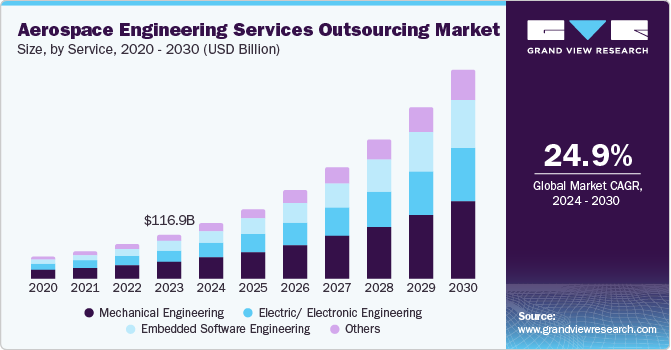

Aerospace Engineering Services Outsourcing Market Size, Share & Trends Analysis growing at a CAGR of 24.9% from 2024 to 2030

The global aerospace engineering services outsourcing market size was valued at USD 116.95 billion in 2023 and is projected to grow at a CAGR of 24.9% from 2024 to 2030. Organizations are following the increasingly popular practice of engineering services outsourcing (ESO) to assign specific functions or projects to external engineering service providers. These organizations can thus focus on their core competencies by outsourcing these tasks to industry specialists.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/aerospace-engineering-services-outsourcing-market/request/rs1

The fast-growing air travel industry, particularly in emerging economies such as India, China, and other Southeast Asian countries, is creating a strong demand for modernized aerospace infrastructure. This translates to increased design, development, and maintenance service requirements, propelling the growth of the ESO market in this sector.

Intensifying competition within the aerospace sector and post-recessionary pressures have compelled manufacturers to explore effective cost-reduction strategies, including outsourcing specific processes. For instance, the aviation sector has recovered from the COVID-induced recession that had caused a major decline in global operations. The number of passengers choosing air travel over other modes is also increasing exponentially. As a result, the aviation sector is experiencing a mismatch between its expanding traveler base and the rate of service delivery. Outsourcing engineering services offers a compelling solution in this regard, enabling companies to leverage the expertise of service providers at much lower costs than in-house development.

Significant developments have been made in integrating advanced electronic components and different types of software in aircraft. This has resulted in the aerospace industry requiring more qualified personnel with specialized engineering skills in their on-ground and in-air operations. ESO providers address this demand by offering access to a broader talent pool, ensuring critical aerospace projects have the necessary expertise. As a result, organizations can instead deploy their resources, time, and energy to expand their operations and grow their business. The experts assigned by providers of engineering services handle projects efficiently and in a time-bound manner, making it very convenient for organizations to meet project deadlines and better serve their customers and stakeholders.

Service Insights

The mechanical engineering segment accounted for the highest revenue share of 39.0% in the global market in 2023. The aerospace industry relies heavily on mechanical engineering services such as structural engineering, systems engineering, and fluid & thermodynamics. The increasing complexity of modern aerospace components leads to a constant demand for qualified mechanical engineers across the design, development, and maintenance stages. However, hiring specialized professionals on a permanent basis comes with significant costs, which compels organizations to outsource these services, driving segment growth. Mechanical engineers are required to carry out extensive evaluations regarding the structural integrity, aerodynamics, and operational efficiency of an aircraft, which are critical parameters to ensure its smooth functioning. As this is a time- and resource-intensive process, outsourcing is considered an effective option.