Procurement Software Market growing at a CAGR of 9.7% from 2025 to 2033

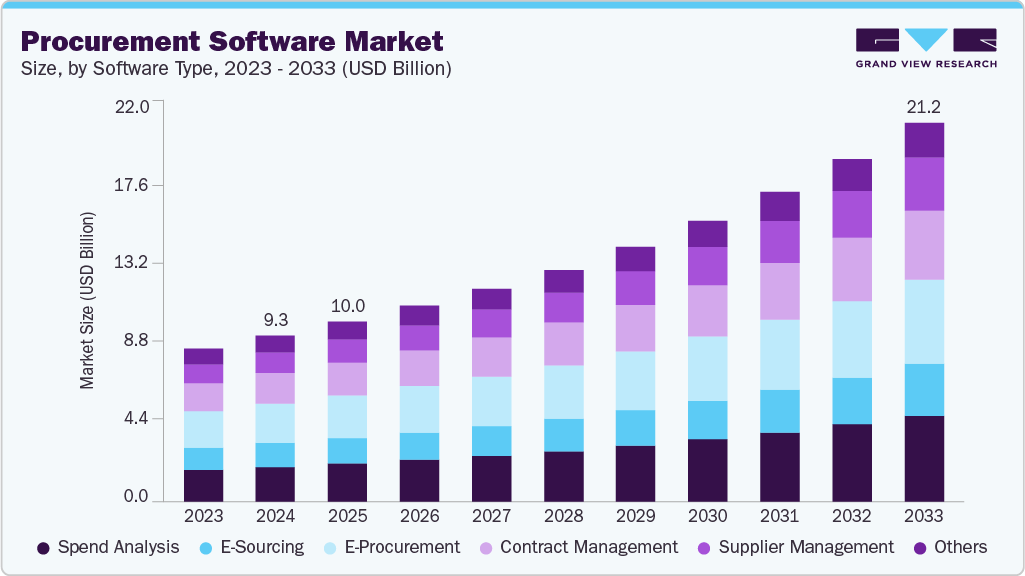

The global procurement software market size was estimated at USD 9,273.6 million in 2024 and is projected to reach USD 21,169.2 million by 2033, growing at a CAGR of 9.7% from 2025 to 2033. It enables organizations to automate, streamline, and control various procurement activities such as sourcing, purchasing, contract management, and supplier collaboration.

Key Market Trends & Insights

- North America procurement software dominated the global market with the largest revenue share of over 35.0% in 2024.

- The procurement software industry in U.S. is expected to grow significantly over the forecast period.

- By Software Type, e-procurement segment led the market and held the largest revenue share of 24.00% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9,273.6 Million

- 2033 Projected Market Size: USD 21,169.2 Million

- CAGR (2025-2033): 9.7%

- North America: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/procurement-software-market-report/request/rs1

As businesses increasingly prioritize cost optimization, compliance, and agility, procurement platforms have evolved from simple transaction-based tools into intelligent, AI-powered ecosystems that deliver real-time visibility and strategic insights. Cloud adoption is a major driver of the procurement software market, as it eliminates the need for costly on-premise infrastructure and offers flexible scalability. Cloud-based procurement platforms allow organizations, particularly SMEs, to access advanced procurement, sourcing, and analytics tools through subscription models, reducing upfront capital investments. These systems also ensure faster deployment, regular updates, and enhanced accessibility across distributed teams. Moreover, cloud-based procurement software seamlessly integrates with enterprise systems such as ERP, CRM, and financial management solutions, ensuring unified data flow and improved decision-making. This integration enhances visibility into spend patterns, supplier performance, and contract compliance key factors for optimizing procurement efficiency. As digital transformation accelerates globally, the shift toward cloud-based models enables organizations to enhance operational agility, streamline workflows, and adapt quickly to changing market conditions while maintaining cost efficiency and security compliance.

The integration of emerging technologies such as Artificial Intelligence (AI) is significantly fueling the growth of the procurement software market. AI enhances automation, enabling intelligent spend analysis, supplier risk assessment, and demand forecasting. Machine learning algorithms analyze large datasets to identify cost-saving opportunities and improve sourcing decisions. Additionally, AI-driven chatbots and virtual assistants streamline purchase requests, approvals, and vendor communication, enhancing efficiency and accuracy. Predictive analytics powered by AI also support proactive procurement strategies by anticipating market fluctuations and supplier performance issues. As organizations prioritize data-driven decision-making, AI integration is transforming procurement from a transactional function into a strategic business enabler.

Vendor fragmentation and lack of standardization present major challenges to procurement software adoption. The market includes numerous providers offering diverse functionalities, pricing models, and integration capabilities, making it difficult for enterprises to identify solutions that align with their procurement maturity and business goals. This fragmentation often results in interoperability issues when integrating with existing enterprise systems. Moreover, managing multiple vendor relationships can increase administrative complexity, create data inconsistencies, and lead to higher operational costs, ultimately hindering the efficiency and scalability of procurement digitalization efforts.

End Use Insights

The manufacturers and automotive segment dominated the market and accounted for the largest revenue share in 2024. Manufacturers and automotive companies often manage highly complex, multi-tiered supply chains that span multiple countries, suppliers, and production stages. Coordinating procurement across these layers involves tracking raw materials, components, logistics, and supplier performance simultaneously. Robust procurement software helps streamline these operations by providing real-time visibility, automated workflows, and data-driven insights, which reduce errors, delays, and operational risks. By centralizing procurement processes, companies can optimize inventory, ensure timely deliveries, and respond quickly to disruptions such as supplier delays or demand fluctuations. This efficiency not only minimizes costs but also strengthens supply chain resilience, supporting consistent production and competitive advantage in global markets.

The retail & e-commerce segment is expected to grow at a significant CAGR during the forecast period. Retailers are embracing digital procurement platforms to modernize and streamline their procurement processes. These platforms automate key activities such as supplier negotiations, contract management, and procurement analytics, reducing manual effort and human errors. Automation accelerates decision-making, ensures compliance, and provides real-time insights into spending patterns, supplier performance, and inventory needs. By integrating digital tools, retailers can optimize costs, improve operational efficiency, and maintain better control over their supply chains. This shift toward digital procurement is essential for staying competitive in the fast-paced retail and e-commerce environment.

Regional Insights

North America dominated the global market with the largest revenue share of 35.48% in 2024. Across North America, businesses are rapidly embracing digital procurement solutions as part of broader digital transformation strategies. These platforms automate routine procurement tasks, streamline supplier management, and enhance data accuracy. By integrating analytics and real-time reporting, organizations can make faster, more informed decisions. The shift to digital procurement improves operational efficiency, reduces manual effort, and supports agile, data-driven purchasing strategies that strengthen competitiveness across diverse industries.

Procurement Software Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 10,057.2 million |

|

Revenue forecast in 2033 |

USD 21,169.2 million |

|

Growth Rate |

CAGR of 9.7% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2033 |

|

Report Application |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Software Type, deployment, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

SAP SE; Proactis Holdings PLC; Epicor Software Corporation; Ginesys (Ginni Systems Limited); Coupa Software Inc.; Zycus Inc.; GT Nexus (Infor Inc.); Ivalua Inc.; Microsoft Corporation; Oracle Corporation; Basware AS; Mercateo AG; GEP Corporation; Jaggaer Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |