Environmental Testing Market growing at a CAGR of 7.3% from 2026 to 2033

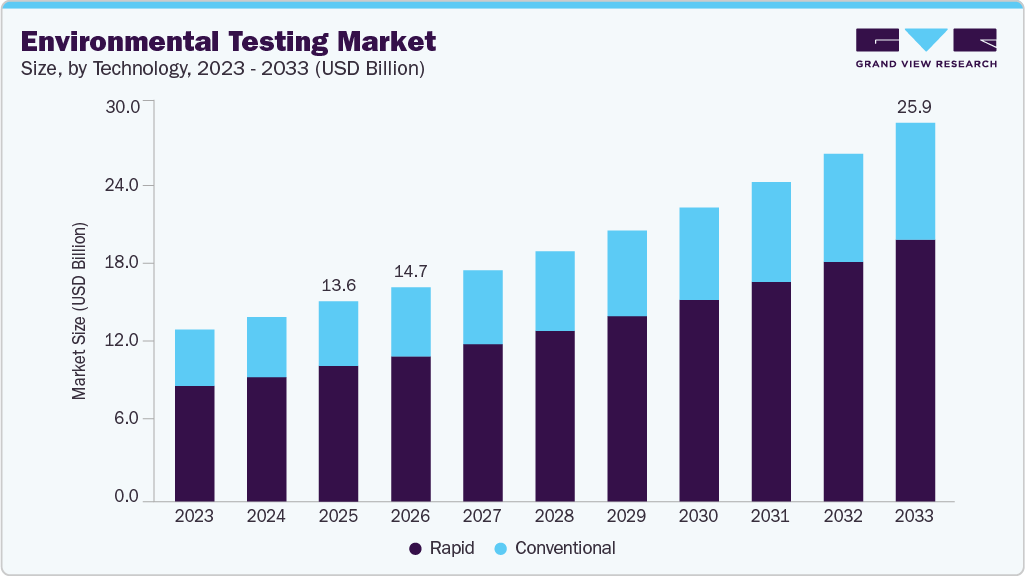

The global environmental testing market size was estimated at USD 13,612.7 million in 2025 and is projected to reach USD 25,977.3 million by 2033, growing at a CAGR of 7.3% from 2026 to 2033. Governments worldwide are imposing stricter environmental standards for air, water, soil, and waste to curb pollution and protect public health, prompting more frequent and comprehensive testing across industries.

Key Market Trends & Insights

- Asia Pacific dominated the environmental testing market with the largest revenue share of 32.6% in 2025.

- By technology, conventional is expected to grow at a considerable CAGR of 6.7% from 2026 to 2033 in terms of revenue.

- By sample, the air segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

- By target tested, biological is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

- By end use, the environmental testing laboratories segment is expected to grow at a considerable CAGR of 7.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 13,612.7 Million

- 2033 Projected Market Size: USD 25,977.3 Million

- CAGR (2026-2033): 7.3%

- Asia Pacific: Largest market in 2025

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/environmental-testing-market-report/request/rs1

This regulatory emphasis, coupled with increased public awareness of pollution and sustainability, is boosting demand for environmental testing services across industrial, municipal, and commercial sectors. Technological advancements, such as rapid testing methods, real‑time monitoring systems, AI‑enhanced analytics, and portable field diagnostics, are enhancing efficiency and broadening applications, further stimulating market expansion. Moreover, rapid industrialization, urbanization, and concerns over water and soil contamination are compelling companies to invest in environmental assessments to ensure compliance and support sustainability initiatives.

Market Concentration & Characteristics

The environmental testing industry is moderately fragmented due to the presence of a mix of large multinational testing companies and numerous small to mid-sized regional laboratories. While major players compete through advanced technologies, broad service portfolios, and global reach, regional firms remain competitive by offering cost-effective, localized, and specialized testing services. This combination prevents market consolidation while maintaining healthy competition across regions and application segments.

The environmental testing industry demonstrates a moderate to high degree of innovation driven by advancements in automation, digital monitoring, AI-based data analysis, and rapid testing technologies. These innovations improve accuracy, reduce turnaround time, and enable real-time environmental monitoring. The adoption of portable testing devices and advanced laboratory instrumentation allows service providers to meet complex regulatory requirements and deliver more efficient, data-driven environmental assessment solutions.

Merger and acquisition activity in the environmental testing industry is steadily increasing as large players seek to expand geographic reach, enhance service portfolios, and strengthen technical capabilities. Leading companies are acquiring regional and specialized laboratories to gain local expertise and scale operations. These strategic consolidations help firms improve operational efficiency, meet growing regulatory demand, and maintain competitive advantage in a moderately fragmented market.

Environmental regulations play a critical role in shaping the environmental testing industry by mandating strict monitoring of air, water, soil, and waste emissions. Governments worldwide continue to tighten environmental standards to protect public health and ecosystems. Compliance requirements force industries and municipalities to conduct frequent testing, driving sustained demand for environmental testing services and encouraging investment in advanced analytical technologies.

Environmental Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 14,680.4 million |

|

Revenue forecast in 2033 |

USD 25,977.3 million |

|

Growth rate |

CAGR of 7.3% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, sample, target-tested, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

SGA SA; Eurofins Scientific; Intertek Group plc; Bureau Veritas; ALS Limited; TUV SUD; Asure Quality; Merieux NutriSciences; Microbac Laboratories, Inc.; R J Hill Laboratories Limited; Symbio Laboratories; Environmental Resources Management (ERM); RSK Group Limited; TestAmerica Laboratories, Inc.; UL Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |