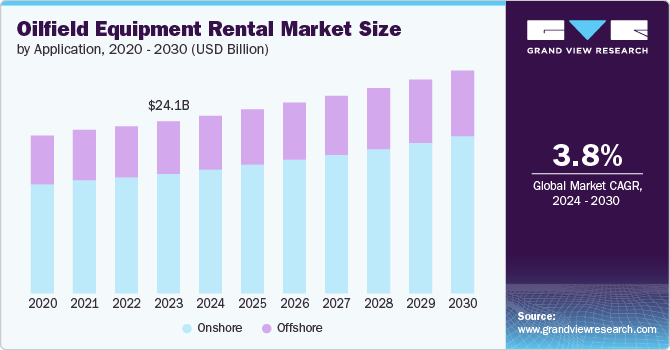

Oilfield Equipment Rental Market growing at a CAGR of 3.8% from 2024 to 2030

The global oilfield equipment rental market size was estimated at USD 24.13 billion in 2023 and is projected to reach USD 31.22 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030. Rising global investments in oil & gas exploration and production (E&P) activities are a major driver for the market. Crude oil and natural gas demand is increasing, leading operators to ramp up drilling and production.

Key Market Trends & Insights

- The North America oilfield equipment rental market is expected to dominate the global market, driven by rising hydrocarbon production.

- The U.S. is estimated to grow at a significant CAGR of 3.8% over the forecast period.

- Based on application, the onshore application segment led the market and accounted for 69.5% of the global revenue share in 2023.

- Based on type, the drilling equipment type segment led the market and accounted for 48.2% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 24.13 Billion

- 2030 Projected Market USD 31.22 Billion

- CAGR (2024-2030): 3.8%

- North America: Largest market in 2023

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/oilfield-equipment-rental-market-report/request/rs1

Moreover, oil & gas operators increasingly favor rental over ownership of oilfield equipment. Renting provides flexibility, reduces upfront capital expenditure, and transfers maintenance responsibilities to the rental provider. Furthermore, oilfield equipment is becoming more advanced, enabling economical exploration of unconventional and deep hydrocarbon resources like shale, tight gas, and heavy oil. Technologies like horizontal drilling, deep drilling, and RFID circulation subs are being widely adopted. These aforementioned factors are anticipated to drive the demand for the market.

Moreover, oil & gas operators increasingly favor rental over ownership of oilfield equipment. Renting provides flexibility, reduces upfront capital expenditure, and transfers maintenance responsibilities to the rental provider. Furthermore, oilfield equipment is becoming more advanced, enabling economical exploration of unconventional and deep hydrocarbon resources like shale, tight gas, and heavy oil. Technologies like horizontal drilling, deep drilling, and RFID circulation subs are being widely adopted. These aforementioned factors are anticipated to drive the demand for the market.

Drivers, Opportunities & Restraints

The oilfield equipment rental market is driven by increasing exploration and production (E&P) activities, technological advancements enabling economical extraction of unconventional resources like shale oil and gas using horizontal drilling and deep drilling techniques, and a shift towards rental models by operators to reduce upfront capital expenditure and gain flexibility. For example, the shale oil and gas boom in North America has fueled extensive drilling activities, creating significant demand for rental equipment. For instance, according to the Energy Institute Statistical Review of World Energy 2024 report oil production in North America increased from 1,109.6 million tons in 2019 to 1,207.5 million tons in 2023.

Growth opportunities exist in regions such as North America, Europe, and Asia Pacific. North America is expected to be the largest market due to the shale boom. Europe has major producers like Norway, Russia, Germany, and the UK investing in drilling to meet demand. Asia Pacific has enormous growth potential driven by infrastructure projects, energy demand, and population growth, with governments keen to reduce oil and gas imports. Deepwater drilling is also expanding in regions like Brazil, Norway, and the UK, enabled by subsea technology advancements.

Volatility in global oil prices impacts E&P investments, with prolonged low prices leading to project delays and cancellations. The increasing complexity of drilling, with the need for specialized equipment for unconventional reserves, puts additional strain on rental providers as demand varies by well. For example, the search for new reserves and the depletion of existing ones has necessitated the use of new extraction techniques and increased drilling complexity.

Oilfield Equipment Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 24.89 billion |

|

Revenue forecast in 2030 |

USD 31.22 billion |

|

Growth Rate |

CAGR of 3.8% from 2024 to 2030 |

|

Actual data |

2018 – 2023 |

|

Forecast period |

2024 – 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Russia; Norway; UK; Netherlands; Germany; Japan, China; India; Indonesia; Brazil; Argentina; Venezuela; Kuwait; Saudi Arabia; UAE; Nigeria; Iraq; Qatar |

|

Key companies profiled |

Schlumberger; Baker Hughes; GE company; Halliburton; Weatherford; Technip; Superior Energy Services; Transocean; BJ Services; Petrofac; COSL – China Oilfield Services Limited; Worley; McDermott International Inc.; Bechtel Corporation; National Oilwell Varco |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |