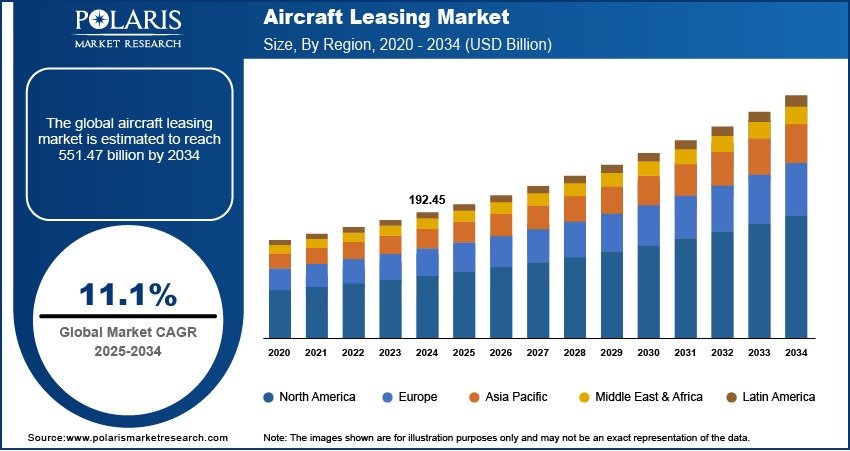

Aircraft Leasing Market Projected to Reach USD 551.47 Billion By 2034, Growing at a CAGR of 11.1%

The global Aircraft Leasing market size was valued at USD 192.45 billion in 2024 and is projected to grow from USD 213.35 billion in 2025 to USD 551.47 billion by 2034 , exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period from 2025 to 2034 .

- Rising Demand for Fleet Expansion Amid Air Travel Recovery: With the aviation industry rebounding post-pandemic, airlines are increasingly opting for aircraft leasing as a cost-effective way to expand fleets without significant capital outlay.

- Growing Preference for Operating Leases Over Finance Leases: Airlines are shifting toward operating leases that offer flexibility, lower balance sheet impact, and the ability to upgrade to newer, more fuel-efficient aircraft models.

- Expansion of Low-Cost Carriers in Emerging Markets: The rise of budget airlines in Asia Pacific, Latin America, and Africa is driving demand for leased aircraft due to their need for rapid fleet expansion with minimal financial risk.

- Technological Advancements and Fuel-Efficient Aircraft: The introduction of next-generation aircraft such as Boeing 787, Airbus A350, and narrowbody jets like the A320neo family is encouraging lessors and lessees to modernize fleets for improved efficiency and reduced emissions.

- Increased Aircraft Financing and Asset Management Activities: Financial institutions, investment firms, and specialized lessors are showing growing interest in aircraft leasing due to its high return potential and stable asset value.

Market Size & Forecast

- Market Size in 2024 – USD 192.45 billion

- Market Size in 2025 – USD 213.35 billion

- Projected Market Size by 2034 – USD 551.47 billion

- CAGR (2025–2034) – 11.1%

Aircraft leasing refers to the practice of acquiring aircraft through rental agreements rather than outright purchase, allowing airlines to operate aircraft without bearing the full capital expenditure. This model offers advantages such as cost savings, operational flexibility, access to modern aircraft, and better cash flow management.

The market is experiencing strong growth driven by increasing air travel demand, fleet modernization needs, and the financial benefits associated with leasing over ownership. Additionally, the recovery of the global aviation sector post-pandemic, coupled with rising fuel costs and environmental pressures, is pushing airlines to adopt leased aircraft equipped with advanced fuel-efficient technologies.

Technological innovation, regulatory developments, and evolving lease structures—such as sale-and-leaseback arrangements—are also shaping the future of the aircraft leasing industry. As emerging markets continue to expand their aviation infrastructure and low-cost carriers proliferate, the demand for leased aircraft is expected to surge significantly over the next decade.