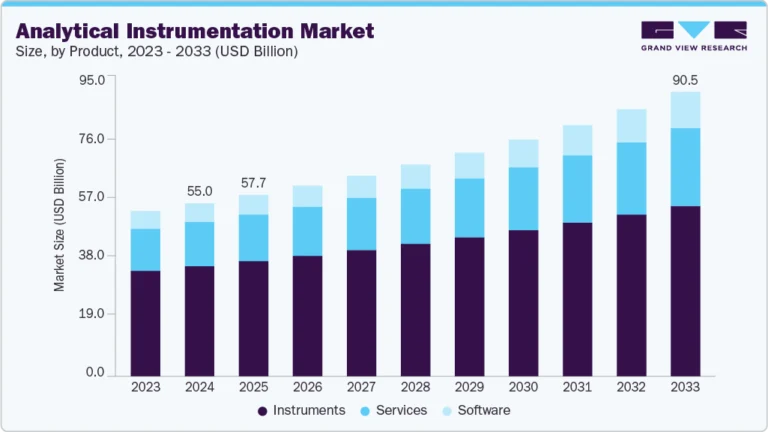

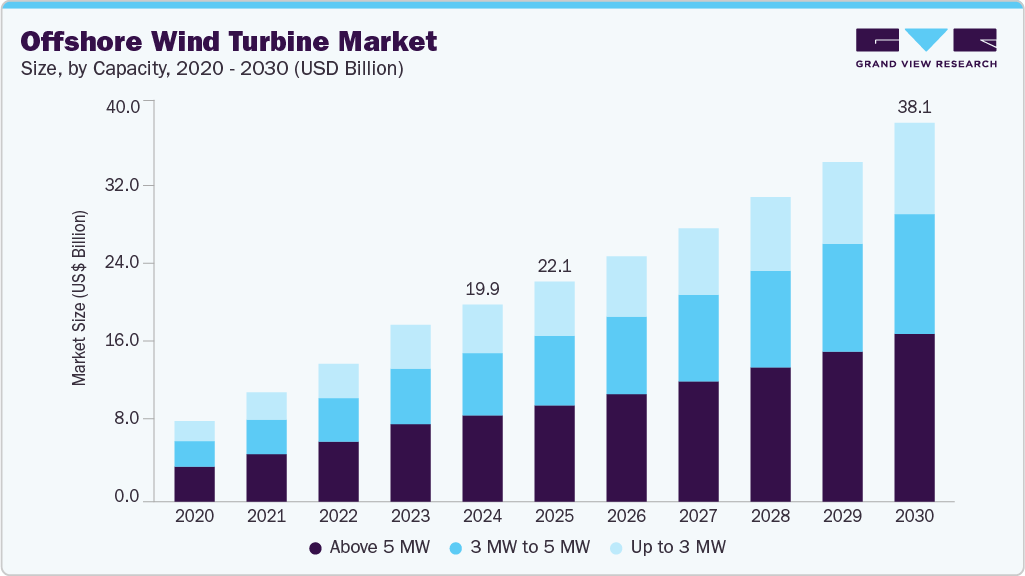

Offshore Wind Turbine Market growing at a CAGR of 11.5% from 2025 to 2030

The global offshore wind turbine market size was estimated at USD 19.85 billion in 2024 and is projected to reach USD 38.13 billion by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The rising interest in reducing the global carbon footprint and increasing demand for renewable energy are the key factors driving the industry growth.

Key Market Trends & Insights

- Europe dominated global offshore wind turbine market and accounted for largest revenue share of over 47.7% in 2024.

- The UK dominates the Europe offshore wind turbines market, with the largest revenue share.

- In terms of capacity segment, the above 5 MW segment dominated the market with the largest revenue share of over 43.8% in 2024.

- In terms of water depth segment, the shallow water (<30 M Depth) segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.85 Billion

- 2030 Projected Market Size: USD 38.13 Billion

- CAGR (2025-2030): 11.5%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/offshore-wind-turbine-market-report/request/rs1

Growing efforts by government agencies and electrical companies to reduce carbon emissions are major market drivers driving market expansion. A key trend in the offshore wind turbine industry is the growing expansion of the broader industrial sector, driven by increasing demand for clean, cost-effective, and reliable electricity. Offshore wind turbines play a vital role in meeting this demand, offering a sustainable energy solution for large communities. As technology advances and costs continue to decline, offshore wind energy is becoming more accessible and economically viable.

The rise in continued research, development, demonstration, and deployment of technologies to eliminate impediments to the widespread installation of turbines is likely to drive the offshore wind turbine market growth during the forecast period. According to a report by the U.S. Department of Energy in June 2024, the National Offshore Wind Research and Development Consortium (NOWRDC) has announced Solicitation 4.0, a USD 10.6 million funding opportunity to advance floating offshore wind technology in the U.S. Advances in turbine design, materials, and manufacturing processes have led to the development of more efficient and reliable turbines. This includes larger turbines with more power, which reduce the cost per megawatt of energy produced.

The increase in the adoption of renewable energy across several emerging countries in regions such as South America, Asia, and Africa is expected to drive market growth in the coming years. Offshore wind turbines are gaining popularity due to their high energy production potential and ability to make a significant contribution to global efforts to reduce greenhouse gas emissions. For instance, according to a report by the Global Wind Energy Council in 2025, the world added a record 117 gigawatts of new wind power capacity, showing strong momentum in clean energy investment. This growth highlights wind power’s increasing role in meeting global energy demand and climate goals.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The offshore wind turbine market is characterized by high innovation due to installation and maintenance innovations, technological advancements, government policies, and investment support. For Instance, in December 2022, Vestas installed its V236-15.0 MW prototype wind turbine at the Østerild National Test Centre in Denmark, marking a significant milestone by producing its first kilowatt-hour of electricity. This achievement initiates an extensive testing and verification program to ensure reliability before commencing full-scale production and commercial deployment.

The market is also characterized by the leading players’ moderate to high levels of mergers and acquisition activity. This is due to increasing demand for renewable energy sources, market consolidation, and global expansion of the product. According to a report by the Institute for Mergers, Acquisitions & Alliances in November 2024, Brookfield Asset Management acquired a 12.45% stake in four of Ørsted’s offshore wind farms in the UK for about $2.28 billion. This move marks Brookfield’s entry into the UK offshore wind market and supports its focus on renewable energy investments.

The global market is also subject to high impact of regulations, due to its multiple layers of regulatory approvals such as federal, state and local regulations to govern the development and operations. For instance, according to a report by Harbinger Land on January 2025, following laws like the National Environmental Policy Act (NEPA) and working with local authorities is crucial. This helps companies get project approvals faster and avoid problems with environmental regulations.

There are a limited number of direct product substitutes for offshore wind turbine. Limited number of direct energy substitute are there for the wind turbine market. While other renewable energy sources like onshore wind, solar, and wave energy are not a direct substitute for the specific advantages offered by offshore wind turbines.

The end use concentration for the offshore wind turbine market is relatively low. Offshore wind turbines are primarily used by utility companies and independent power producers to generate electricity for the grid. This electricity is served to a wide range of end-users, including residential, commercial, and industrial consumers.

Offshore Wind Turbine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.13 billion |

|

Revenue forecast in 2030 |

USD 38.13 billion |

|

Growth Rate |

CAGR of 11.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Capacity, water depth, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Denmark; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

General Electric; Equinor ASA; Iberdrola, S.A.; Mitsubishi Heavy Industries, Ltd; Goldwind; Naval Group; Nordex SE; Siemens; ABB; MODEC, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |