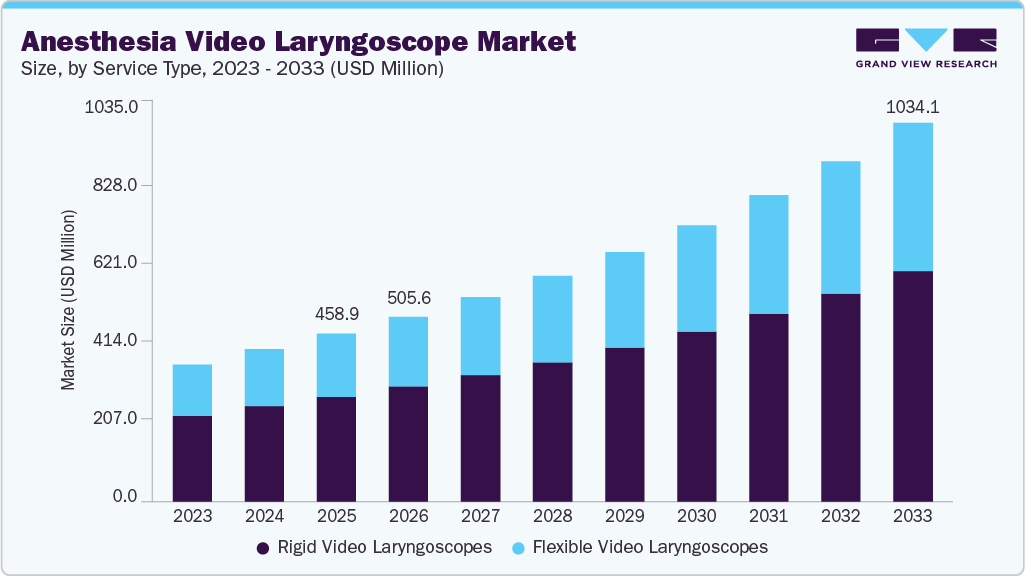

Anesthesia Video Laryngoscope Market growing at a CAGR of 10.76% from 2026 to 2033

The global anesthesia video laryngoscope market size was estimated at USD 458.93 million in 2025 and is projected to reach USD 1,034.14 million by 2033, growing at a CAGR of 10.76% from 2026 to 2033. The rising awareness of patient safety, advances in minimally invasive airway management, the increasing availability of user-friendly visualization devices, and the growing prevalence of obesity, which is associated with higher rates of complex airway management, are significant factors driving market growth.

Key Market Trends & Insights

- The North America anesthesia video laryngoscope market dominated the global market in 2025, accounting for the largest revenue share of 40.22%.

- The U.S. dominated the anesthesia video laryngoscope market in the North America region in 2025.

- By product, the rigid video laryngoscopes segment dominated the market, accounting for over 60.00% of revenue in 2025.

- By usage model, the reusable video laryngoscopes segment dominated the market, accounting for over 65% of revenue in 2025.

- By channel, the non-channeled video laryngoscopes segment dominated the market, accounting for over 55% of revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 458.93 Million

- 2033 Projected Market Size: USD 1,034.14 Million

- CAGR (2026-2033): 10.76%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/anesthesia-video-laryngoscope-market-report/request/rs1

According to WHO article published in December 2025, with about one in eight people worldwide are affected by obesity. This rising prevalence complicates anesthesia management by increasing the risk of difficult intubations. To address these challenges, healthcare providers are increasingly adopting anesthesia video laryngoscopes, which offer enhanced airway visualization, safer intubation, and more reliable airway control during surgical and emergency procedures.

Anesthesia video laryngoscopes improve procedural efficiency by minimizing repeat intubation attempts. Fewer attempts reduce the risk of hypoxia and airway trauma while saving critical operating room time, particularly in high-volume surgical centers where throughput and scheduling efficiency are essential. By improving first-attempt success rates, anesthesia teams can reduce delays between cases, optimize staffing utilization, and enhance overall operating room productivity.

The increasing prevalence of obesity, particularly class II and class III obesity, has contributed to a rise in tracheal intubations and a higher risk of airway-related complications during anesthesia. According to an NCBI article published in June 2025, a systematic review and meta-analysis of 10 randomized controlled trials involving 955 adult patients showed that video laryngoscopy significantly reduced the risk of failed tracheal intubation and hypoxaemia during airway management, while also lowering first-attempt intubation failure compared with direct laryngoscopy. Improved glottic visualization further eased the intubation process and reduced procedure-related stress, highlighting the enhanced safety and effectiveness of video laryngoscopes in high-risk obese patients and positioning them as a preferred airway management solution in anesthesia.

The growing burden of overweight and obesity across younger populations further supports the long-term need for effective airway management solutions in both pediatric and adult care settings. The following table highlights the global prevalence of overweight and obesity among children and adolescents.

Market Concentration & Characteristics

The anesthesia video laryngoscope market continues to benefit from a high degree of technological innovation, as manufacturers introduce advanced systems with slimmer blades, improved imaging, and eco-friendly features that enhance ease of use and performance. For instance, in April 2025, KARL STORZ launched the Slimline C-MAC S video laryngoscope with a slimmer profile, crystal-clear imaging, and reduced material use, representing a user-focused evolution of traditional designs.

The anesthesia video laryngoscope market is characterized by low merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for anesthesia video laryngoscopes to maintain a competitive edge.Regulatory standards and oversight significantly influence the anesthesia video laryngoscope market by ensuring the quality, safety, and performance of devices used for airway visualization and intubation. In the U.S., electrically powered video laryngoscopes and related systems must meet recognized medical device standards covering components such as the handle, rigid blade, light source, camera, and image display, reflecting ongoing updates to consensus regulatory requirements for these devices.

Anesthesia Video Laryngoscope Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 505.60 million |

|

Revenue forecast in 2033 |

USD 1,034.14 million |

|

Growth rate |

CAGR of 10.76% from 2026 to 2033 |

|

Actual data |

2021 – 2025 |

|

Forecast data |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, usage model, channel, device, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Medtronic; Karl Storz SE & Co. KG; Ambu A/S; Teleflex Incorporated; NIHON KOHDEN CORPORATION; Shenzhen Chemira Medpharma Co., Ltd.; Flexicare (Group) Limited; Verathon Inc. (Roper Technologies, Inc.); Infinium Medical; Tuoren Medical Device India Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |