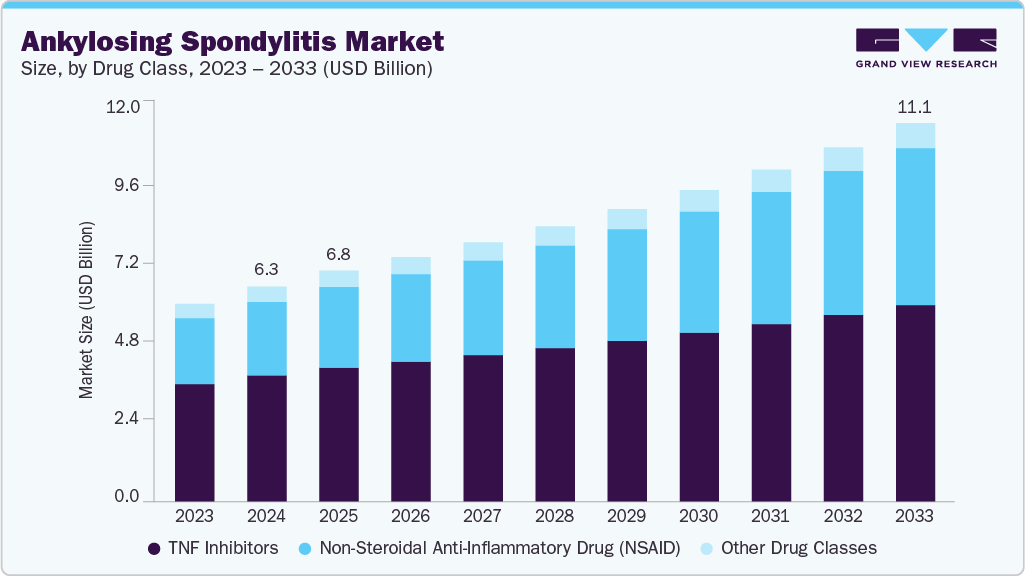

Ankylosing Spondylitis Market growing at a CAGR of 6.4% from 2025 to 2033

The global ankylosing spondylitis market size was estimated at USD 6.29 billion in 2024 and is projected to reach USD 11.08 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. The market is growing due to the rising prevalence of inflammatory diseases and greater diagnostic awareness among healthcare providers.

Key Market Trends & Insights

- The North America ankylosing spondylitis market held the largest share of 57.32% of the global market in 2024.

- The ankylosing spondylitis industry in the U.S. is expected to grow significantly over the forecast period.

- By drug class, the TNF inhibitors segment held the highest market share of 58.70% in 2024.

- By distribution channel, the hospital pharmacy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.29 Billion

- 2033 Projected Market Size: USD 11.08 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/ankylosing-spondylitis-market/request/rs1

The market is growing due to the rising prevalence of inflammatory diseases and greater diagnostic awareness among healthcare providers. Chronic back pain associated with ankylosing spondylitis is increasing demand for early intervention, supported by advanced imaging techniques such as MRI and CT scans that enable accurate diagnosis at earlier stages. This accelerates treatment initiation and improves long-term outcomes, driving adoption of targeted therapies. For instance, in September 2024, the American Journal of Managed Care reported that the FDA had approved bimekizumab-bkzx (Bimzelx) for adults with AS, nr-axSpA, and PsA, marking the first dual IL-17A and IL-17F inhibitor to secure approval for these indications. Supported by Phase 3 BE MOBILE trials, this milestone expanded therapeutic options and strengthened market growth.

Advancements in biologic therapies are another major factor contributing to market growth. Biologic agents targeting tumor necrosis factor (TNF) and interleukin-17 (IL-17) pathways have transformed the management of ankylosing spondylitis. These therapies reduce inflammation, slow disease progression, and improve quality of life, making them the preferred choice among physicians and patients. For instance, in November 2023, UCB reported at ACR Convergence 2023 that BIMZELX (bimekizumab) delivered sustained five-year improvements in ankylosing spondylitis across disease activity, physical function, and quality of life, with consistent safety. Among 303 patients entering OLE, 202 remained at Week 256, with ASAS40 response rates maintained near 50%. The introduction of biosimilars is also increasing accessibility and affordability, which further expands treatment adoption rates. Pharmaceutical companies actively invest in clinical research to develop novel biologics and small-molecule therapies. Regulatory bodies ‘ increasing approvals of new drugs give patients and physicians more options.

The rising focus on personalized medicine shapes future opportunities in the market. Genetic testing and biomarker-driven approaches enable more precise selection of therapies tailored to individual patient needs. Such approaches enhance treatment effectiveness and reduce the risk of adverse reactions. The expansion of digital health platforms and telemedicine is improving patient monitoring and adherence to long-term treatment plans. Growing collaborations between pharmaceutical companies and research institutes lead to faster development of innovative treatment options. The global burden of disability linked with ankylosing spondylitis is also pushing demand for advanced therapies that restore mobility and reduce pain. These trends are expected to sustain market growth over the coming years.

Market Concentration & Characteristics

The ankylosing spondylitis industry is characterized by a high degree of innovation driven by biologics and targeted therapies. TNF inhibitors such as Humira, Enbrel, and Remicade set the standard for disease management by improving outcomes in patients with severe symptoms. In recent years, IL-17 inhibitors and JAK inhibitors have expanded the treatment landscape, offering new mechanisms of action. Continuous R&D efforts by key players like AbbVie, Novartis, and Eli Lilly fuel the introduction of novel drugs. Companies are investing in biosimilars that offer cost-effective alternatives while maintaining therapeutic efficacy. The rise of precision medicine and biomarker research is shaping a more personalized approach to treatment. These advancements highlight the strong innovation pipeline that sustains the market’s long-term growth.

The ankylosing spondylitis industry presents significant barriers to entry due to complex R&D requirements and high development costs. Clinical trials for biologics are resource-intensive, with long approval timelines and substantial investment in patient recruitment. Established players such as Pfizer and Johnson & Johnson dominate with extensive product portfolios and strong brand recognition. New entrants face challenges in achieving differentiation due to the presence of highly effective drugs like Simponi and Cimzia. Manufacturing biologics requires advanced facilities and strict compliance with quality standards, further raising the entry threshold. Distribution networks are also firmly established, making it harder for smaller firms to penetrate global markets. As a result, the competitive landscape favors established companies with significant financial and technological resources.

Ankylosing Spondylitis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.76 billion |

|

Revenue forecast in 2033 |

USD 11.08 billion |

|

Growth rate |

CAGR of 6.4% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Drug class, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key company profiled |

AbbiVie, Inc.; Amgen, Inc.; Pfizer, Inc.; Johnson & Johnson, Inc.; Novartis AG; UCB, Inc.; Eli Lilly and Company; Merck & Co., Inc.; Zydus Lifescience Ltd.; Izana Bioscience |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |