segments.

Automotive manufacturers are investing in biometric systems that enable personalized settings based on driver recognition, improving comfort and user experience. Additionally, real-time biometric monitoring of drivers’ vital signs, such as heart rate and stress levels, is being integrated to enhance safety by detecting fatigue or medical emergencies early. The adoption of contactless biometric solutions reduces the need for physical interaction, aligning with hygiene concerns post-pandemic. Also, regulatory pressures to improve driver monitoring systems to prevent accidents are encouraging the incorporation of advanced biometric sensors. This growing emphasis on both personalization and safety through biometrics is expected to drive substantial market expansion globally.

The increasing integration of biometric authentication with infotainment and connected car platforms is driving the automotive biometric market. This trend supports personalized in-vehicle experiences by enabling secure user profiles, preferences, and access controls tailored to individual occupants. According to a Salesforce survey of over 2,000 car owners, connected vehicles are projected to constitute 95% of all vehicles by 2030, highlighting the critical role of biometrics in enhancing user engagement and data security. Automakers and technology providers are investing in biometric solutions to facilitate seamless, secure interactions within smart vehicles, contributing to market expansion. The convergence of biometrics with connected car systems fosters improved convenience, safety, and customer loyalty, strengthening the overall appeal of advanced automotive technologies worldwide.

Automotive Biometric Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.59 billion |

|

Revenue forecast in 2033 |

USD 5.33 billion |

|

Growth rate |

CAGR of 16.3% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, technology, application, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Fujitsu Limited; Synaptics Incorporated; Continental AG; Fingerprint Cards AB; Hitachi Ltd.; Methode Electronics Inc.; VOXX International Corporation; Safran S.A.; HID Global Corporation; BioEnable Technologies Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |