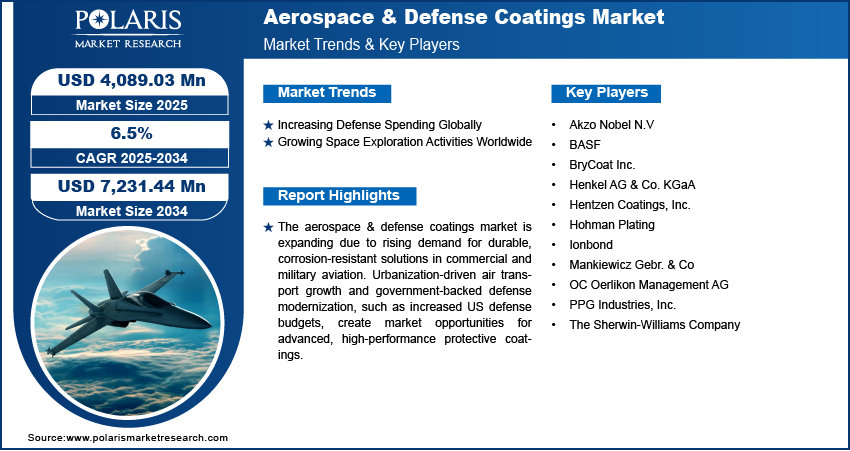

Aerospace & Defense Coatings Market Poised to Hit USD 7,231.44 Million by 2034 | CAGR: 6.5%

The global aerospace and defense coatings market was valued at USD 3,854.30 million in 2024 and is projected to grow from USD 4,089.03 million in 2025 to reach USD 7,231.44 million by 2034, exhibiting a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2025 to 2034. A key factor driving this growth is the ongoing technological advancements in material composition, which have led to the development of highly durable and efficient coatings essential for aerospace and defense applications.

Aerospace & Defense Coatings Market Key Trends & Insights:

- Lightweight, multifunctional coatings: Coatings are increasingly designed to be lighter while offering multiple benefits such as corrosion resistance, UV protection, stealth capabilities, and thermal stability to improve aircraft performance and efficiency.

- Eco-friendly formulation adoption: There is a strong shift toward environmentally sustainable coatings, including water-based and low/zero-VOC formulations. This trend is driven by global environmental regulations and the aerospace industry’s sustainability goals.

- Nanotechnology and smart/self-healing coatings: Advanced coatings incorporating nanomaterials enhance durability, provide better protection against corrosion and UV exposure, and can exhibit hydrophobic or anti-icing properties. Some smart coatings are capable of self-healing or providing real-time condition monitoring.

- Thermal and anti-corrosion barrier innovation: High-performance coatings are being developed to act as thermal barriers for engine components exposed to extreme temperatures and as anti-corrosion layers to withstand harsh environments, especially in military and marine applications.

- Strategic collaborations and advanced resin use: Industry partnerships are accelerating innovations in resin technologies such as polyurethane, epoxy, silicone, and ceramic-based coatings tailored for high-performance applications like stealth, altitude endurance, and impact resistance.

- Regional growth and regulatory demands: North America leads in technological advancements, while Asia-Pacific is witnessing rapid market expansion due to growing defense investments and aviation activity. Strict regulatory standards are also pushing the development of compliant and sustainable coating solutions.

Market Size & Forecast:

- Market size value in 2025 – USD 4,089.03 million

- Revenue forecast in 2034 – USD 7,231.44 million

- CAGR – 6.5% from 2025 – 2034

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Aerospace & Defense Coatings Market Overview:

The Aerospace & Defense Coatings market is witnessing notable growth due to increasing demand for high-performance coatings that offer protection against corrosion, extreme temperatures, and mechanical wear. Technological advancements such as nanotechnology-based coatings, self-healing surfaces, and thermal barrier formulations are setting new benchmarks for performance and durability. Additionally, multifunctional coatings, including radar-absorbing materials, are being adopted to enhance stealth capabilities in defense applications. The industry is also embracing sustainable solutions, including water-based, low-VOC, and bio-based coatings, in response to tightening environmental regulations and a growing focus on eco-friendly manufacturing.

Regionally, North America dominates the market owing to its strong aerospace manufacturing base, defense modernization programs, and emphasis on sustainability. The Asia-Pacific region is emerging as the fastest-growing market, driven by increasing air travel, expanding commercial fleets, and rising defense investments in countries such as China and India. Europe is also focusing on innovative and environmentally friendly coating technologies, particularly for military and commercial aircraft. However, the market faces challenges such as high compliance costs, complex certification processes, and competitive pressures. To address these, manufacturers are investing in R&D, modular product development, and strategic collaborations with OEMs and MRO providers.