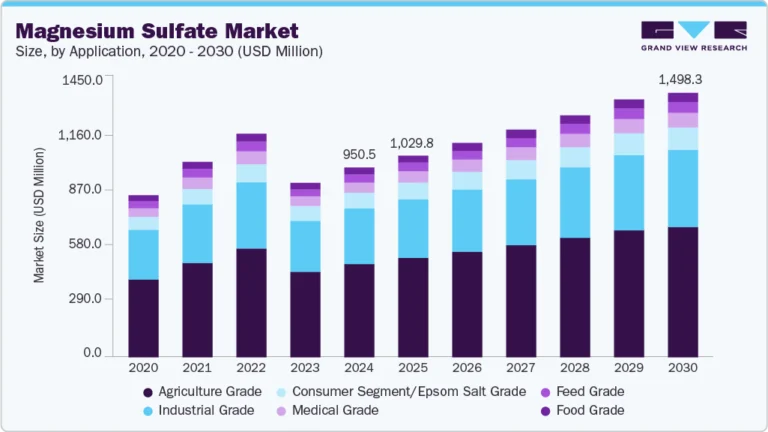

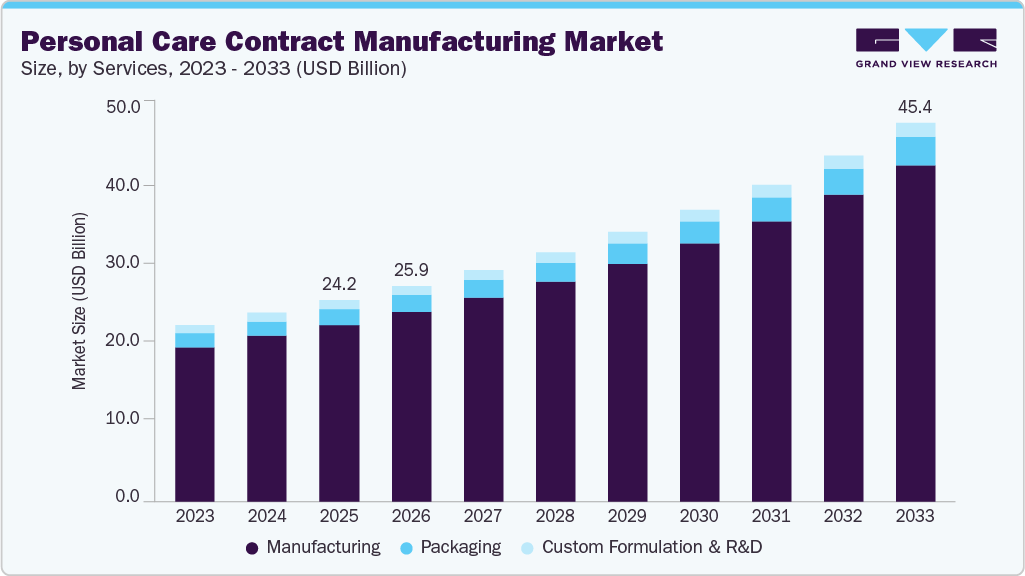

Personal Care Contract Manufacturing Market growing at a CAGR of 8.4% from 2026 to 2033

The global personal care contract manufacturing market size was valued at USD 24.18 billion in 2025 and is projected to reach USD 45.44 billion by 2033, growing at a CAGR of 8.4% from 2026 to 2033. The industry is driven by brands shifting toward asset-light business models to reduce capital investment and operational risk.

Key Market Trends & Insights

- Asia Pacific dominated the personal care contract manufacturing market with the largest revenue share of 38.6% in 2025.

- The personal care contract manufacturing market in the U.S. is expected to grow at a substantial CAGR of 7.3% from 2026 to 2033.

- By services, the manufacturing segment is expected to grow at a considerable CAGR of 8.5% from 2026 to 2033 in terms of revenue.

- By product, the skin care segment is expected to grow at a considerable CAGR of 8.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 24.18 Billion

- 2033 Projected Market Size: USD 45.44 Billion

- CAGR (2026-2033): 8.4%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/personal-care-product-contract-manufacturing-market/request/rs1

Outsourcing manufacturing allows companies to focus on branding, marketing, and distribution while relying on specialized partners for production. Increasing regulatory complexity around safety, quality, and compliance further encourages brands to work with experienced contract manufacturers.

Another key driver is rising demand for innovation, customization, and rapid product launches across skin care, hair care, and color cosmetics. Contract manufacturers with strong R&D capabilities help brands develop differentiated formulations, clean-label products, and premium offerings. Growing consumer preference for sustainable, natural, and personalized products is accelerating the outsourcing of formulation and packaging expertise. Additionally, the scalability offered by contract manufacturers supports brands in managing fluctuating demand and global expansion efficiently.

Market Concentration & Characteristics

The market is moderately fragmented, with a mix of large multinational CDMOs and numerous small to mid-sized regional players. Leading companies hold strong positions due to their global manufacturing networks, regulatory expertise, and ability to serve large brand portfolios. However, no single player dominates the market, as brands often diversify suppliers to reduce risk and improve flexibility. Continuous entry of niche formulators and specialty manufacturers keeps competitive intensity high across regions.

Innovation is a defining characteristic of the personal care contract manufacturing industry, driven by frequent product launches and evolving consumer preferences. Contract manufacturers invest heavily in formulation science, active ingredients, and multifunctional products to support brand differentiation. Demand for clean-label, vegan, and science-backed formulations has accelerated innovation cycles. Advanced testing, rapid prototyping, and flexible production lines further strengthen innovation intensity across the industry.

Regulatory requirements significantly influence operations, covering ingredient safety, labeling, and manufacturing practices across regions. Contract manufacturers must comply with strict standards such as GMP, REACH, and cosmetic safety regulations, increasing the value of experienced partners. Compliance costs and frequent regulatory updates raise entry barriers for smaller players. As a result, brands increasingly rely on compliant manufacturers to minimize regulatory risk and delays.

End-user concentration in this market is moderate, with demand coming from a broad mix of global brands, private-label companies, and emerging indie players. Large multinational brands account for higher volumes, but smaller brands contribute significantly through frequent, small-batch orders. This diversified customer base reduces dependency on any single client. At the same time, rising private-label penetration is reshaping order patterns and production planning.

Drivers, Opportunities & Restraints

The personal care contract manufacturing industry is driven by brands adopting outsourcing to reduce capital costs and improve operational flexibility. Growing demand for fast product launches across skin care, hair care, and cosmetics supports reliance on experienced manufacturers. The rising complexity of formulations and compliance requirements further pushes brands toward specialized partners. Expansion of indie and private-label brands is steadily increasing outsourced production volumes.

Strong opportunities are emerging from demand for clean, natural, and sustainable personal care products. Contract manufacturers that offer advanced R&D, eco-friendly packaging, and customization can capture higher-value projects. Growth of direct-to-consumer and niche beauty brands creates steady demand for small-batch and flexible manufacturing. Expansion into emerging markets also opens long-term opportunities for capacity and Services diversification.

The market faces restraints from rising raw material prices and supply-chain volatility, which pressure margins for contract manufacturers. High regulatory compliance costs can limit participation by smaller players and slow capacity expansion. Intense price competition among manufacturers reduces profitability, especially in commoditized product categories. Dependence on brand owners for volume commitments also exposes manufacturers to demand fluctuations.

Personal Care Contract Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 25.88 billion |

|

Revenue forecast in 2033 |

USD 45.44 billion |

|

Growth rate |

CAGR of 8.4% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Services, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; Japan; India; South Korea; Australia; Argentina; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

Albea; Accupac; Knowlton Development Corporation; Vi-Jon; MAESA; HatchBeauty Brands, LLC; Fareva; Colep; Intercos S.p.A; Oxygen Development; Voyant Beauty; Mansfield-King; NuWorld; Biogenesis; Bright International; Eco Lips |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |