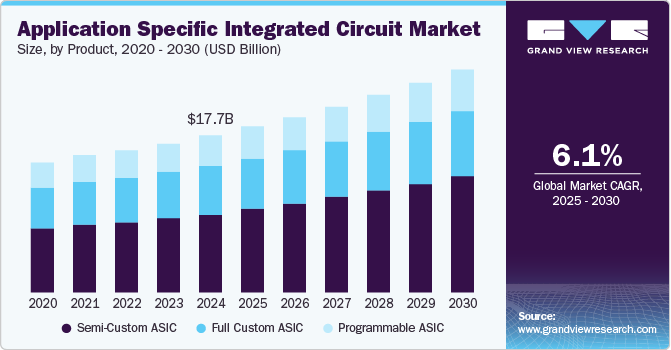

Application Specific Integrated Circuit Market Size, Share & Trends Analysis growing at a CAGR of 6.1% from 2025 to 2030

The global application specific integrated circuit market size was estimated at USD 17,654.1 million in 2024 and is projected to reach USD 25,084.3 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The global market is poised to experience a surge in demand primarily driven by the increasing utilization of Application-Specific Integrated Circuits (ASICs) in consumer electronics, including smartphones, smartwatches, and tablets, among other devices.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, semi-custom asic accounted for a revenue of USD 9,376.8 million in 2024.

- Semi-Custom ASIC is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 17,654.1 Million

- 2030 Projected Market Size: USD 25,084.3 Million

- CAGR (2025-2030): 6.1%

- Asia Pacific: Largest market in 2024

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/application-specific-integrated-circuits-market/request/rs1

The growing demand for tailored solutions that deliver maximum performance for specific applications has led to a rise in demand for ASICs. Industries are opting for ASICs to achieve optimal efficiency, speed, and reliability, which general-purpose chips cannot offer.

The rapidly growing demand for smartphones and tablets is expected to drive market growth over the forecast period. According to GVR analysis, approximately 75% of the total mobile phone owners will own a smartphone by 2025. ASICs help in providing the high-bandwidth, smaller size & weight, low-cost, and long battery life requirements of next-generation smartphones. Also, with the advent of ‘smart’ devices, electrical products such as televisions, laptops, wearables, digital cameras, and gaming consoles offers various advanced technologies such as touch screen displays, flat screens, and Bluetooth functions are generating a demand for a larger number of ICs. Furthermore, due to the constantly growing adoption of mechatronics across industrial and automotive applications, the demand for electronic components with ASICs has witnessed massive growth over the forecast period.

Governments across the globe are investing heavily in semiconductor manufacturing to support ASIC production. For instance, the U.S. government’s CHIPS Act, passed in 2022, has allocated over USD 52 billion to semiconductor research and development, which is expected to benefit the ASIC sector significantly by encouraging domestic manufacturing and reducing dependency on overseas production. Furthermore, the automotive sector, particularly in North America and Europe, has seen significant investments in autonomous and electric vehicles. ASICs, with their low-power and application-specific features, are essential in processing data from sensors and ensuring energy efficiency in EVs, driving growth in this sector.