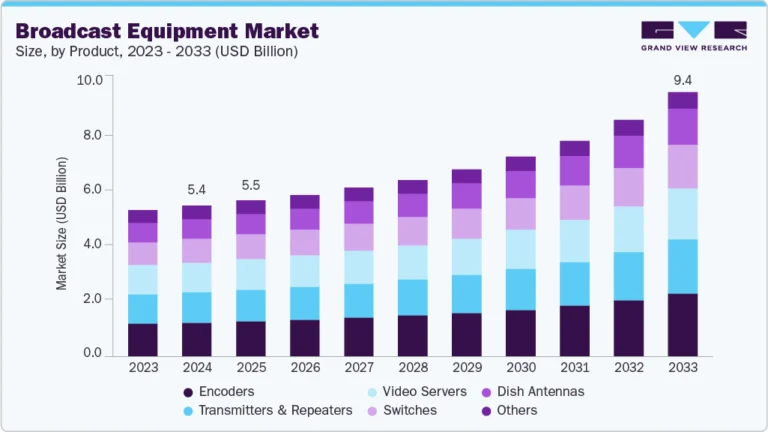

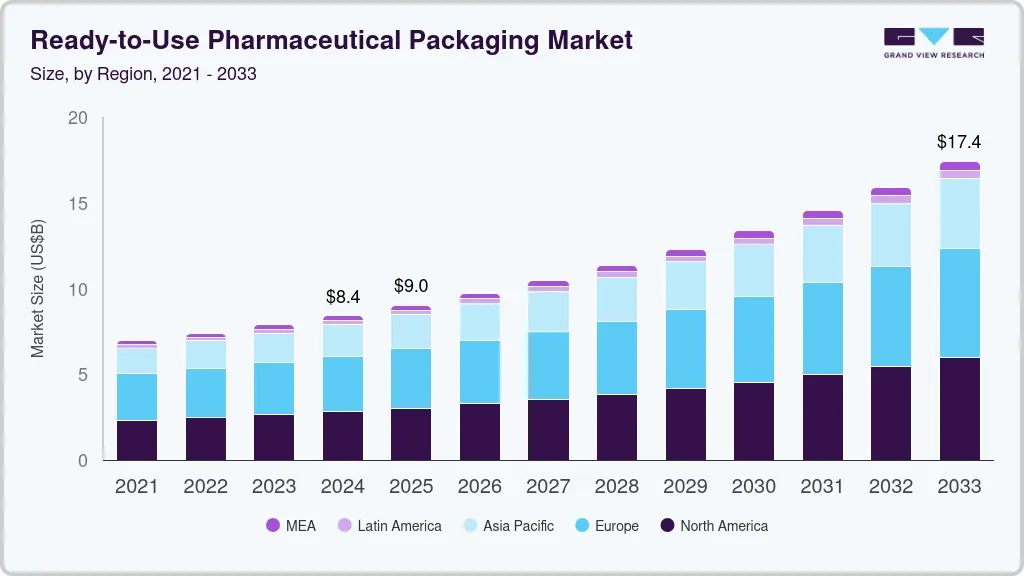

Ready-to-Use Pharmaceutical Packaging Market growing at a CAGR of 8.6% from 2025 to 2033

The global ready-to-use pharmaceutical packaging market size was estimated at USD 8.41 billion in 2024 and is projected to reach USD 17.42 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. Another strong driver is the growing need for faster drug delivery to market, which pushes companies to adopt RTU packaging to reduce time spent on in-house sterilization and preparation.

Key Market Trends & Insights

- North America dominated the global ready-to-use pharmaceutical packaging market and accounted for the largest revenue share of 33.60% in 2024.

- Based on container type, the sterile vials segment dominated the market across the container type segmentation in terms of revenue, accounting for a market share of 49.90% in 2024.

- Based on end use, the glass segment dominated the market across the end use segmentation in terms of revenue, accounting for a market share of 56.12% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.41 Billion

- 2033 Projected Market Size: USD 17.42 Billion

- CAGR (2025-2033): 8.6%

- North America: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/ready-to-use-pharmaceutical-packaging-market-report/request/rs1

This helps streamline production and meet rising global demand more efficiently. The demand for RFID-enabled labels, time-temperature indicators, and real-time monitoring solutions is accelerating as pharmaceutical companies push for higher drug compliance and safety levels in complex supply chains.

This digital convergence is reshaping packaging as a functional asset and transforming it into a data-driven tool for clinical feedback, aligning closely with the broader movement toward connected health ecosystems.

Drivers, Opportunities & Restraints

A key driver fueling the growth of the RTU pharmaceutical packaging market is the rising shift of pharmaceutical production from large centralized facilities to decentralized, agile, and outsourced manufacturing environments. With contract development and manufacturing organizations (CDMOs) playing an increasingly pivotal role, pharmaceutical firms opt for pre-sterilized, ready-to-fill packaging formats that streamline operational efficiency, reduce regulatory complexity, and minimize contamination risks. RTU systems enable faster batch release and minimize downtime, making them indispensable in high-throughput biologics and personalized medicine production pipelines.

An emerging opportunity in the RTU pharmaceutical packaging space lies in the underserved niche of advanced biologic therapies, particularly cell and gene therapies, which require high-barrier packaging with exceptional sterility assurance and compatibility. As biotech innovation surges, the demand for specialized packaging systems that support ultra-low temperature storage, precise dosing, and flexible container formats opens new frontiers. Companies that can offer customizable RTU packaging platforms tailored to the physicochemical sensitivities of next-generation therapeutics stand to capture significant market share and long-term supplier contracts in this high-value segment.

Despite strong market momentum, a notable restraint is the significant upfront investment and technical complexity associated with validating RTU packaging systems across diverse regulatory environments. Pharmaceutical manufacturers must conduct exhaustive compatibility, extractables, leachables, and sterility validation studies to meet stringent compliance benchmarks in the US, EU, and Asia-Pacific markets.

Market Concentration & Characteristics

The polycarbonate films market’s growth stage is medium, and the pace is accelerating. The market exhibits a significant level of market concentration, with key players dominating the industry landscape. Major companies like Schott AG, Gerresheimer AG, West Pharmaceutical Services, Stevanato Group, SGD Pharma, Nipro Corporation, AptarGroup, Berry Global, Datwyler, and others significantly shape the market dynamics. These leading players often drive innovation, introducing new products, technologies, and applications to meet evolving industry demands.

Stringent global regulatory frameworks are pivotal in shaping the Ready-to-Use (RTU) pharmaceutical packaging market, particularly through mandates around aseptic processing, container closure integrity, and extractables and leachables. Agencies such as the U.S. FDA, EMA, and Japan’s PMDA are increasingly enforcing harmonized standards like Annex 1 revisions and ISO 11040, driving pharmaceutical manufacturers to adopt pre-validated, pre-sterilized packaging components to meet compliance thresholds with minimal risk. This regulatory rigor compels legacy drugmakers and CDMOs to transition from in-house sterilization to RTU platforms to ensure faster approval cycles and higher batch consistency.

The market exhibits a high degree of end-user concentration, with a limited number of global pharmaceutical giants and biologics manufacturers accounting for a significant share of RTU packaging demand. Companies such as Pfizer, Roche, and Novartis, alongside major CDMOs, are centralizing purchasing volumes, driving economies of scale, and influencing supplier innovation pipelines.

Ready-to-Use Pharmaceutical Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9.03 billion |

|

Revenue forecast in 2033 |

USD 17.42 billion |

|

Growth rate |

CAGR of 8.6% from 2025 to 2033 |

|

Historical data |

2018 – 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Container type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Schott AG; Gerresheimer AG; West Pharmaceutical Services; Stevanato Group; SGD Pharma; Nipro Corporation; AptarGroup; Berry Global; Datwyler |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |