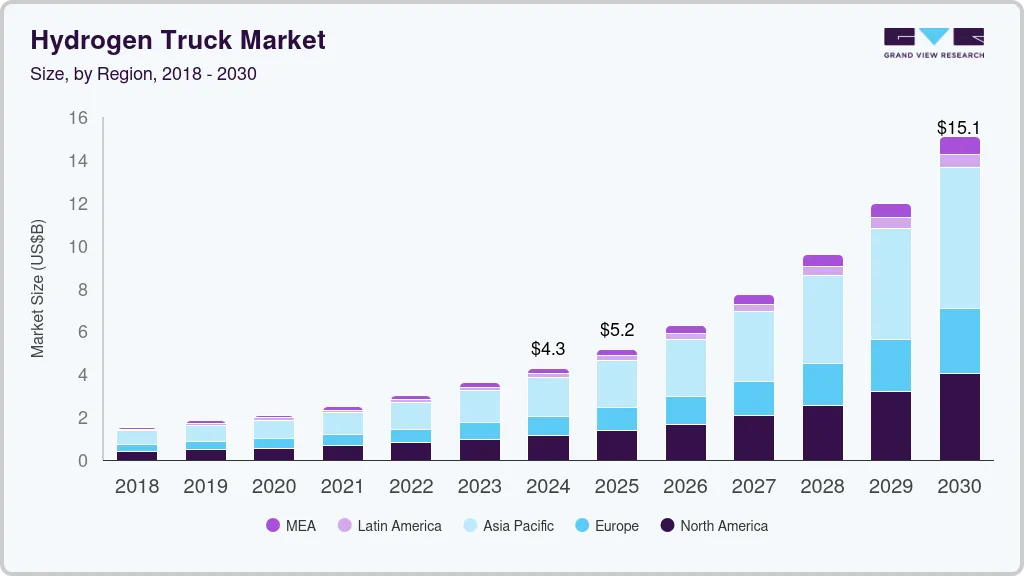

Hydrogen Truck Market growing at a CAGR of 23.9% from 2025 to 2030

The global hydrogen truck market size was estimated at USD 4.3 billion in 2024 and is projected to reach USD 15.10 billion by 2030, growing at a CAGR of 23.9% from 2025 to 2030. Governments and regulatory bodies globally are implementing stringent emissions standards to combat climate change and reduce greenhouse gas (GHG) emissions.

Key Market Trends & Insights

- The Asia Pacific hydrogen trucks industry dominated and accounted for 41.9% share of the global revenue in 2024.

- China hydrogen trucks industry is driven by the integration of hydrogen in broader energy and environmental policies by the Government of China.

- By vehicle, the heavy-duty trucks segment led the market with a global revenue share of 50.22% in 2024.

- By fuel cell technology, the PEMFC segment dominated the market in 2024 in terms of market share.

- By motor power, the upto 200 kW segment is anticipated to witness significant growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.3 Billion

- 2030 Projected Market Size: USD 15.10 Billion

- CAGR (2025-2030): 23.9%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/hydrogen-truck-market-report/request/rs1

Traditional diesel-powered trucks are significant contributors to air pollution, prompting policymakers to promote the adoption of cleaner alternatives. Hydrogen trucks, which produce only water vapor as a byproduct, are emerging as a key solution to meet these regulatory requirements. This regulatory push is a critical factor driving investments in hydrogen truck technology and infrastructure. In addition, the global push towards sustainability is driving businesses to adopt greener transportation solutions. Fleet operators and logistics companies are increasingly prioritizing vehicles that align with their environmental, social, and governance (ESG) goals. Hydrogen trucks offer a zero-emission alternative that meets these objectives, making them an attractive option for companies seeking to reduce their carbon footprint while maintaining operational efficiency.

Technological advancements in hydrogen fuel cell technology have significantly improved the performance, efficiency, and cost-effectiveness of fuel cell systems, addressing challenges such as energy density, durability, and scalability. One key development is the enhancement of energy density, which allows fuel cells to generate more power relative to their size. This has led to the creation of more compact systems that can be integrated into existing truck platforms without compromising payload capacity or operational efficiency. These improvements make hydrogen-powered trucks a more practical alternative to traditional internal combustion engine vehicles in commercial and industrial applications. In September 2023, Nikola Corporation launched its hydrogen fuel cell electric truck at its manufacturing facility in Arizona, U.S. The event featured demonstrations, sustainability discussions, and production line tours. The truck offers a range of up to 500 miles and refueling in approximately 20 minutes.

As countries seek to reduce their reliance on fossil fuels and enhance energy security, hydrogen is emerging as a key component for their energy diversification strategies. Hydrogen trucks not only support the transition to renewable energy but also help mitigate risks associated with fluctuating oil prices and supply chain disruptions. This growing focus on energy diversification is further boosting the demand for hydrogen trucks worldwide.

Fuel Cell Technology Insights

The PEMFC segment dominated the market in 2024 in terms of market share. This significant market share reflects the widespread adoption of PEMFC technology due to its advanced performance characteristics, compatibility with hydrogen fuel, and suitability for various truck applications. PEMFCs are particularly advantageous in heavy-duty and commercial vehicle segments because of their high-power density, quick start-up capabilities, and efficient operation at relatively low temperatures (around 80°C). These attributes make PEMFCs ideal for trucks that need consistent, reliable energy output under diverse operational conditions, including long-haul freight and urban delivery routes. In addition, their ability to deliver zero-emission energy aligns with stringent global regulations promoting cleaner transportation solutions.

The SOFC segment is anticipated to register the fastest growth over the forecast period. One of the key factors propelling the growth of the SOFC segment is its ability to operate at high temperatures (approximately 600-1,000°C), which allows for greater energy conversion efficiency compared to other fuel cell types. This makes SOFCs particularly suitable for applications requiring consistent and prolonged energy output, such as long-haul trucking and heavy-duty operations. In addition, SOFCs are known for their durability and reduced need for frequent maintenance, which appeals to fleet operators looking for cost-effective and reliable energy solutions. Their capability to utilize various fuel sources also makes them a flexible option, especially in regions where hydrogen infrastructure is still developing.

Application Insights

The logistics segment led the market in 2024. Logistics operations, which encompass freight transportation, regional deliveries, and last-mile distribution, demand vehicles capable of handling diverse payloads while ensuring operational efficiency and reliability. Hydrogen trucks have proven to be a game-changer in addressing these requirements, offering benefits that traditional diesel vehicles and other zero-emission alternatives struggle to match.

The municipal segment is expected to witness significant growth in the hydrogen trucks market over the forecast period, driven by increasing government initiatives to reduce carbon emissions, the adoption of clean energy solutions, and the need for efficient and sustainable vehicles in public services. Municipalities are actively transitioning their fleets to zero-emission alternatives to align with environmental goals and enhance operational efficiency in urban and peri-urban areas. In addition, hydrogen-powered trucks are well-suited for various municipal operations, including waste management, road maintenance, and emergency services. Their ability to deliver high performance, even in stop-and-go traffic typical of urban areas, ensures reliability and efficiency in fulfilling municipal duties.

Hydrogen Truck Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.17 billion |

|

Revenue forecast in 2030 |

USD 15.10 billion |

|

Growth Rate |

CAGR of 23.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle, fuel cell technology, range, motor power, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa |

|

Key companies profiled |

Hyundai Motor Company; Nikola Corporation; Daimler Truck AG (Mercedes-Benz Group AG); Volvo Group; TRATON GROUP (MAN Truck & Bus SE); Scania; PACCAR Holding B.V. (DAF); Dongfeng Motor Corporation; Foton International; Yutong International Holding Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |