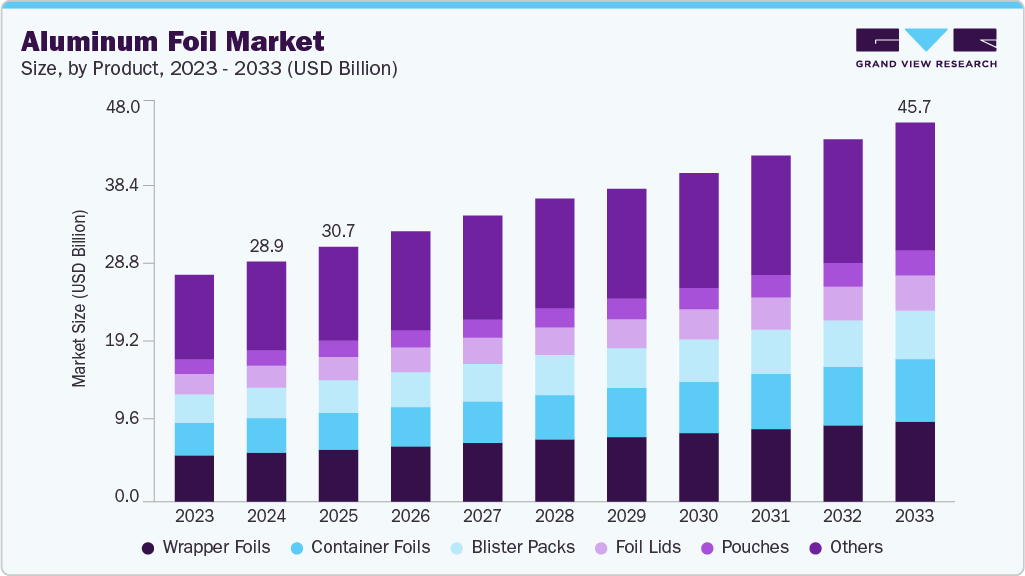

Aluminum Foil Market Size, Share & Trends Analysis growing at a CAGR of 5.1% from 2025 to 2033

The global aluminum foil market size was estimated at USD 28.93 billion in 2024 and is projected to reach USD 45.67 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. As more people lead busy lives, especially in urban areas, they prefer ready-to-eat meals or packaged snacks that are easy to carry and store.

Key Market Trends & Insights

- Asia Pacific dominated the aluminum foil market with the largest market revenue share of 55.0%.

- The aluminum foil market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, wrapper foils segment led the market with the largest revenue share of 20.4% in 2024.

- By end use, the packaging segment led the market with the largest revenue share of % in 2024..

Market Size & Forecast

- 2024 Market Size: USD 28.93 Billion

- 2033 Projected Market Size: USD 45.67 Billion

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/aluminum-foil-market/request/rs1

Aluminum foil is widely used to wrap and seal these products because it keeps food fresh by protecting it from light, moisture, and air. For example, chocolate bars, instant noodles, and dairy products like butter and cheese are often packed in aluminum foil. In countries like India and China, the shift toward convenience foods due to changing lifestyles has significantly increased aluminum foil usage in the food packaging.

Aluminum foil is commonly used in blister packs and strip packs for tablets and capsules, helping to shield medicines from contamination and environmental exposure. This is particularly important in countries with strict pharmaceutical safety regulations, such as the United States and Germany. The growth of the healthcare sector, fueled by an aging population and rising healthcare awareness, has significantly boosted the use of aluminum foil. A clear example was during the COVID-19 pandemic, when the surge in demand for medications and vaccines led to increased production and use of foil-based packaging materials to ensure safe storage and delivery.

Environmental concerns are also pushing the market forward, as aluminum foil is considered a more sustainable alternative to plastic. Unlike many plastic materials, aluminum foil is fully recyclable and can be reused repeatedly without losing its quality. This makes it an attractive choice for companies aiming to reduce their environmental footprint. In Europe and North America, where environmental regulations are stricter and consumer awareness is high, businesses are switching from plastic to foil packaging. For instance, some supermarkets in Germany and the UK have replaced plastic food trays with aluminum foil trays to support their sustainability goals, leading to higher demand for recyclable packaging materials.

Technological advancements in aluminum foil production have further fueled market growth. Modern manufacturing processes allow companies to create thinner, stronger, and more versatile foil that can be used in various industries. This includes multilayered foil for liquids like juices, high-barrier foil pouches for pet foods, and decorative foil wraps for cosmetics and premium chocolates. Some companies now offer foil with embossed logos or colored finishes to enhance product appeal. These innovations not only improve the functionality of the foil but also help brands stand out on the shelves, expanding the use of aluminum foil beyond traditional food applications.

Furthermore, the rapid growth of e-commerce and food delivery services has boosted demand for aluminum foil, especially for takeout packaging. Online food ordering through platforms like Swiggy, Zomato, Uber Eats, and DoorDash has increased the need for packaging to keep food warm, prevent leaks, and handle long delivery times. Aluminum foil containers are ideal, so restaurants, bakeries, and cloud kitchens rely heavily on them. During the pandemic, this demand surged as people avoided dining out and ordered meals at home, and this habit has continued in many parts of the world. As the online food industry grows, so does the need for practical and hygienic packaging solutions like aluminum foil.

Drivers, Opportunities & Restraints

As urbanization increases and lifestyles become more fast-paced, particularly in emerging economies like India, Brazil, and Southeast Asia, consumers rely more on ready-to-eat and packaged food items. Aluminum foil provides an effective barrier against moisture, oxygen, and light, making it ideal for food preservation. Similarly, the pharmaceutical sector is boosting demand due to the use of foil in blister packs and strip packaging, which helps maintain drug safety and shelf life. The growth in global healthcare spending and drug production, particularly in developed markets like the U.S. and Germany, further strengthens the market outlook.

One of the biggest opportunities lies in the global shift toward sustainable and recyclable packaging materials. With rising environmental awareness and tightening regulations on single-use plastics, aluminum foil is increasingly viewed as a viable alternative due to its 100% recyclability. Food service, retail, and personal care brands are turning to aluminum foil-based packaging to meet their sustainability goals. In addition, ongoing innovations in foil manufacturing, such as ultra-thin laminates, embossed designs, and multi-layer foils, are opening up new applications in electronics, construction insulation, and premium product packaging. The growing popularity of online food delivery and cloud kitchens also creates a significant opportunity, as aluminum foil containers are widely used for hot and secure meal packaging.

However, the market faces several restraints that could limit growth. One major challenge is the volatility in raw material prices, particularly aluminum, which is influenced by global trade policies, energy costs, and supply chain disruptions. Rising production costs can affect the pricing and profitability of foil manufacturers.