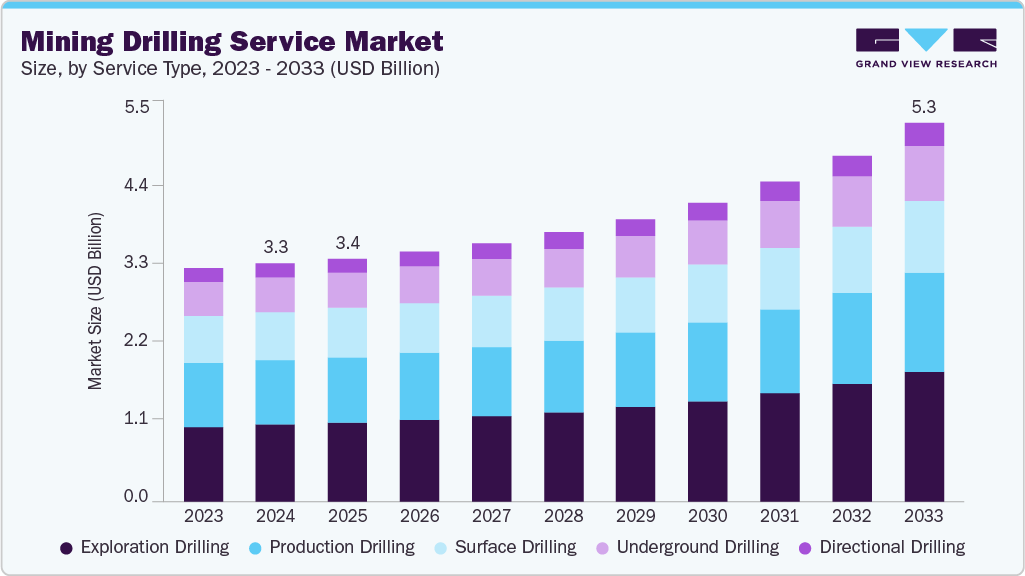

Mining Drilling Service Market growing at a CAGR of 5.7% from 2025 to 2033

The global mining drilling service market size was estimated at USD 3,310.5 million in 2024, and is projected to reach USD 5,270.6 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is witnessing steady growth, driven primarily by the rising global demand for minerals, metals, and rare earth elements essential to industries such as construction, electronics, automotive, and renewable energy.

Key Market Trends & Insights

- The Asia Pacific mining drilling service market accounted for a revenue share of 39.5% share in 2024.

- The mining drilling service industry in China held a dominant position in 2024.

- By service type, the exploration drilling segment accounted for the largest share of 32.4% in 2024.

- By mining method, the open-pit mining segment held the largest market share in 2024.

- By application, the metal mining segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3,310.5 Million

- 2033 Projected Market Size: USD 5,270.6 Million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest Market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/mining-drilling-service-market-report/request/rs1

The increasing consumption of critical materials such as lithium, copper, and cobalt, particularly for battery production and electric vehicles, is fueling exploration and production activities worldwide. In addition, depletion of near-surface ore bodies is prompting mining companies to intensify drilling operations in remote and deeper locations, thereby boosting demand for both surface and underground drilling services. Emerging markets, especially in Latin America, Africa, and the Asia Pacific, are also contributing significantly to the market’s expansion through mineral-rich reserves and favorable mining policies.

Technological advancement is transforming the mining drilling service industry, with automation, data analytics, and remote-control capabilities playing a pivotal role. Integration of real-time monitoring systems, GPS-enabled drilling rigs, and AI-driven predictive maintenance tools is enhancing drilling precision and reducing operational risks. Directional drilling and 3D seismic imaging are becoming more prevalent, particularly in complex geological terrains.

Investment in mining drilling services continues to rise, supported by strong commodity prices and increasing exploration budgets from mining companies. Governments and private firms are ramping up capital expenditure, especially for exploration projects targeting green minerals critical to the energy transition. Strategic collaborations between drilling service providers and technology firms are also on the rise, aimed at integrating advanced solutions into drilling fleets. For instance, partnerships focused on machine guidance systems and digital drilling platforms are enabling service providers to offer more value-added services and improve project outcomes.

The regulatory landscape for mining drilling services is becoming more complex and stringent, particularly with respect to environmental and safety standards. Governments are enforcing stricter permitting requirements, land use policies, and emissions regulations to mitigate the environmental impact of drilling activities. In several regions, local community engagement and social license to operate have become essential components of regulatory compliance. Compliance with international standards such as ISO 14001 for environmental management and adherence to occupational health and safety norms is now a critical expectation for drilling service providers.

Despite positive growth drivers, the mining drilling service industry faces several restraints. Fluctuating commodity prices can lead to inconsistent capital flows, affecting exploration and drilling project timelines. Environmental concerns and opposition from local communities can delay or halt drilling operations. In addition, the high capital cost of advanced drilling equipment and the shortage of skilled labor in remote mining regions can limit service capacity and profitability.

Service Type Insights

The exploration drilling segment accounted for the largest share of 32.4% in 2024. The global surge in demand for critical minerals and metals is fueling the growth of the segment. The clean energy transition fuels an unprecedented need for materials such as lithium, copper, cobalt, nickel, and rare earth elements, which are essential for electric vehicle (EV) batteries, wind turbines, solar panels, and other green technologies. As accessible reserves of these minerals become depleted, mining companies are investing heavily in exploration to discover new deposits.

The directional drilling segment is expected to grow at a significant CAGR during the forecast period. The cost efficiency and operational flexibility drive the segment’s growth. However, initially more capital-intensive, directional drilling can lead to significant long-term cost savings by reducing the need for multiple drill pads, minimizing excavation, and improving ore targeting accuracy. In addition, the ability to drill multiple intersecting holes from a single location offers operational flexibility, enabling better resource estimation and planning. This efficiency is particularly beneficial in exploration and pre-feasibility studies.

Mining Method Insights

The open-pit mining segment held the largest market share of 68.3% in 2024. High productivity and scalability drive the segment’s growth. Open-pit mining enables large-scale extraction of mineral resources, allowing for high-volume output. It facilitates the use of heavy-duty drilling and excavation equipment, which significantly boosts productivity. The method is also highly scalable, making it suitable for both short-term and long-term mining projects. The scalability and ability to handle massive volumes of overburden and ore contribute to sustained demand for surface drilling services such as blast hole drilling and production drilling.

The underground mining segment is expected to grow at the fastest CAGR during the forecast period. Access to high-value and deep ore deposits fuels the market growth. Underground mining enables access to deep-seated and high-value deposits, including gold, copper, zinc, nickel, and rare earth elements. Many of these deposits are located at depths that are impractical or uneconomical to exploit through open-pit mining. With directional and long-hole drilling techniques, underground operations can extract these resources more efficiently. This growing demand for deeper resource extraction directly fuels the need for advanced underground drilling services.

Application Insights

The metal mining segment dominated the mining drilling service market in 2024. The increasing global consumption of base metals such as copper, zinc, nickel, and aluminum, along with precious metals such as gold and silver, is driving the market growth. These metals are critical to infrastructure development, electrical grids, manufacturing, and consumer electronics. In addition, copper and nickel are vital components in electric vehicles (EVs), batteries, and renewable energy systems. As demand surges across industrial and clean energy sectors, mining companies are ramping up drilling efforts to locate and extract new metal reserves, directly boosting the need for drilling services.

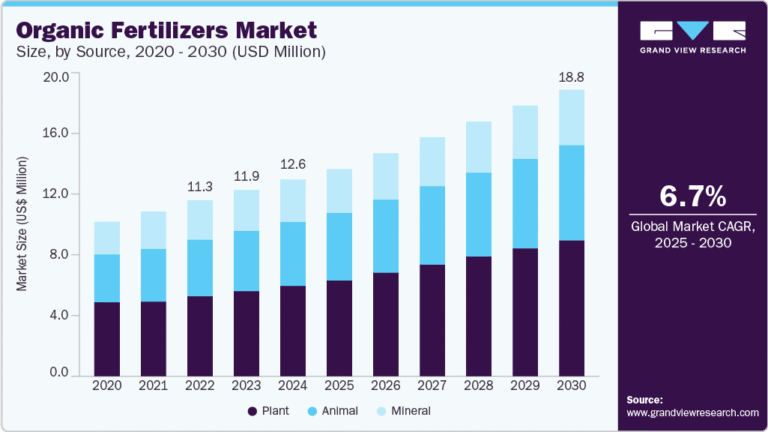

The mineral mining segment is projected to grow at a significant CAGR of 5.8% over the forecast period. The growing global demand for agricultural fertilizers, particularly those based on phosphate and potash, fuels the growth. As the global population increases and food security becomes a central concern, countries are investing in enhancing agricultural productivity. This drives the need for large-scale extraction of fertilizer-grade minerals, requiring exploration and production drilling in mineral-rich areas such as Canada, Russia, and Morocco. Drilling services are essential for discovering new reserves and expanding existing operations to meet the rising demand.

Mining Drilling Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3,386.3 million |

|

Revenue forecast in 2033 |

USD 5,270.6 million |

|

Growth rate |

CAGR of 5.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2033 |

|

Report mining method |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, mining method, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Boart Longyear; Sandvik AB; Ausdrill; Major Drilling; Foraco International SA; Orbit Garant Drilling inc.; Action Drill & Blast; SWICK MINING SERVICES; Drillcon Group; Geodrill |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |