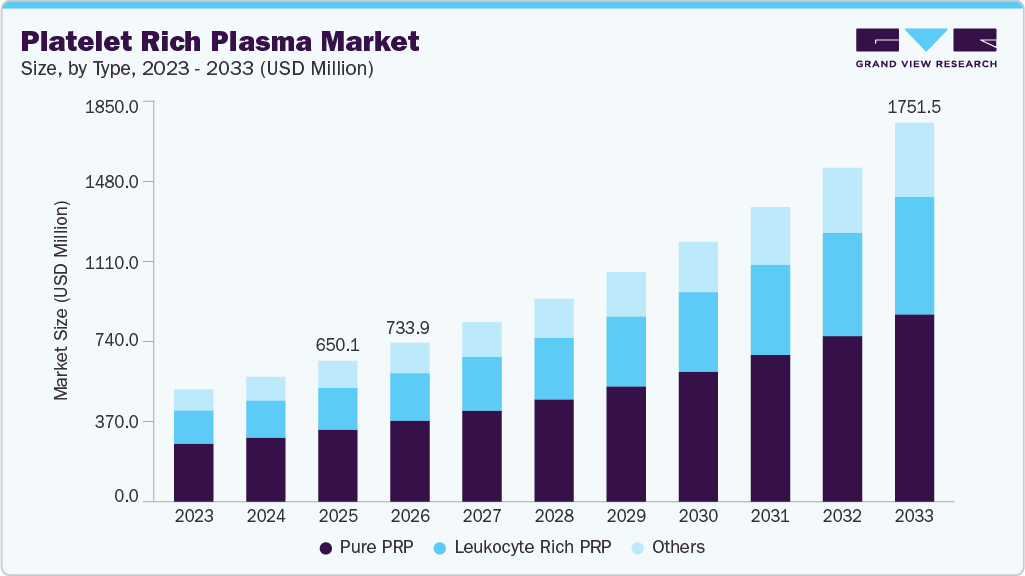

Platelet Rich Plasma Market growing at a CAGR of 13.2% from 2026 to 2033

The global platelet rich plasma market size was estimated at USD 650.13 million in 2025 and is projected to reach USD 1,751.45 million by 2033, growing at a CAGR of 13.2% from 2026 to 2033. Platelet-rich plasma (PRP) usage is witnessing growth owing to the increasing participation in sporting events, leading to an increasing number of cases of sports injuries and an upsurge in cosmetic surgery.

Key Market Trends & Insights

- North America dominated the platelet rich plasma market with the largest revenue share of 42.00% in 2025.

- The platelet rich plasma market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By type, the pure PRP segment accounted for the largest revenue share of 51.12% in 2025.

- By application, the orthopedics segment accounted for the largest revenue share of 25.38% in 2025.

- By end use, hospitals segment accounted for the largest revenue share of 48.58% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 650.13 Million

- 2033 Projected Market Size: USD 1,751.45 Million

- CAGR (2026-2033): 13.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/platelet-rich-plasma-prp-market/request/rs1

The Platelet Rich Plasma (PRP) market is expanding steadily as clinicians and patients increasingly favor autologous, minimally invasive therapies across orthopedics, sports medicine, dermatology, aesthetics, and wound care. PRP’s appeal lies in its use of a patient’s own blood components, which lowers immunogenic risk and aligns with broader healthcare trends toward outpatient procedures and biologic-adjacent therapies without the complexity of cell or gene treatments. Adoption is driven by rising musculoskeletal disorders, sports injuries, age-related degeneration, and aesthetic demand, particularly in private care settings where procedural flexibility is higher.

Clinical standardization and professional guidance are playing an important role in sustaining adoption. For instance, in 2025, the American Academy of Orthopaedic Surgeons continued to reference PRP within its evidence-based discussions on tendon and joint disorders, reflecting ongoing evaluation of PRP’s role in musculoskeletal care rather than dismissal as an experimental intervention. This reinforces physician confidence and supports continued procedural use, even as outcomes vary by indication and protocol.

At the same time, growth in aesthetic and dermatologic applications is reinforcing the market’s diversification beyond orthopedics. For instance, in 2025, the International Society of Aesthetic Plastic Surgery highlighted PRP as one of the commonly performed non-surgical regenerative adjuncts in procedures such as facial rejuvenation and hair restoration in its global practice insights. This reflects sustained patient demand for natural, biologically derived treatments and supports recurring procedural volumes in private clinics.

Market Concentration & Characteristics

The degree of innovation in the PRP market is moderate, with development primarily centered on device and process optimization rather than biological breakthroughs. Manufacturers focus on improving centrifugation efficiency, platelet yield consistency, and closed-system designs to reduce contamination risk and procedural variability. Automation and point-of-care usability are key innovation themes, enabling broader adoption in outpatient and clinic-based settings. Clinical innovation is largely physician-led, involving protocol customization by indication rather than standardized therapeutic regimens, which limits disruptive change but supports steady incremental improvement.

Barriers to entry are moderate but increasing. While PRP devices face lower development complexity than pharmaceuticals or cell therapies, compliance with medical device regulations, quality systems, and sterility standards still requires capital investment. Market access depends heavily on physician education, training programs, and brand trust, creating soft barriers that favor established players. Additionally, fragmented reimbursement and inconsistent clinical guidelines constrain rapid scale-up for new entrants without strong commercial infrastructure.

Regulatory impact on the PRP market is moderate and nuanced. PRP is typically regulated through oversight of blood processing devices rather than as a standalone therapeutic product, reducing approval timelines. However, regulatory scrutiny intensifies when PRP is promoted for non-homologous uses or combined with additives, creating compliance risk. This regulatory flexibility supports innovation and adoption but also contributes to variability in clinical practice and outcome consistency across regions.

The threat of product substitutes is moderate and indication dependent. In orthopedics, PRP competes with corticosteroid injections, hyaluronic acid injections, physical therapy, and surgical intervention. In aesthetics, substitutes include dermal fillers, botulinum toxin, and energy-based devices. While these alternatives may offer faster symptom relief or more predictable outcomes, PRP’s autologous profile, safety perception, and regenerative positioning reduce full substitution, particularly among patients seeking non-synthetic options.

Type Insights

The pure PRP segment dominated the market with the largest revenue share of 51.12% in 2025, as it represents the most clinically accepted and operationally scalable PRP formulation. Pure PRP, which is leukocyte-poor, is favored across orthopedics, sports medicine, dermatology, and aesthetic procedures because it reduces inflammatory response while supporting tissue regeneration, making it suitable for repeated and elective treatments. Its strong alignment with standardized, closed-system preparation kits improves procedural consistency and clinic workflow efficiency, particularly in outpatient and private practice settings. For instance, in 2025, Arthrex continued to emphasize leukocyte-poor (pure) PRP systems within its regenerative medicine portfolio for musculoskeletal applications, reinforcing clinician confidence and accelerating routine adoption of Pure PRP over leukocyte-rich alternatives.

End-use Insights

The hospitals segment dominated the platelet rich plasma market with a share of 48.57% in 2025, reflecting the concentration of PRP use in settings that manage high patient volumes and complex musculoskeletal cases. Hospitals offer integrated orthopedic and sports medicine departments, imaging support, sterile processing, and standardized clinical governance, enabling consistent and repeat PRP utilization. Their ability to invest in advanced PRP systems and comply with procedural oversight further strengthens adoption versus standalone clinics. For instance, in 2025, Hospital for Special Surgery continued to expand orthobiologic services, including PRP, within hospital-based orthopedic and sports medicine care pathways, reinforcing hospitals as the dominant end use setting.

The Clinics segment is projected to grow at a CAGR of 13.36% over the forecast period, driven by the rapid expansion of outpatient, specialty, and private practice settings offering PRP procedures. Clinics benefit from lower operating costs, faster patient throughput, and greater procedural flexibility compared with hospitals, making PRP an attractive cash-pay and elective service. Growth is particularly pronounced in sports medicine, dermatology, and aesthetic clinics, where repeat treatments and patient-driven demand support volume expansion. For instance, in 2025, Athletico Physical Therapy continued to broaden regenerative and orthobiologic services across its clinic network, supporting rising PRP adoption and accelerating the growth of clinic-based PRP delivery.

Platelet Rich Plasma Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 733.90 million |

|

Revenue forecast in 2033 |

USD 1,751.45 million |

|

Growth rate |

CAGR of 13.2% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/million, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key company profiled |

Johnson & Johnson Services, Inc.; Arthrex, Inc.; EmCyte Corporation; Dr PRP USA LLC; Juventix Regenerative Medical LLC.; Terumo Corporation; Zimmer Biomet; Stryker; Apex Biologix; Celling Biosciences, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |