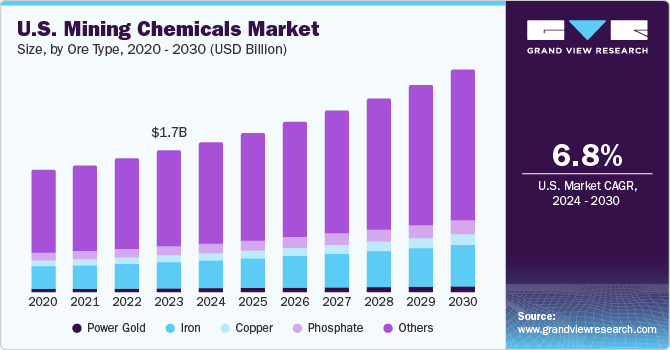

Mining Chemicals Market growing at a CAGR of 6.4% from 2024 to 2030

The global mining chemicals market size was estimated at USD 11.44 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. This growth is attributable to a growing demand for minerals in various end-user industries such as electronics, medical equipment, paints & coating, and others.

Key Market Trends & Insights

- North America dominated the global mining chemicals market with the largest revenue share in 2023.

- The mining chemicals market in the U.S. led the North America market and held the largest revenue share in 2023.

- By ore type, the iron segment led the market, holding the largest revenue share of 18.9% in 2023.

- By application, the explosives and drilling segment held the dominant position in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.44 Billion

- 2030 Projected Market Size: USD 17.54 Billion

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/mining-chemicals-market/request/rs1

According to a World Bank article published in March 2020, the production of minerals such as graphite, cobalt, and lithium will grow by 500% by 2050 due to the growing demand for clean energy technologies. Thus, increasing demand for minerals boosts the demand for mining chemicals in the market.

The demand for the product in North America is primarily driven by the increasing mining operations and mineral production in the U.S. and Canada. The coal industry is the key end-user of the product as it is highly reliable on coal for generating electricity. In the U.S., over 19.3% of electricity was generated from coal in 2020, as per the data by the U.S. Energy Information Administration.

In the coming years, digital mines are likely to utilize evolving digital technologies such as the Industrial Internet of Things (IIoT). For instance, purposively placed sensors that are connected to the internet can be used for the collection of data from mines in real time. They help in improving the efficiency of operations, reduce costs, and enhance safety. They also help in eliminating injuries and fatalities caused by high-energy environments. These factors are expected to create new opportunities for the mining industry over the forecast period.

Mining chemicals are manufactured using raw materials such as nitric acid, mercury, sulfuric acid, cyanide, lead, and uranium. These chemicals are highly harmful and toxic to humans and the environment. As a result, they are regulated by several regulations, including the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), the Industrial Chemicals Act, and the OSPAR Convention.

Market Concentration & Characteristics

Companies such as BASF SE, Ashland Inc., AECI, and Dow dominate the market due to their global presence and extensive product portfolio catering to each application market. The market is highly competitive due to the presence of multinationals that are engaged in constant expansion and research & development activities. In January 2023, BASF SE and Eramet announced an agreement worth USD 2.6 billion to establish a facility in Indonesia for processing nickel, specifically for use in electric vehicle (EV) batteries.

Companies such as BASF SE, Clariant AG, and Ashland Inc. have very diverse product portfolios. These companies have well-established brands, such as Rheomax, Derakane, and FLOTIGAM 5806, which have a prominent presence in the market. A majority of the players are integrated across the value chain to gain a competitive edge in the market. For instance, Clariant AG manufactures iron and copper ores for various end-use industries such as agriculture & animal feed, automotive & transportation, coatings, building & construction, paints, inks, and consumer goods.

Key players in the industry are focused on increasing the production of their core product portfolios, including high-quality mining chemicals, to gain significant market shares. The discovery of new chemicals and technological advancements have led to the development of eco-friendly products, which are used in green manufacturing processes of production. Arkema, SNF Flomin, and ArrMaz are some of the players in the market that offer raw materials for the production of such products.

Mining Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12.08 billion |

|

Revenue forecast in 2030 |

USD 17.54 billion |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 – 2022 |

|

Forecast period |

2024 – 2030 |

|

Report updated |

July 2024 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ore type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Russia; Italy; China; India; Japan; South Korea; Argentina; Peru; Chile; Columbia; Saudi Arabia; Africa; South Africa; Ghana; Morocco; DRC; Zambia; Zimbabwe; Tanzania; Mali; Ivory Coast; Sudan |

|

Key companies profiled |

AECI Mining Chemicals; BASF SE; Ashland; Dow; Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD; Cytec Solvay Group; Arkema; Clariant; Nowata; Kemira; Shell Chemicals; Quaker Chemical Corporation; Akzo Nobel N.V.; Solenis; Sasol |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |