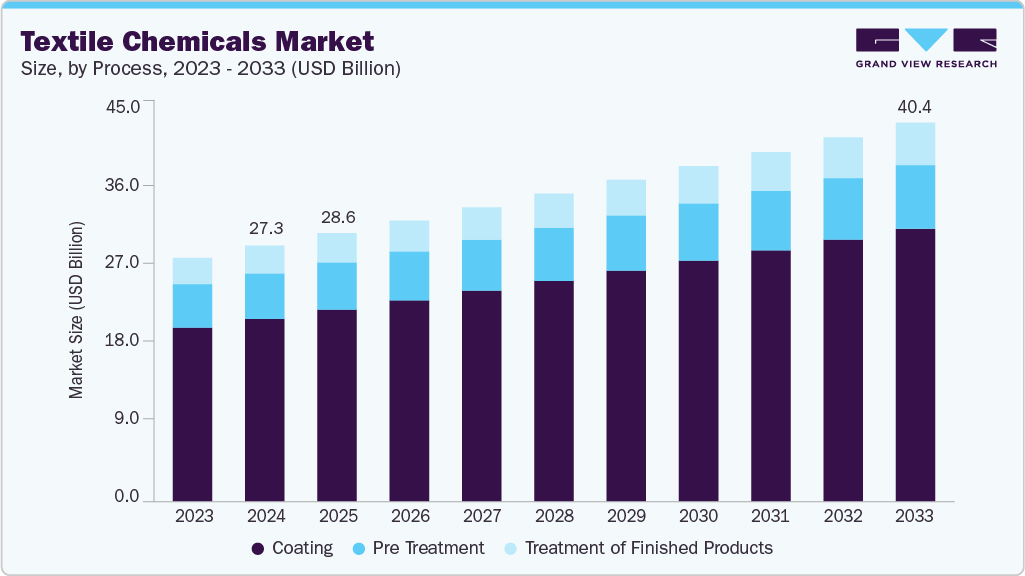

Textile Chemicals Market growing at a CAGR of 4.4% from 2025 to 2033

The global textile chemicals market size was estimated at USD 27,293.7 million in 2024 and is projected to reach USD 40,429.0 million by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The demand for textile chemicals is increasing rapidly due to the booming clothing and apparel industry, driven by the rising global population, urbanization, and higher disposable incomes.

Key Market Trends & Insights

- Asia Pacific dominated the textile chemicals market, accounting for a 57.6% revenue share in 2024.

- The China textile chemicals industry dominated the APAC region with a revenue share of 66.6% in 2024.

- By process, the coating process dominated the market with a 71.4% revenue share in 2024.

- By product, the finishing agents segment is anticipated to register the fastest CAGR of 4.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 27,293.7 Million

- 2033 Projected Market Size: USD 40,429.0 Million

- CAGR (2025-2033): 4.4%

- Asia Pacific: Largest market in 2024

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/textile-chemical-market/request/rs1

The textile chemicals industry’s growth is driven by innovations in manufacturing, including digital printing, nanotechnology, and smart textiles, which require advanced chemicals to enhance performance and functionality. Major textile-producing countries such as China, India, and Bangladesh are boosting production with supportive policies and cost advantages. For example, in 2024, the Government of India allocated over INR 1,000 crore to strengthen the textile sector, including INR 600 crore for the Cotton Corporation of India, reflecting strong government backing.

However, strict environmental regulations and sustainability standards are challenging the industry, as they restrict the use of certain chemicals and increase compliance costs. According to the UN Environment Programme, the textile industry remains highly resource-intensive and contributes significantly to pollution, prompting a shift toward greener alternatives.

Emerging trends such as sustainable, biodegradable, and non-toxic chemical formulations are shaping market growth. The rising demand for smart textiles, functional fabrics, and high-performance materials in sectors like healthcare, automotive, and construction is further propelling innovation in textile chemicals.

Market Concentration & Characteristics

The textile chemicals market is moderately fragmented, with the presence of several global and regional players competing through innovation, product differentiation, and sustainability initiatives. Leading companies focus on developing eco-friendly and high-performance formulations to comply with tightening environmental regulations and changing consumer preferences. Strategic partnerships, acquisitions, and capacity expansions are common as manufacturers aim to strengthen their supply chain integration and expand their product portfolios across diverse textile applications such as apparel, home furnishings, and technical textiles.

A growing emphasis on sustainable chemistry and performance-driven products characterizes the market. Manufacturers are increasingly investing in R&D to develop chemicals that improve fabric quality, durability, and functionality while minimizing environmental impact. Additionally, demand patterns are shifting toward multifunctional and smart textiles, encouraging suppliers to offer tailored solutions. The integration of digital textile printing and automation across production facilities is also redefining product requirements, creating opportunities for advanced and customized chemical formulations.

Process Insights

The coating process segment held the dominant position in the textile chemicals industry, accounting for around 71.4% of the revenue share in 2024. This process is widely used as it imparts specialized functional properties to textiles that are difficult to achieve through other methods. Coatings can enhance textiles with features such as antimicrobial protection or electrical conductivity, making them suitable for applications like smart textiles. Moreover, the coating process allows high levels of customization to meet specific end-user requirements, while continuous innovations in coating technologies are further expanding the functional and performance capabilities of textile products.

The protection segment under the coating category is expected to register a robust CAGR of 4.9% during the review period, driven by the growing demand for textiles with enhanced resistance to water, UV radiation, fire, and microbial growth. These protective coatings are widely used across sectors such as outdoor apparel, military textiles, and industrial fabrics. Increasing focus on safety, durability, and performance in end-use applications continues to strengthen the demand for protective textile coatings.

The treatment of finished products segment is expected to grow at the fastest CAGR of 4.8% during the forecast period. This segment’s growth is driven by the rising demand for high-quality, durable, and value-added fabrics that meet evolving consumer expectations. Post-finishing treatments enhance textile properties such as softness, wrinkle resistance, color fastness, and water repellency, improving both performance and aesthetics. Additionally, the increasing adoption of sustainable and eco-friendly finishing chemicals is fueling segment expansion, as manufacturers seek to reduce environmental impact while maintaining fabric quality. Continuous innovations in advanced treatment formulations and smart textile finishes are further accelerating the growth of this segment.

Textile Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 28,621.1 million |

|

Revenue forecast in 2033 |

USD 40,429.0 million |

|

Growth rate |

CAGR of 4.4% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Process, product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; Turkey; Italy; UK; France; Russia; Spain; Poland; China; India; Japan; South Korea; Vietnam; Indonesia; Saudi Arabia; South Africa; Morocco; Tunisia; UAE; Kenya; Brazil; Argentina |

|

Key companies profiled |

AB Enzymes; Archroma; BASF SE; BioTex Malaysia; Dow; Ethox Chemicals, LLC; Evonik Industries AG; Fibro Chem, LLC; German Chemicals Ltd.; Govi N.V.; Huntsman International LLC; Kemira Oyj; Kiri Industries Ltd.; LANXESS; OMNOVA Solutions Inc.; Omya United Chemicals; Organic Dyes and Pigments; Resil Chemicals Pvt. Ltd.; Solvay S.A.; The Lubrizol Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |