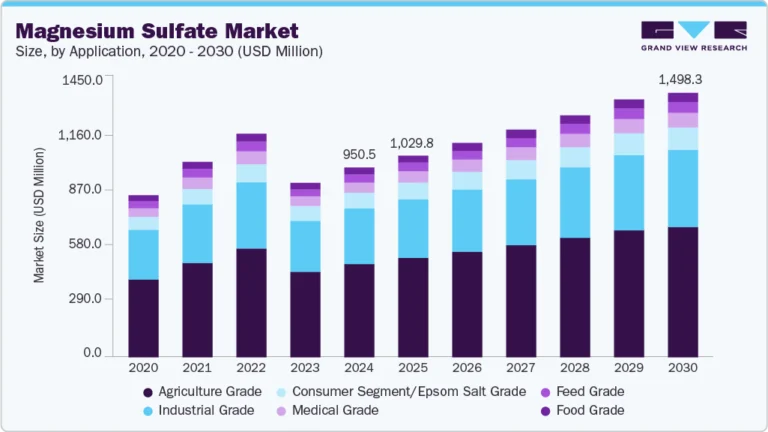

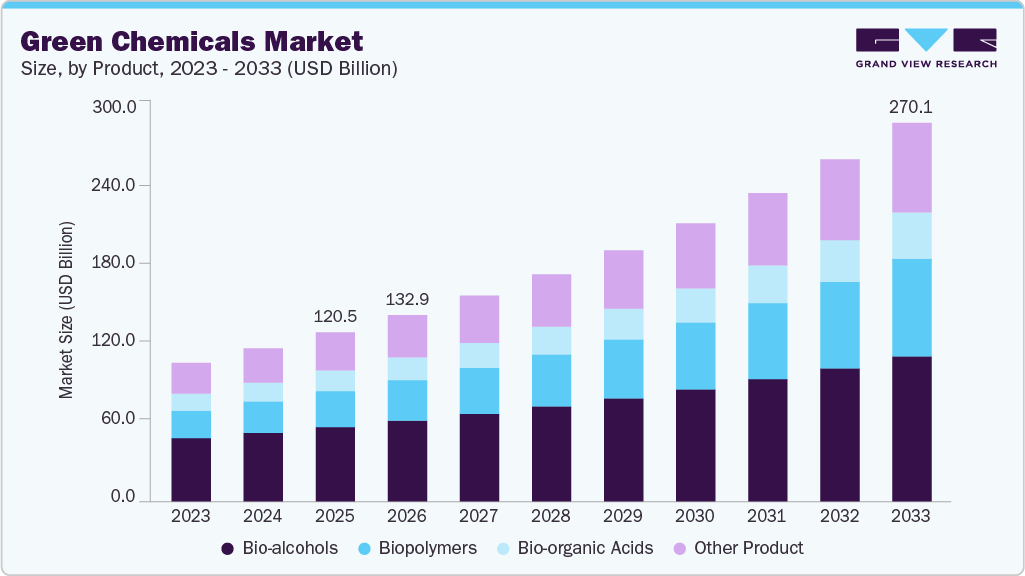

Green Chemicals Market growing at a CAGR of 10.7% from 2026 to 2033

The global green chemicals market size was estimated at USD 120.51 billion in 2025 and is projected to reach USD 270.13 billion by 2033, growing at a CAGR of 10.7% from 2026 to 2033. An increasing global focus on sustainability and the adoption of circular economy practices is driving market growth.

Key Market Trends & Insights

- Asia Pacific dominated the green chemicals market with the largest revenue share of 30.8% in 2025.

- The green chemicals market in China held a substantial share of 41.6% in the Asia Pacific market in 2025.

- By product, bio-alcohols green chemicals, dominated the market with a revenue share of 44.0% in 2025.

- By application, packaging dominated the green chemicals market with a revenue share of 26.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 120.51 Billion

- 2033 Projected Market Size: USD 270.13 Billion

- CAGR (2026-2033): 10.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/green-chemicals-market-report/request/rs1

Governments, industries, and consumers are collectively pushing for the reduction of hazardous chemicals, carbon emissions, and dependence on fossil-based raw materials. This transition is further reinforced by stringent environmental regulations, corporate ESG (Environmental, Social, and Governance) initiatives, and rising demand for safer, biodegradable, and renewable alternatives across various sectors.

A key application driving the market growth is packaging. With increasing pressure to reduce plastic waste, particularly single-use plastics, industries are rapidly adopting bio-based polymers and biodegradable materials derived from green chemicals for packaging solutions. Companies are leveraging materials such as polylactic acid (PLA), starch blends, and bio-polyethylene (Bio-PE) to produce compostable films, containers, and flexible packaging. Leading food and beverage brands are partnering with green chemical producers to support circular economy goals and comply with regulations like the EU Single-Use Plastics Directive and extended producer responsibility frameworks in countries such as India, Japan, and Canada. Consequently, packaging continues to be one of the most dynamic and commercially impactful applications in the market.

In the textile industry, bio-organic acids, particularly polycarboxylic acids, are increasingly used as sustainable alternatives to conventional harmful chemicals. They play vital roles in cross-linking fibers, enhancing dimensional stability, dye fixation, antimicrobial finishing, and improving fabric lightfastness. Their eco-friendly, biodegradable, and non-toxic properties make them ideal for environmentally responsible textile processing. In addition, these acids support waste paint and coatings recycling and contribute to circular manufacturing practices, helping textile industries achieve sustainability targets.

The fuel sector is also witnessing growth driven by technologies that convert non-edible bio feedstocks and waste into sustainable fuels and chemicals. These innovations aim to reduce greenhouse gas emissions, enhance process efficiency, and replace petroleum-based products with renewable alternatives. Advanced pretreatment and supercritical processing techniques enable the use of low-quality oils and fats, minimizing impurities and environmental impact. Furthermore, upcycling industrial byproducts into valuable fuel inputs supports circular economy goals and promotes cleaner, more sustainable energy solutions. These developments align with global efforts to lower carbon intensity and advance eco-friendly fuel production.

Market Concentration & Characteristics

The green chemicals industry is moderately fragmented, with market leadership concentrated among several large, vertically integrated chemical manufacturers. These key players leverage economies of scale, internal sourcing of bio-based raw materials, including natural oils, sugars, and bio-based acids, and extensive global distribution networks to maintain a competitive advantage. Their integration across the green chemical value chain, from feedstock processing to the production of bio-alcohols, biopolymers, and bio-based solvents, enables enhanced cost efficiency, consistent product quality, and reliable supply. This strategic positioning allows them to effectively cater to a wide range of end-use industries, including agriculture, automotive, packaging, textiles, and construction, reinforcing their market influence and supporting sustainable industry adoption.

At the same time, emerging players in the Asia-Pacific and Middle East are steadily expanding their presence in the green chemicals industry by leveraging abundant renewable feedstocks, cost-efficient energy infrastructure, and growing domestic demand for sustainable alternatives. These regional producers are supported by targeted investments in biopolymer, bio-organic acid, and bio-alcohol manufacturing hubs strategically located within economic and industrial corridors.

Green Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2026 |

USD 132.96 billion |

|

Revenue forecast in 2033 |

USD 270.13 billion |

|

Growth rate |

CAGR of 10.7% from 2026 to 2033 |

|

Base year for estimation |

2025 |

|

Historical data |

2018 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; MEA; Latin America |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina |

|

Key companies profiled |

Dow Chemical; ADM; BASF SE; Cargill, Inc.; Corbion; Merck KGaA; Syensqo; Solugen; Evonik; DUDECHEM GmbH; Mitsubishi Chemical; DuPont |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |