Cell Culture Media & Cell Lines Market growing at a CAGR of 9.87% from 2026 to 2033

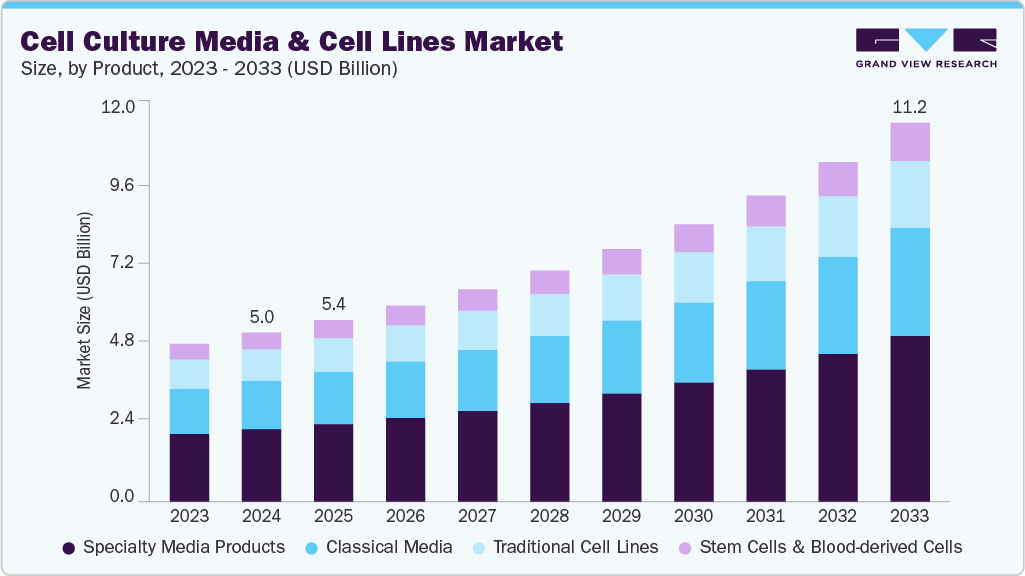

The global cell culture media & cell lines market size wasestimated at USD 5.39 billion in 2025 and is projected to reach USD 11.25 billion by 2033, growing at a CAGR of 9.87% from 2026 to 2033. This growth is driven by the rising demand for biopharmaceuticals, increasing investments in regenerative medicine and cancer research, and advancements in cell-based technologies.

Key Market Trends & Insights

- The North America cell culture media & cell lines market held the largest share of 43.15% of the global market in 2025.

- The cell culture media & cell lines market in the U.S. dominates the regional market.

- By product, the specialty media products cells segment held the highest market share of 42.78% in 2025.

- By application, the biopharmaceutical production segment held the highest market share of 45.75% in 2025.

- By end-use, the large biopharmaceutical companies segment dominated the market in 2025 with a share of 30.18%.

Market Size & Forecast

- 2025 Market Size: USD 5.39 Billion

- 2033 Projected Market Size: USD 11.25 Billion

- CAGR (2026-2033): 9.87%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/cell-culture-media-cell-lines-market-report/request/rs1

Market Concentration & Characteristics

The cell culture media & cell lines industry is significantly driven by a high degree of innovation, continuously enhancing product quality and process efficiency. Innovations in cell line engineering, including genetically modified and immortalized cell lines, have boosted productivity and stability, enabling more efficient biologics and vaccine production. For instance, in February 2025, Discovery Life Sciences announced the U.S. launch of its OncoPro-derived Tumoroid Cell Lines at Precision Med Tri-Con, advancing oncology research with predictive 3D cancer models. Moreover, the adoption of automation, artificial intelligence, and advanced screening is streamlining workflows and reducing costs. This ongoing technological progress meets the growing and evolving demands of the pharmaceutical and biotech industries and further fuels the market expansion.

The rising level of mergers and acquisitions (M&A) is a significant driver for the cell culture media and cell lines industry. Strategic moves allow companies to integrate innovative cell culture platforms, proprietary media formulations, and high-performance cell lines into their operations, accelerating product development and commercialization timelines. For instance, in April 2023, AnaBios Corporation acquired Cell Systems, a human primary cell and cell culture media company located in Kirkland, Washington. This acquisition enhances AnaBios’ portfolio of human tissue and cells, providing researchers with a broader array of biologically relevant tools to expedite drug discovery and deepen understanding of cell biology. Moreover, M&A activity fosters industry consolidation, enhances supply chain capabilities, and promotes investment in R&D, ultimately driving innovation and boosting demand for high-quality cell culture solutions across a broader range of applications.

Regulatory frameworks play a critical role in shaping the cell culture media and cell lines industry by enforcing stringent quality, safety, and compliance standards, particularly for products used in biopharmaceutical manufacturing, vaccine production, and clinical research. Agencies such as the FDA, EMA, and other global regulatory bodies require rigorous testing and validation of cell lines and media components to ensure consistency, traceability, and the elimination of contaminants like animal-derived pathogens. This regulatory pressure drives the adoption of chemically defined serum-free, GMP-compliant media and thoroughly characterized and traceable cell lines. While compliance increases operational complexity and costs, it also encourages innovation and differentiation among manufacturers. As companies strive to meet evolving regulatory demands, the need for advanced, regulatory-compliant cell culture solutions continues to rise, fueling market growth.

Product Insights

The specialty media products segment dominated the market with a revenue share of 42.78% in 2025. This segment’s strong performance is attributed to the increasing demand for customized and application-specific media formulations designed to support the growth and function of specialized cell types, such as stem cells, primary cells, and genetically modified cell lines. Specialty media are widely used in advanced research areas, including regenerative medicine, cancer biology, vaccine production, and biopharmaceutical development, where precise control over cell behavior is critical. Their ability to enhance cell performance, improve reproducibility, and meet stringent regulatory standards makes them essential in academic and industrial settings. As research becomes more targeted and the need for high-efficiency culture systems grows, the demand for specialty media will continue rising, reinforcing this segment’s leadership in the global market.

Application Insights

Biopharmaceutical production held the dominant market share of 45.75% in 2025, primarily due to the rapidly increasing demand for biologics such as monoclonal antibodies, recombinant proteins, and vaccines. The biopharmaceutical industry heavily relies on cell culture technologies for the large-scale production of these complex therapeutics, requiring high-performance media and robust, high-yield cell lines to ensure product consistency, safety, and scalability. The shift toward personalized medicine and targeted therapies has also increased the need for advanced biomanufacturing platforms.

End-use Insights

The large biopharmaceutical companies segment dominated the market in 2025 with a share of 30.18%, owing to their substantial investments in biopharmaceutical research and development, advanced manufacturing capabilities, and established global supply chains. These companies have extensive biologics pipelines, including monoclonal antibodies, vaccines, and cell-based therapies. These require large-scale, high-quality cell culture media and well-characterized cell lines for efficient production. Their ability to fund innovation and adopt cutting-edge technologies, such as serum-free media and genetically engineered cell lines, gives them a competitive edge in optimizing yields and reducing production costs. These factors collectively contribute to their dominant market position in the cell culture media and cell lines industry.

Cell Culture Media & Cell Lines Market Report Scope

|

Attribute |

Details |

|

Market size value in 2026 |

USD 5.82 billion |

|

Revenue forecast in 2033 |

USD 11.25 billion |

|

Growth rate |

CAGR of 9.87% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway,; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait |

|

Key companies profiled |

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; STEMCELL Technologies; PromoCell GmbH; ATCC; AllCells |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |